Midcontinent Independent System Operator (MISO)

MISO is re-examining its longstanding policy that forbids stakeholders from recording meetings and is considering the possibility of some form of AI notetaking or transcription.

MISO has indicated that new generation to serve data centers and other large loads will be mission critical over 2026 and said it will take pains to interconnect units.

MISO and the Minnesota Department of Commerce said federal funding for the Joint Targeted Interconnection Queue portfolio is still in play, though they didn't offer any additional details.

MISO officials clarified the J.H. Campbell coal plant — kept online and in retirement limbo by the Department of Energy’s series of emergency orders — is not eligible for the RTO’s capacity market and is not receiving special treatment for dispatch.

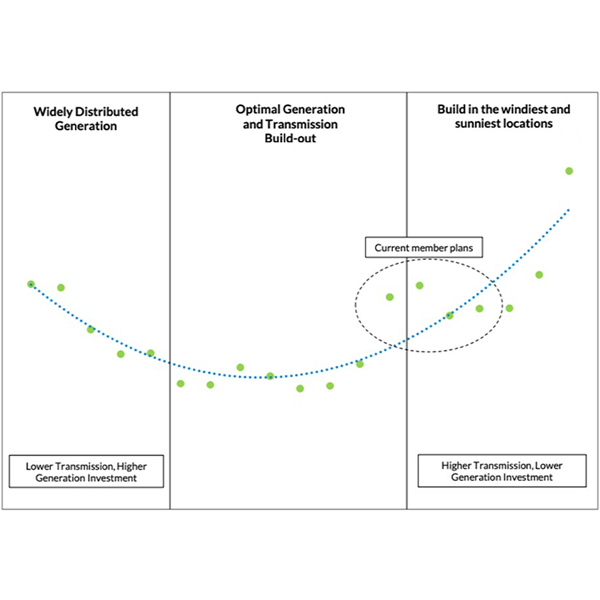

Expanding transmission can reduce electricity costs for consumers, but only if the buildout uses consumer welfare as the North Star and ignores narrow political or business interests, say Travis Fisher and Nick Loris.

A trade group representing multiple MISO power producers has lodged a complaint against retroactive pricing revisions in MISO’s 2025/26 capacity auction, joining Pelican Power in calling the repricing unlawful.

MISO ended its 10-year run allowing energy efficiency in its capacity market, as FERC allowed the change to take effect.

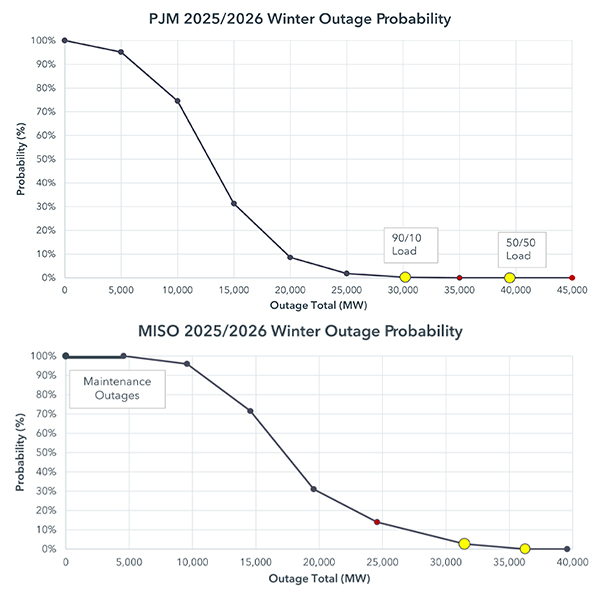

A presenter from ReliabilityFirst said the regional entity expects a normal level of risk this winter, indicating a low chance of energy shortfalls.

Texas regulators have approved two more applications under the Texas Energy Fund’s completion-bonus program, making the generation resources eligible for more than $100 million in grants.

MISO has trimmed its annual budget, now expecting to spend a little less than $431 million in 2026, down from nearly $450 million.

Want more? Advanced Search