renewable technology resource (RTR)

Fletcher6, CC BY-SA 3.0, via Wikimedia Commons

FERC has a number of paths it could take with ISO-NE's filing proposing a transitioned MOPR removal.

Fletcher6, CC BY-SA 3.0, via Wikimedia Commons

The NEPOOL Markets Committee signed off on a plan to delay the elimination of ISO-NE’s MOPR, which the RTO abruptly threw its support behind.

Fletcher6, CC BY-SA 3.0, via Wikimedia Commons

ISO-NE has proposed maintaining its MOPR for the next two capacity auctions and eliminating it for FCA 19, with RTR exemptions of 700 MW over that period.

Crispins C. Crispian, CC BY-SA-4.0, via Wikimedia

NEPOOL stakeholders and ISO-NE continue to work on eliminating the MOPR from the capacity market, discussing multiple proposals on transitional mechanisms.

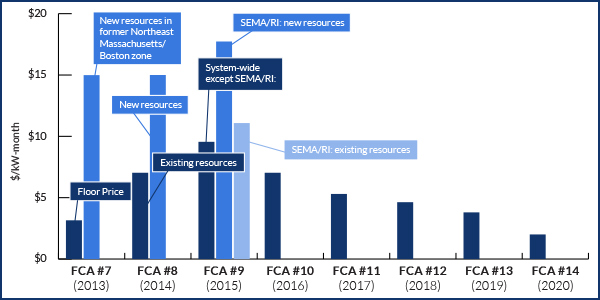

ISO-NE’s 15th annual Forward Capacity Auction cleared with prices ranging from $2.48/kW-month to $3.98/kW-month.

FERC defended its CASPR order, which permitted ISO-NE to create a 2-stage capacity auction to accommodate state renewable energy procurements

FERC denied CPower’s two waiver requests to allow its seven summer-only distributed solar demand capacity resources to participate in ISO-NE’s FCA 14.

ISO-NE's 2020 Forward Capacity Auction cleared at a record low of $2/kW-month, a nearly 50% drop from the $3.80/kW-month in 2019.

Connecticut regulators hosted a public hearing to examine whether ISO-NE’s wholesale electricity markets are geared to serving clean energy objectives.

The results of ISO-NE’s Forward Capacity Auction 13 became effective “by operation of law” because FERC was unable to muster a quorum.

Want more? Advanced Search