New York Independent System Operator (NYISO)

Consolidated Edison has been tasked with creating a contingency plan to avert the energy shortfall that it and NYISO have warned may develop in New York City.

The newest iteration of New York’s energy road map maintains a zero-emission grid as a target but acknowledges an uncertain path to that goal, and likely a longer reliance on fossil fuels.

NYISO's Business Issues Committee and Operating Committee both endorsed tariff changes ahead of the completion of the Champlain Hudson Power Express.

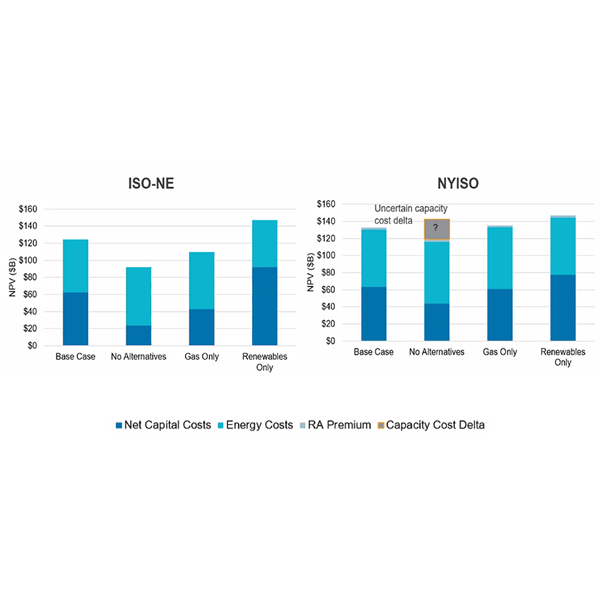

Northeastern power systems cannot afford to drop offshore wind if they are to maintain reliability, reduce emissions and lower electricity prices, according to a new analysis from Charles River Associates.

The NYISO Market Monitoring Unit told the Installed Capacity Working Group that more data is necessary to verify the need for out-of-market actions on the part of transmission owners for reliability.

The New York Power Authority announced the appointments of Todd Josifovski and Christopher Hanson to its advanced nuclear energy initiative.

Discussion about potential changes to the NYISO demand curve reset process dominated a recent Installed Capacity Working Group meeting and will likely take up more oxygen in stakeholder meetings throughout the coming year.

FERC approved LS Power’s deal to sell 12.9 GW of its gas generation in PJM, NYISO and ISO-NE, as well as its 6-GW demand response business, CPower, to NRG Energy for $12 billion.

Aaron Markham, NYISO vice president of operations, presented the 2025-2026 Winter Capacity Assessment and Winter Preparedness forecasts to the Operating Committee.

NYISO presented the results of Phase 1 of the 2024 Cluster Study process at a special Operating Committee meeting.

Want more? Advanced Search