NEPOOL Markets Committee

ISO-NE presented the initial scope of its work to coordinate resource capacity accreditation improvements with proposed capacity market timing changes at the NEPOOL Markets Committee summer meeting.

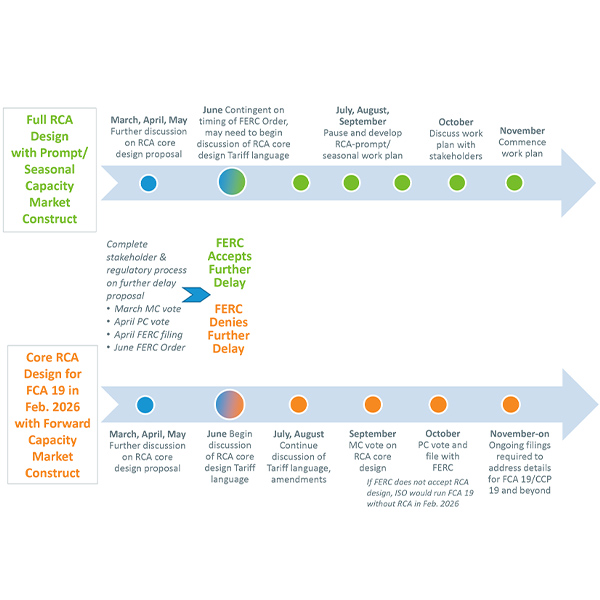

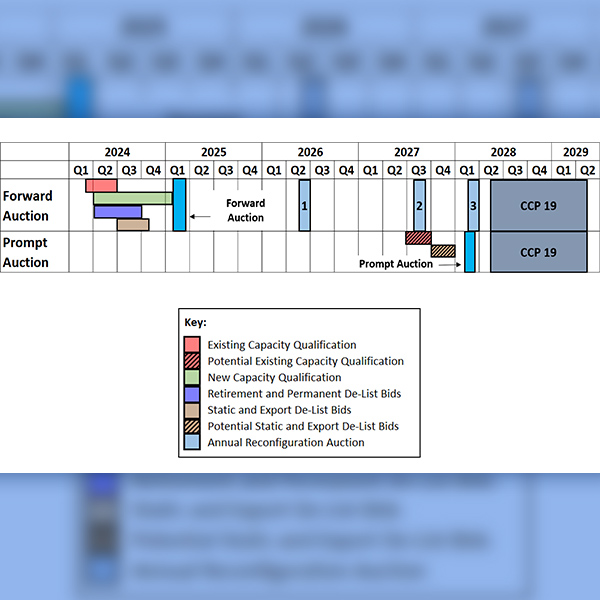

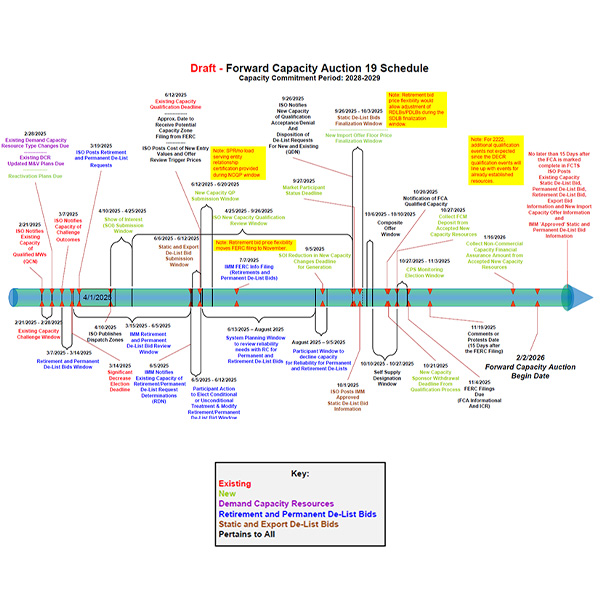

The NEPOOL Markets Committee approved an additional two-year delay of ISO-NE’s Forward Capacity Auction 19 to develop and implement a new seasonal capacity auction.

ISO-NE told the NEPOOL Markets Committee that it is proposing a major redesign to its capacity market, moving from a three-years-ahead schedule to a prompt and seasonal design.

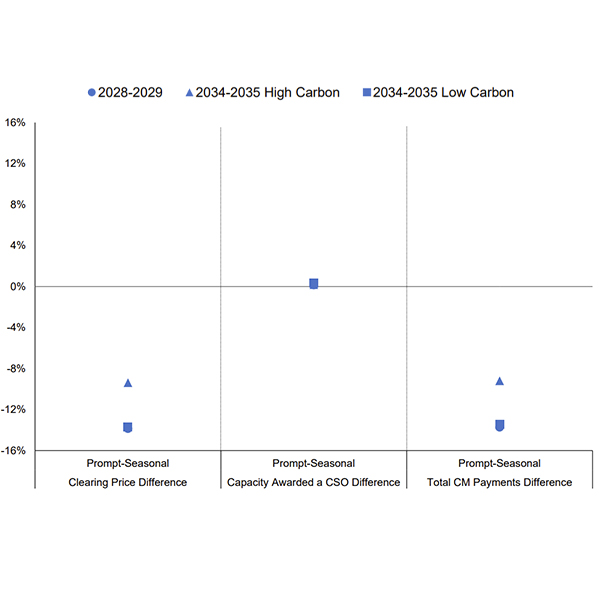

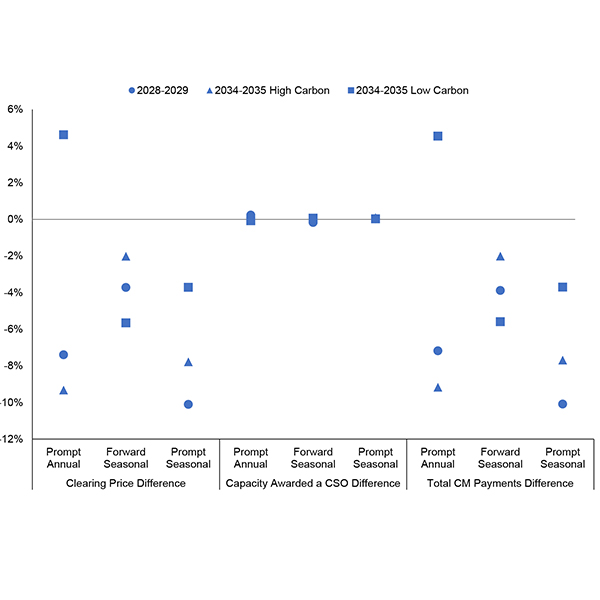

Analysis Group presented its final report on converting ISO-NE's Forward Capacity Market to a prompt, seasonal construct.

Analysis Group outlined the methodology of its study of major changes to the structure of ISO-NE’s Forward Capacity Market (FCM) at the NEPOOL Markets Committee meeting.

Some clean energy stakeholders have expressed concerns about the impacts that delaying ISO-NE's FCA 19 would have on new resources looking to secure capacity rights in the auction.

A range of clean energy stakeholders outlined questions and concerns about the potential changes in ISO-NE's FCA 19.

ISO-NE presented stakeholders the pros and cons of moving to a prompt and seasonal capacity market.

NEPOOL's Markets Committee approved changes to the Inventoried Energy Program intended to get the winter reliability program in line with global energy markets.

ISO-NE is narrowing down its options as it moves forward with revamping its process for resource capacity accreditation.

Want more? Advanced Search