Powerex Corp.

SPP secured $150 million in financing and entered the second phase of development for its day-ahead market Markets+, the grid operator announced.

CAISO dismissed Powerex’s contention that the ISO only recently has “revealed” that participation in its EDAM is voluntary at the balancing authority level but not voluntary for “individual customers” operating within the BA participating in the market.

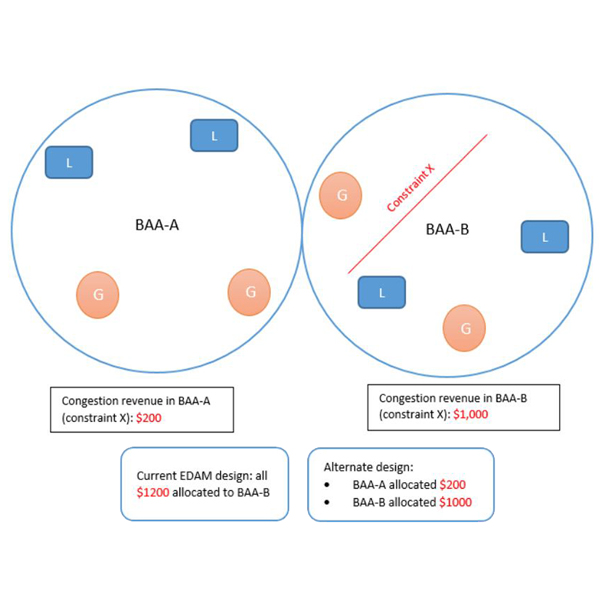

CAISO's Board of Governors and the Western Energy Markets Governing Body approved a new method for allocating certain congestion revenues in the ISO's Extended Day-Ahead Market, set to launch in 2026

Bonneville's final record of decision will come as little surprise to those who’ve been following market developments in the West.

FERC’s approval of SPP’s Markets+ funding agreement and its recovery mechanism came as backers of the Western centralized day-ahead market were meeting with the snow-capped Rockies as a backdrop.

SPP has appointed Jim Gonzalez as its new senior director of seams and Western services, in what will be a highly visible position in the RTO as it continues to develop Markets+ ahead of its expected launch in 2027.

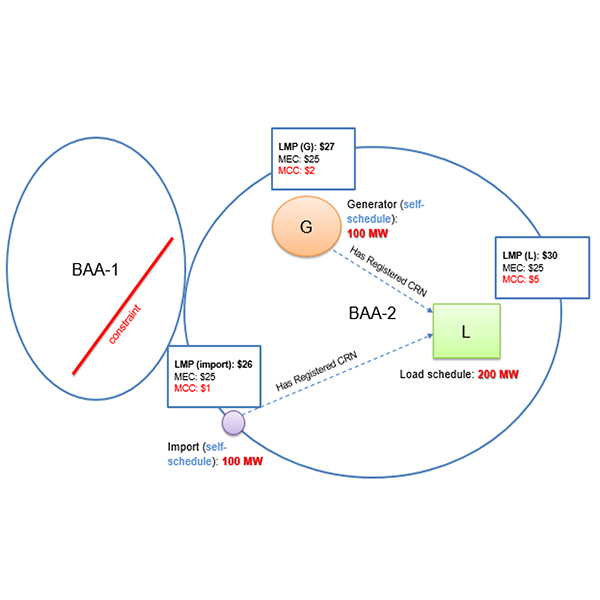

CAISO released a draft final proposal detailing how EDAM will allocate congestion revenues in circumstances when a transmission constraint in one BAA produces “parallel” flows in a neighboring BAA also participating in the market.

The Bonneville Power Administration elicited nearly 150 comments in response to the draft policy outlining its decision to join SPP’s Markets+ rather than CAISO’s Extended Day-Ahead Market.

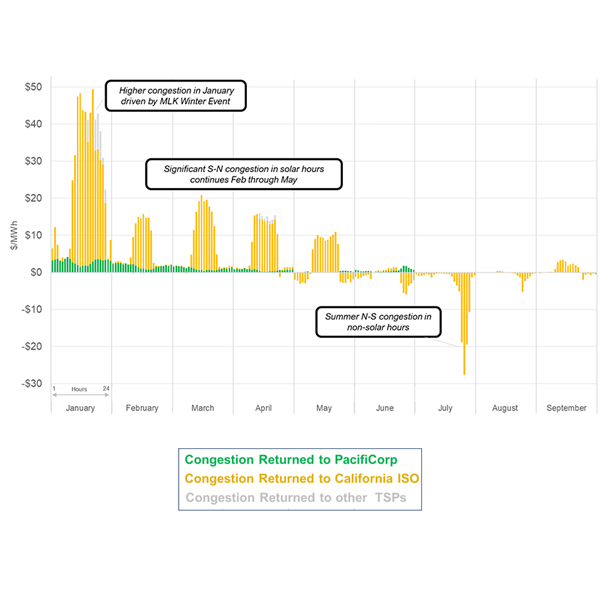

The dispute over how CAISO’s Extended Day-Ahead Market will allocate congestion revenues to market participants continues, even as the ISO moves to address stakeholder concerns.

CAISO launched an “expedited” initiative to address stakeholder concerns about how EDAM will allocate congestion revenues when a transmission constraint in one balancing authority area causes congestion in a neighboring BAA.

Want more? Advanced Search