pay-for-performance

With costs associated with ISO-NE’s new day-ahead ancillary services market far exceeding expectations, the RTO is working to fast-track changes to improve the efficiency of the market in time for next winter.

FERC partially granted a complaint by the New England Power Generators Association about the design of ISO-NE's Pay-for-Performance mechanism.

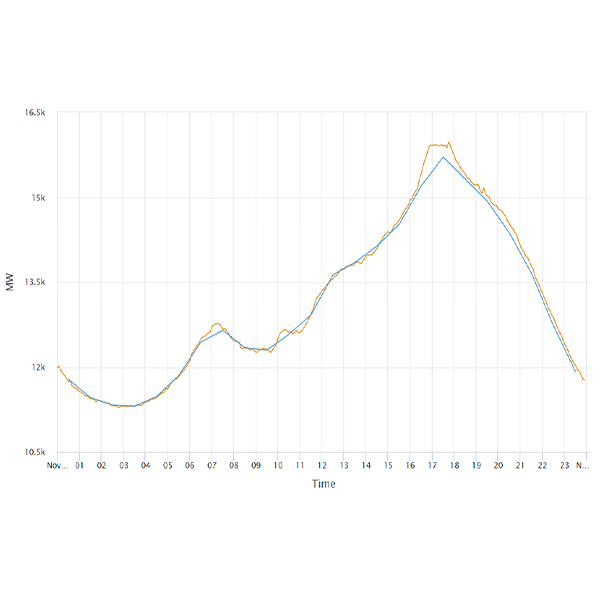

ISO-NE declared a capacity deficiency after an unexpected loss of generation left the region short of its operating reserve requirements.

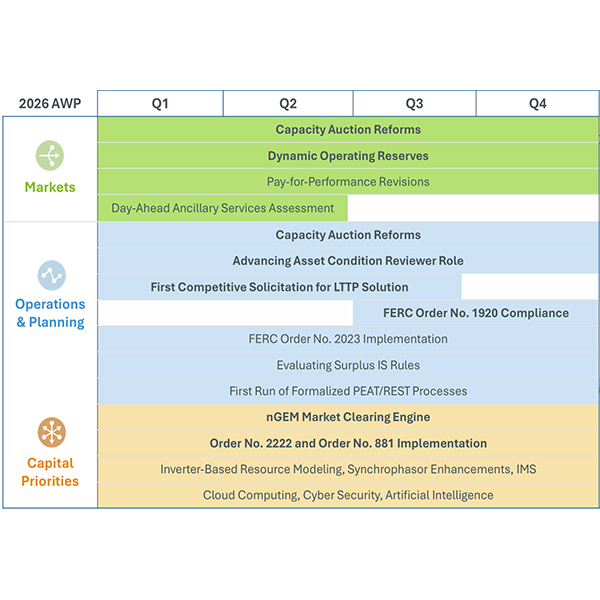

Capacity auction reforms, a new asset condition reviewer role, parallel transmission planning efforts, new reserve products, Pay-for-Performance changes and interconnection modifications are likely to be on the docket for ISO-NE in 2026.

ISO-NE kicked off NEPOOL discussions for the second phase of its capacity auction reform project, beginning long-awaited talks on accreditation and seasonal capacity auction changes.

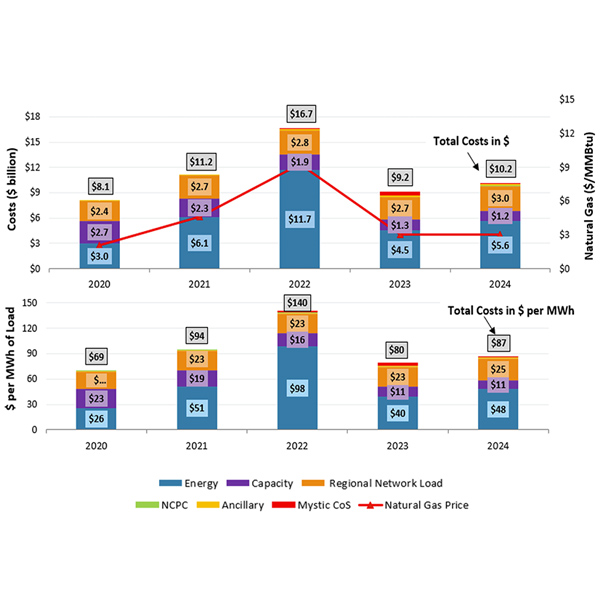

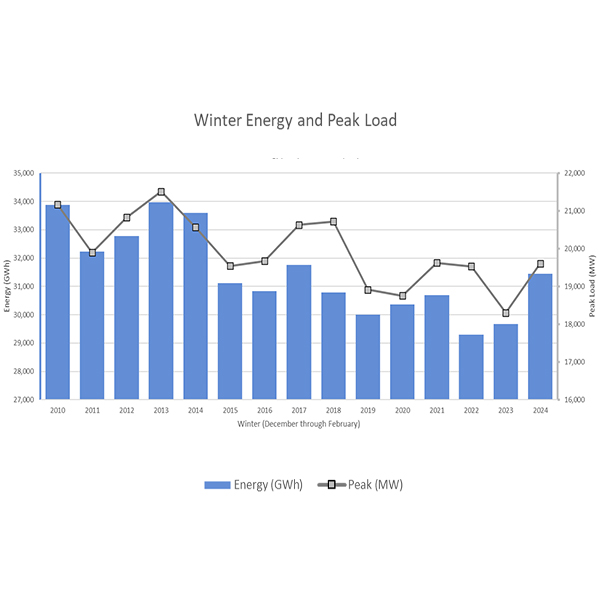

The New England wholesale electricity markets performed competitively in 2024, while decreased imports and higher emissions compliance rates increased overall market costs, the ISO-NE Internal Market Monitor told the NEPOOL Participants Committee.

ISO-NE said it is open to capping the balancing ratio used to calculate Pay-for-Performance payments to prevent capacity resources from being required to provide more power than their capacity supply obligations.

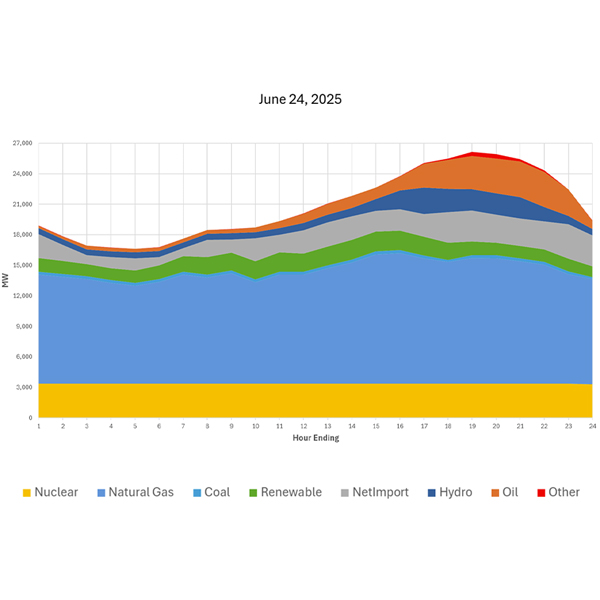

Pay-for-Performance credits accumulated during capacity scarcity conditions June 24 totaled about $114 million, ISO-NE's COO told the NEPOOL Participants Committee.

The New England Power Generators Association is seeking immediate action from FERC to address what it calls “serious flaws” in the design of ISO-NE’s pay-for-performance mechanism.

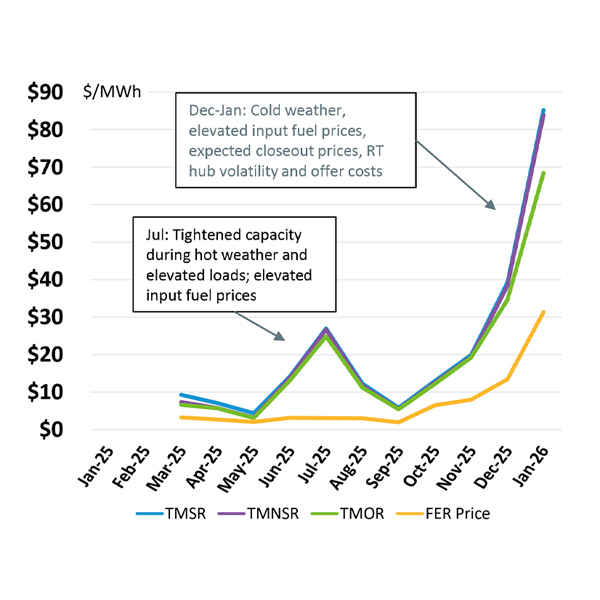

New England energy market revenues increased by roughly 150% in the winter of 2024/25 compared to the prior winter.

Want more? Advanced Search