Midcontinent Independent System Operator (MISO)

Xcel Energy and AEP both said during their quarterly earnings calls that they have increased their capital investment spend to meet increasing demand from large loads.

The J.H. Campbell coal plant in Michigan has racked up $80 million in net costs since late May to stay online per emergency orders from the Department of Energy.

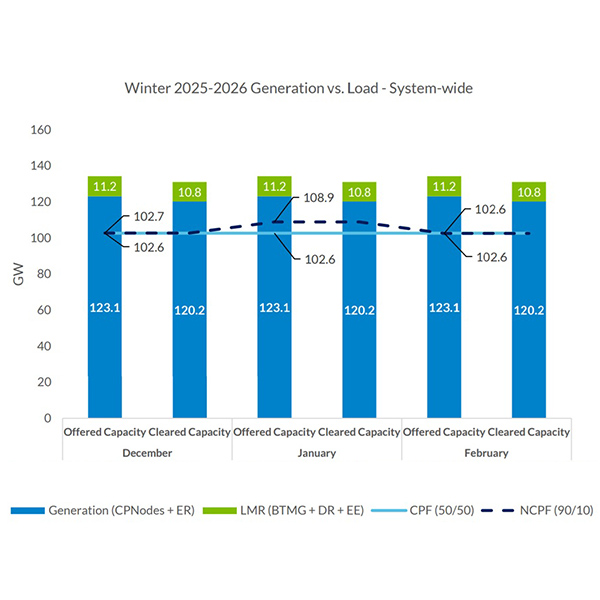

MISO said even a 109-GW peak this winter shouldn’t prove problematic, though a more probable scenario would deliver a 103-GW peak in January.

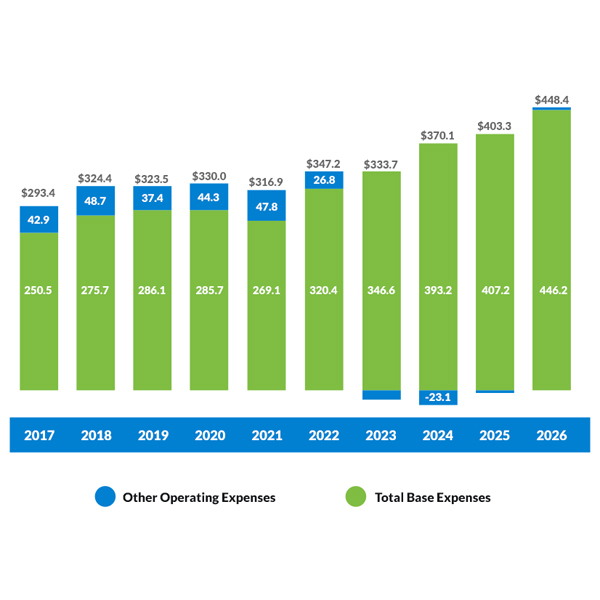

MISO said its 2026 budget requires an increase of more than 11% over 2025’s.

Holistic reform to interconnection barriers is essential to meeting rapidly growing power demand across the country, experts said at a recent webinar.

MISO’s Advisory Committee will continue to be led by its vice chair through the end of 2025 after the departure of Sarah Freeman from Indiana’s regulatory agency.

Year-over-year prices rose in MISO to serve a typical September peak.

MISO leadership shed more light on the RTO’s need for a pilot program to estimate load growth on a 20-year horizon after stakeholders asked for details.

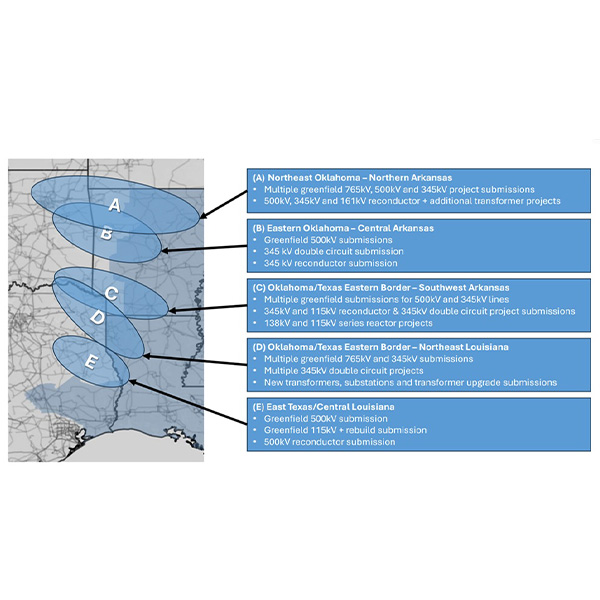

MISO and SPP said they will study more than 30 project suggestions — some estimated to cost more than $1 billion apiece — in a four-state area in their pursuit of major, regionally cost-shared transmission projects.

Panelists at FERC's Reliability Task Force praised the efforts of NERC's Large Loads Task Force while highlighting the work still needed.

Want more? Advanced Search