Midcontinent Independent System Operator (MISO)

MISO said all four recommendations in the Independent Market Monitor’s 2024 State of the Market Report are likely viable.

MISO announced it will honor a request from Texas regulators and include southeastern Texas in its first long-range transmission study for MISO South.

MISO’s Independent Market Monitor said a MISO South September transmission emergency shows the RTO needs a better handle on constraint management within its markets.

MISO signaled an openness to alter its 31-day planned outage rule for units that signed up to be capacity resources.

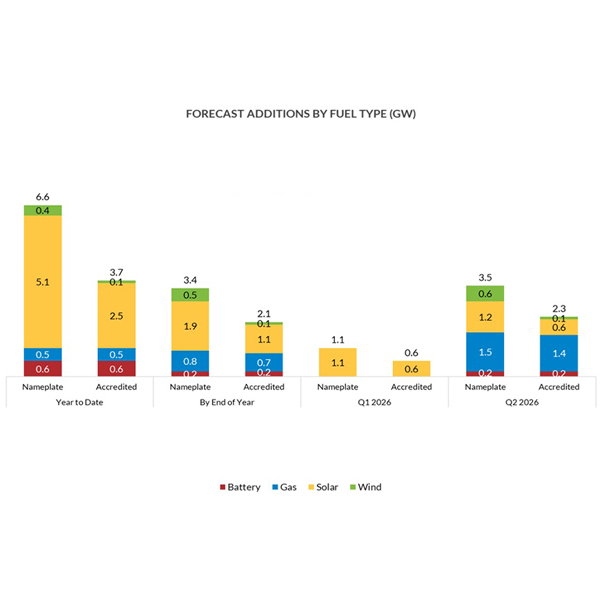

MISO’s generator interconnection queue now totals 174 GW across 944 projects, a result of several developers dropping out of the line in recent months.

The Organization of MISO States is warning NERC that its possible new resource adequacy standard would tread on states’ planning authority.

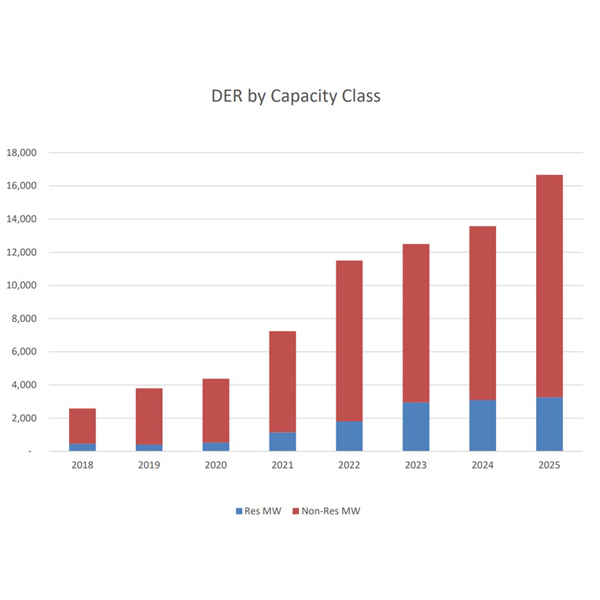

The Organization of MISO States estimates MISO is up to approximately 16.6 GW of distributed energy resources across its footprint, up 3 GW from 2024.

MISO will add Bonneville Power Administration’s former COO to its Board of Directors and welcome back two term-limited directors in 2026 after collecting membership votes.

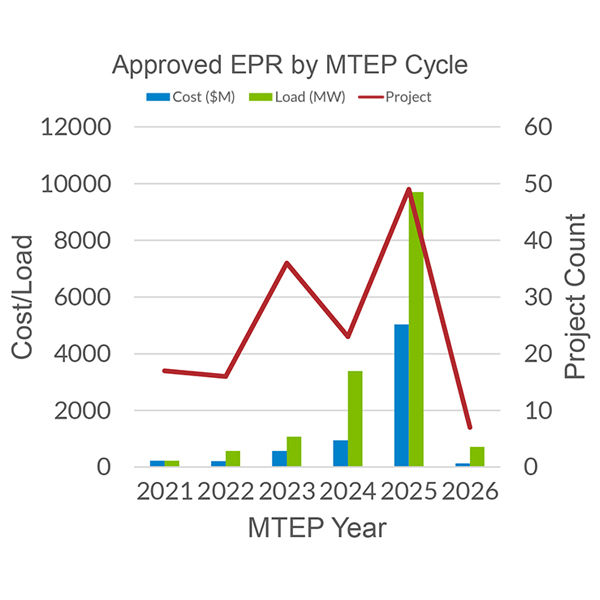

With its 2025 cycle of transmission projects not yet final and approved, MISO already is working through 43 expedited project requests ahead of its 2026 cycle to support almost 14 GW of new load.

MISO members debated how their system could change under the weight of large load additions and scheduled a future discussion in front of the RTO’s board of directors.

Want more? Advanced Search