PJM Interconnection LLC (PJM)

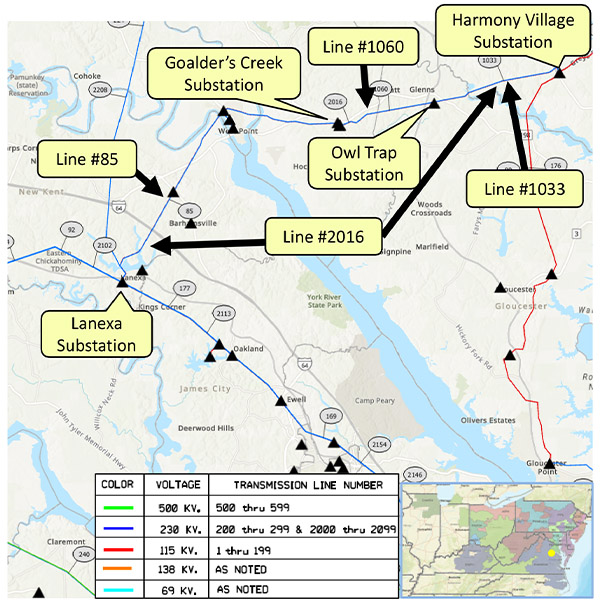

PJM stakeholders endorsed an expanded dual fuel manual definition, and the Transmission Expansion Advisory Committee was presented with a list of supplemental projects.

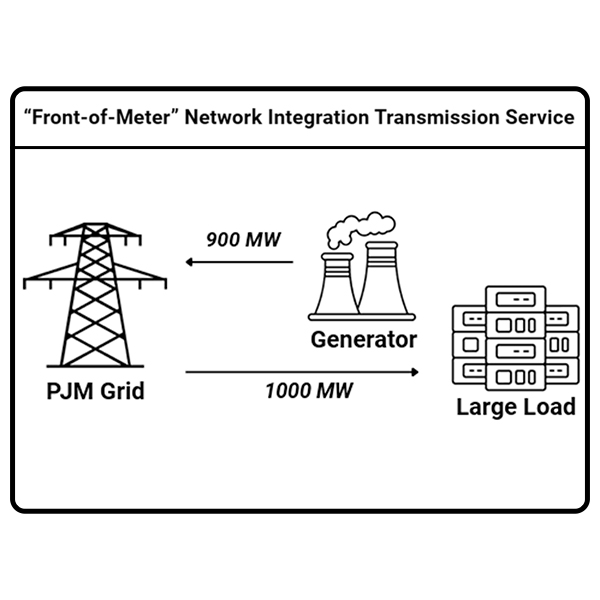

PJM presented stakeholders with an initial look into the first of a handful of compliance filings it is drafting to define how co-located large loads receive transmission service.

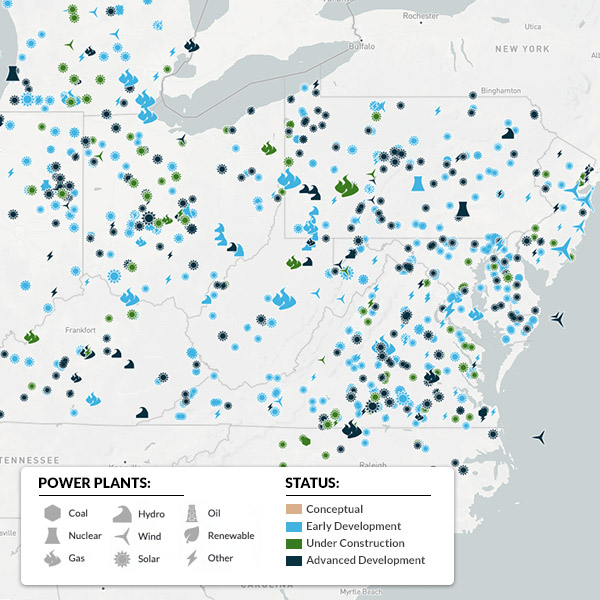

PJM enters 2026 amid several efforts to ward off a reliability gap attributed to accelerating data center load, sluggish development of new capacity and resource deactivations.

FERC and the organized power markets it oversees are facing huge challenges in trying to meet rising demand reliably and affordably.

The defining story of the coming year will be the widening chasm between electricity supply and demand, a dynamic driven by a slow-moving supply side, coupled with the explosive growth of energy-hungry data centers, says columnist Peter Kelly-Detwiler.

FERC told PJM to change its rules to allow for co-located load at generators, with new transmission services and other tweaks.

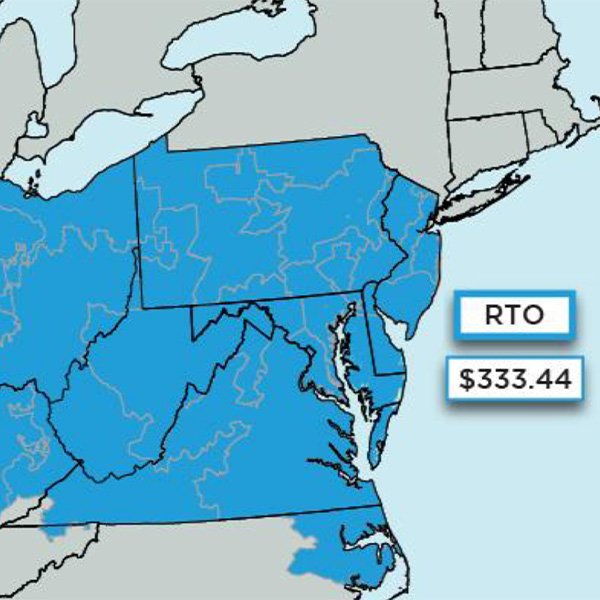

PJM’s 2027/28 Base Residual Auction procured 134,479 MW in unforced capacity at the $333.44/MW-day maximum price, falling 6,623 MW short of the reliability requirement and setting a clearing price record.

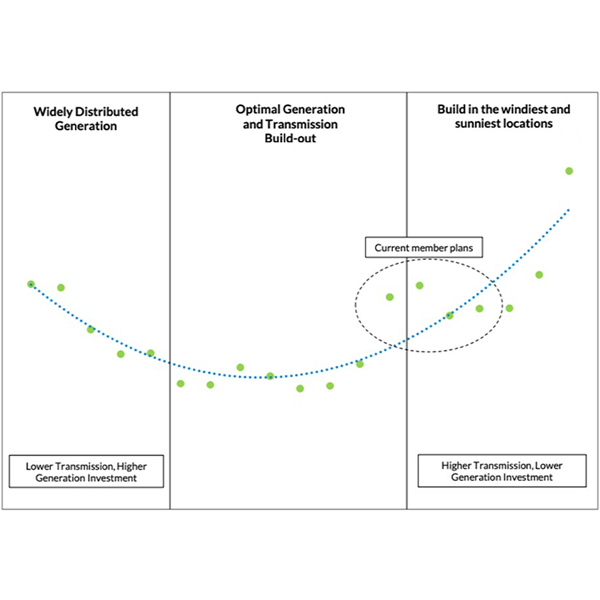

Expanding transmission can reduce electricity costs for consumers, but only if the buildout uses consumer welfare as the North Star and ignores narrow political or business interests, say Travis Fisher and Nick Loris.

Data center developers’ imperative of speed to market not only stresses the power grid but also is felt on the ground as the giant facilities — often paired with onsite generation — spring up in neighborhoods overburdened by pollution.

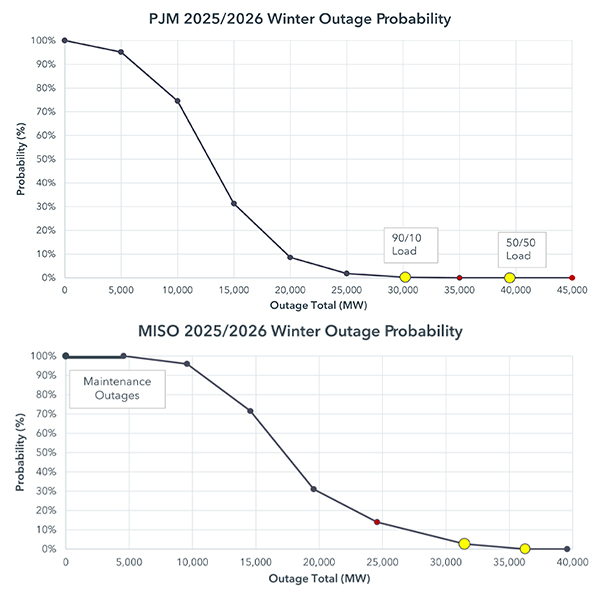

A presenter from ReliabilityFirst said the regional entity expects a normal level of risk this winter, indicating a low chance of energy shortfalls.

Want more? Advanced Search