minimum offer price rule (MOPR)

The minimum offer price rule (MOPR) was a controversial topic at last week’s FERC technical conference.

FERC granted New York officials’ request to exempt new “special case resources” from buyer-side market power mitigation rules in NYISO.

Commissioner Norman Bay gave his perspective on the impact of the shale gas revolution in a FERC order approving a pipeline.

FERC rebuffed generators’ attempt to apply ISO-NE’s minimum offer price rule (MOPR) to 200 MW of renewable generation that were granted an exemption.

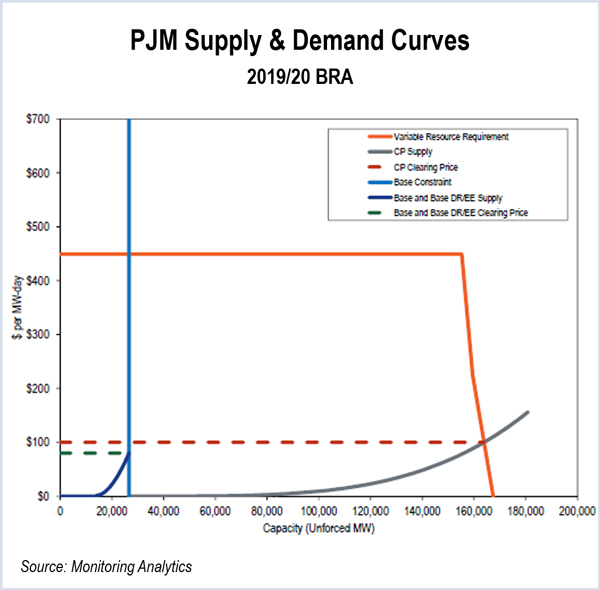

The PJM Independent Market Monitor gave his blessing to the RTO’s Capacity Auction for delivery year 2019/20 but called for additional Capacity Performance rule changes.

FERC has again upheld ISO-NE’s limited exemption for renewables from the RTO’s minimum offer price rule.

PJM asked FERC not to order changes to the RTO’s minimum offer price rule before May’s Base Residual Auction.

Eleven generating companies have asked FERC to expand the PJM minimum offer price rule (MOPR) in time for May’s 2019/20 Base Residual Auction.

PSEG and P3 had disputed PJM’s use of an 8% cost of capital used in cost of new entry calculations.

FERC declined to rehear a 2013 order approving PJM's revisions to a rule designed to mitigate buyer-side market power in the capacity market.

Want more? Advanced Search