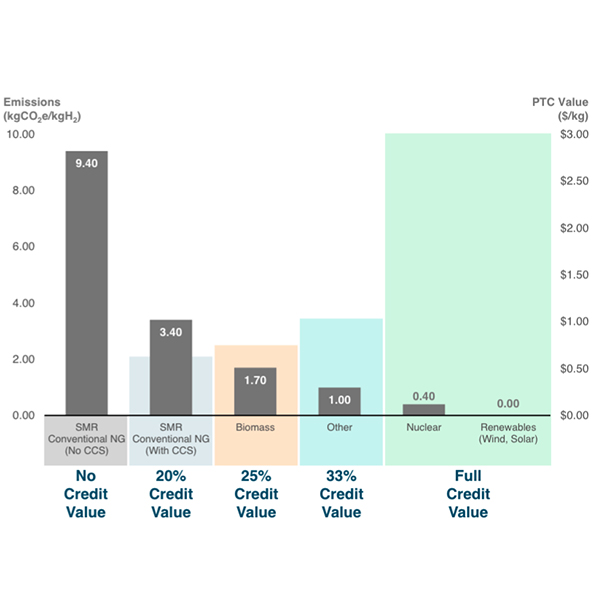

Production Tax Credit (PTC)

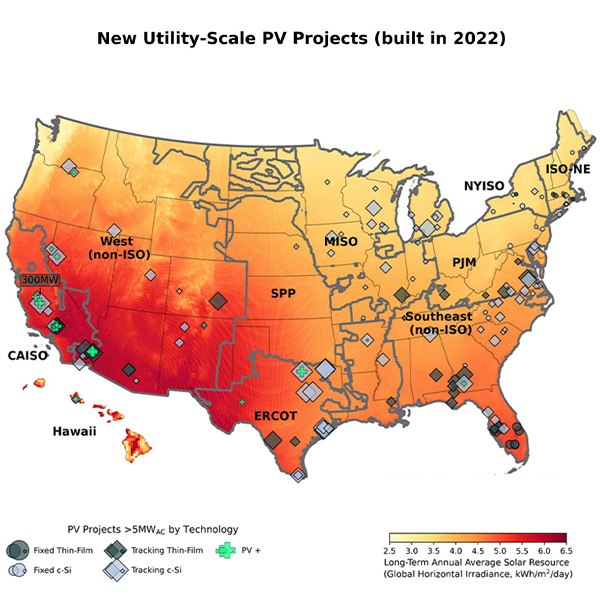

After a down year, the Berkeley Lab sees new utility-scale solar capacity increasing more than fourfold by the mid-2030s to over 50 GW per year.

Power demands from the upstart clean hydrogen industry could lead to a dirtier electric grid.

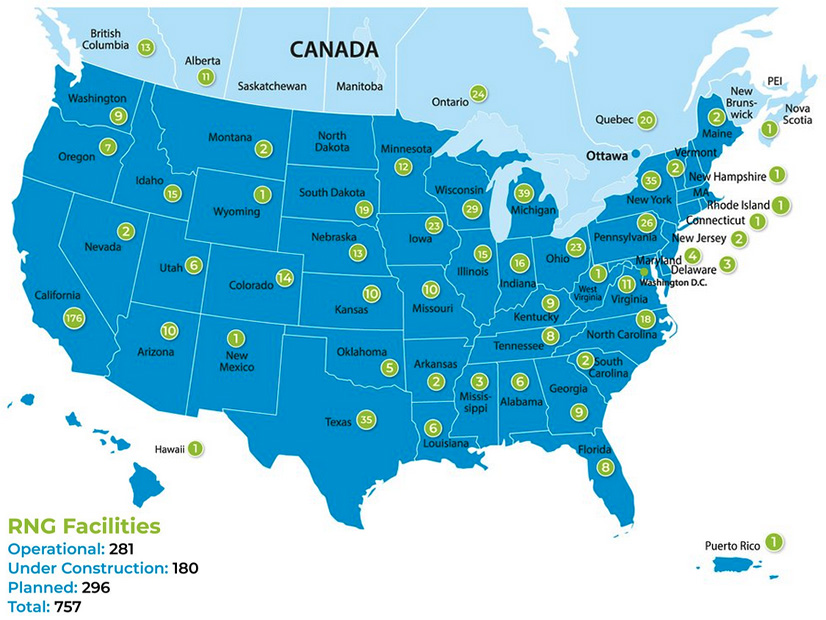

Using RNG as a feedstock offers hydrogen producers a shortcut to claiming the full federal tax credit created for hydrogen production, industry experts said.

Constellation says the IRA's tax credits for nuclear could boost its profits by $100 million per year and help extend the life of its reactors to 80 years.

Federal production tax credits for green hydrogen will depend on the "cleanliness" of the power used to produce it.

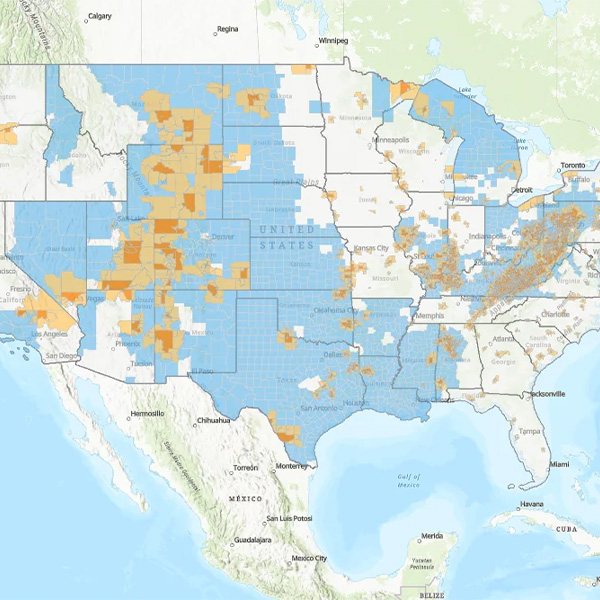

Millions in new funding and bonus tax credits are heading to new clean energy projects in communities impacted by the closure of fossil fuel-based industries.

A closed nuclear plant in Michigan could be eligible for federal funding to reopen under new guidelines for the 2nd round of the Civil Nuclear Credit Program.

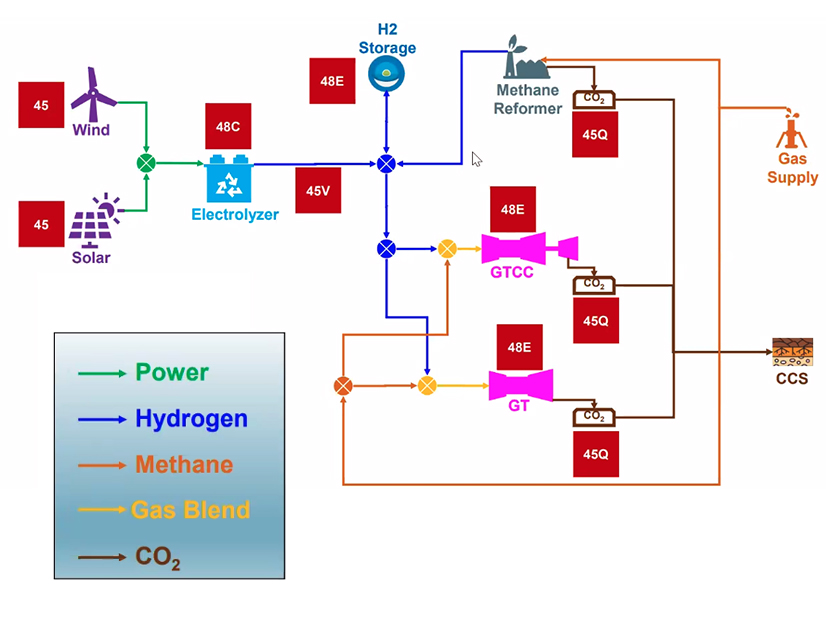

The tax credits provided by the IRA are key to the development of major clean hydrogen projects and seasonal hydrogen storage, Mitsubishi Power Americas said.

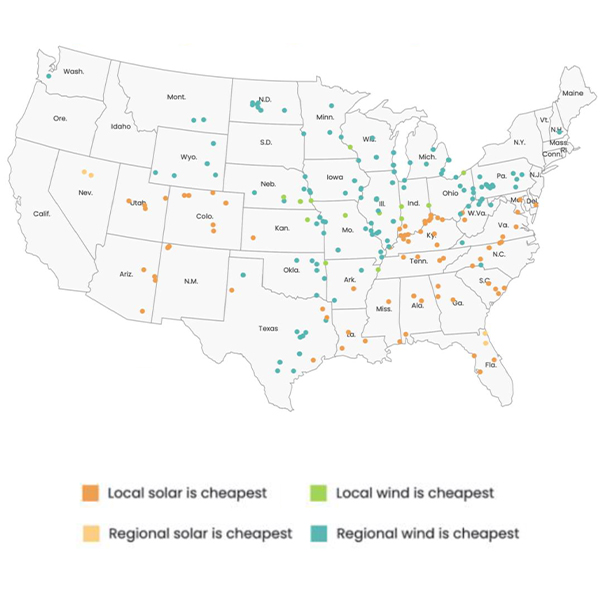

A new report found that nearly all coal plants studied “are more expensive to run than replacing their generation capacity with either new solar or wind.”

The emerging producer of fuel cells, electrolyzers and green hydrogen may have a Wall Street credibility problem.

Want more? Advanced Search