Reliability Pricing Model (RPM)

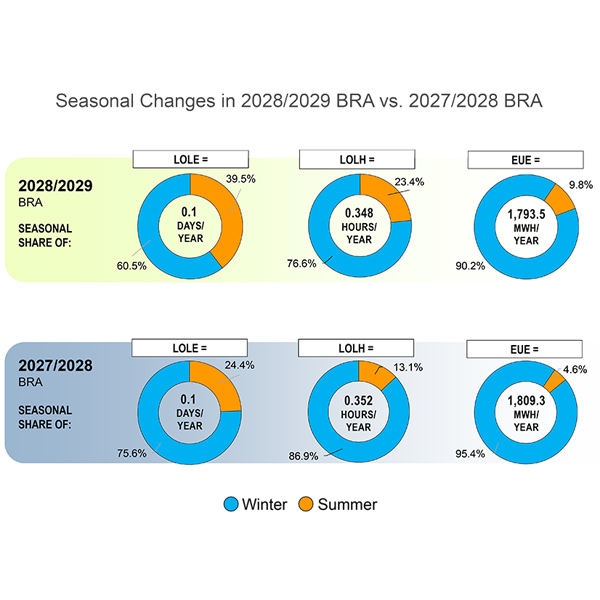

Stakeholders endorsed PJM’s recommended installed reserve margin and forecast pool requirement for the 2028/29 Base Residual Auction at the Markets and Reliability Committee meeting.

Two PJM proposals would revise its tariff to extend the collar on capacity prices for two more years and implement an expedited interconnection track for large projects to bring new capacity online quickly.

PJM's Markets and Reliability Committee and Members Committee will be asked to endorse the recommended IRM and FPR values for the 2028/29 BRA.

PJM enters 2026 amid several efforts to ward off a reliability gap attributed to accelerating data center load, sluggish development of new capacity and resource deactivations.

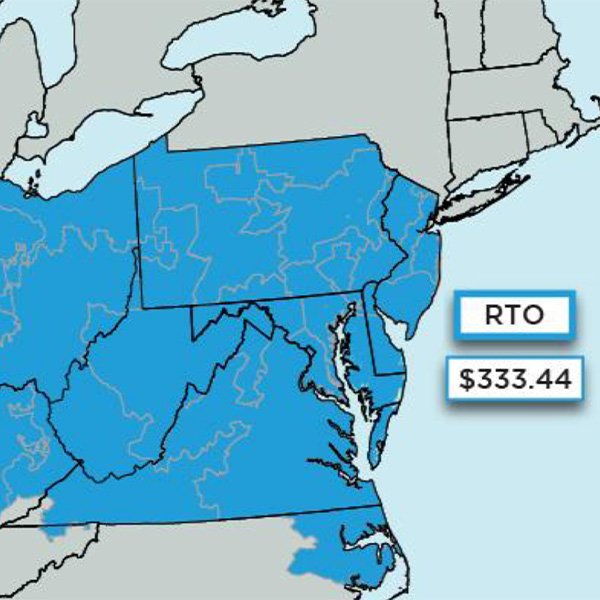

PJM’s 2027/28 Base Residual Auction procured 134,479 MW in unforced capacity at the $333.44/MW-day maximum price, falling 6,623 MW short of the reliability requirement and setting a clearing price record.

The PJM Planning Committee has endorsed manual revisions to reflect how distributed energy resources would be accredited for participation in the 2028/29 Base Residual Auction.

PJM stakeholders are to vote on a record-breaking number of proposals on how the RTO should integrate large loads without impacting resource adequacy.

PJM has withdrawn its non-capacity backed load proposal, shifting the focus of its solution for rising large load additions to creating a parallel resource interconnection queue and reworking price-responsive demand.

PJM revised elements of its proposal to create a non-capacity backed load product for large loads as the Critical Issue Fast Path embarks on determining how to address the reliability challenges posed by accelerating data center load growth.

The Markets and Reliability Committee rejected three proposals to revise aspects of PJM’s effective load-carrying capability accreditation model.

Want more? Advanced Search