Revolution Wind

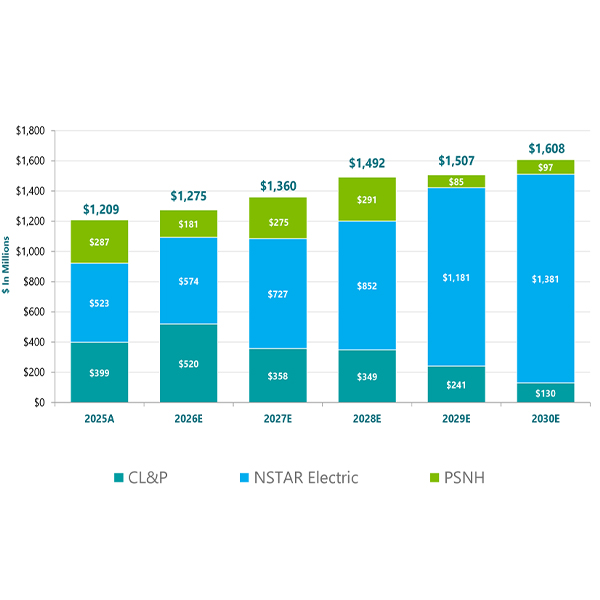

Eversource Energy increased its five-year capital investment plan by $2.3 billion, an increase largely driven by investments in its gas and electric distribution systems.

If Ørsted can continue to beat back the Trump administration’s interference, it could start generating electricity with its Revolution Wind project in a matter of weeks.

Debates about affordability continue to dominate state-level energy policy debates throughout New England, shifting the focus away from decarbonization, a panel of experienced lobbyists said.

A judge has lifted the stop-work order against Revolution Wind, one of the five offshore wind projects shut down by the Trump administration in December.

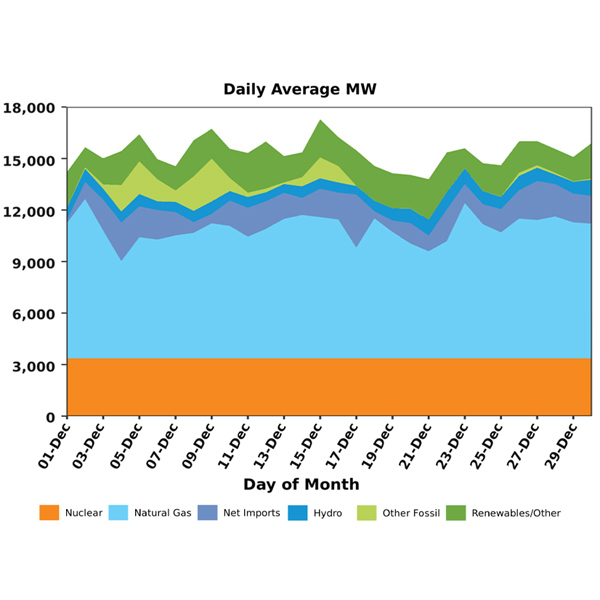

Consistently cold weather drove record-high December energy market costs for ISO-NE and caused the region to rely heavily on stored oil and LNG injections.

Three of the four developers building wind farms in U.S. waters are challenging the Trump administration’s Dec. 22 order suspending all such construction.

Heading into 2026, New England is counting on an increasingly collaborative approach to energy policy as federal opposition to renewable energy development threatens affordability, reliability, and decarbonization objectives in the region.

An announcement by the U.S. Department of Interior said the Department of Defense had identified wind farms as national security risks and is pausing offshore wind leases.

The House Natural Resources Committee advanced a package of permitting bills, headlined by the SPEED Act that seeks to speed up permit processing and limit litigation.

Ørsted reported a net loss for the third quarter, attributed to the continuing financial challenges for its U.S. offshore wind portfolio, but it also said those projects are progressing well toward completion.

Want more? Advanced Search