RTO credit policy

FERC approved all the jurisdictional ISO/RTO compliance filings with Order 895, which established rules for sharing credit information among the organized markets.

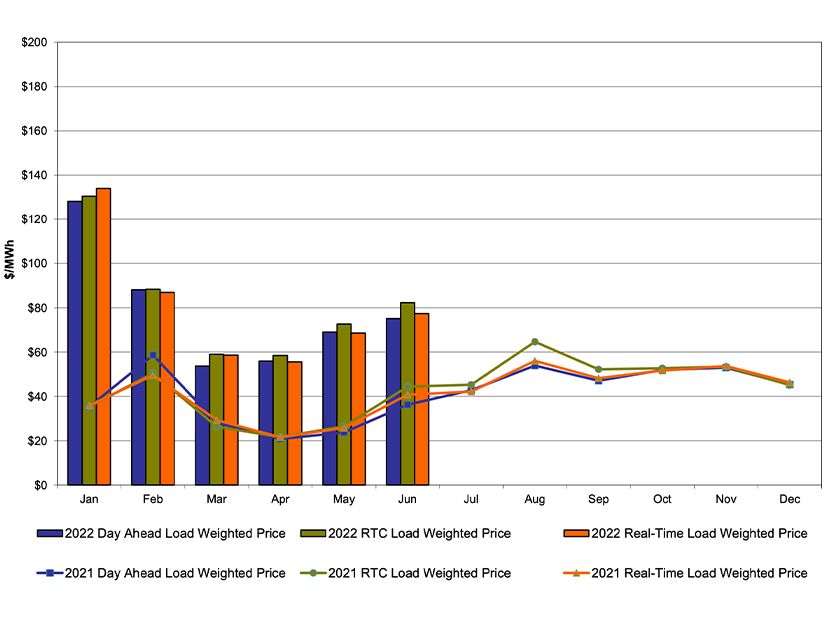

MISO said it will debut a task team dedicated to improving its credit policy as market participants experience more price volatility in the market and default risk grows.

ERCOT stakeholders have thrown their support behind staff’s recommended changes to the ORDC that will serve as a bridge to regulators' proposed market design.

PJM has assessed more than $1.8 billion in performance penalties on generators that underperformed during the December 2022 winter storm, the RTO said.

ERCOT has approved a pilot project where Texas energy providers can aggregate their customers’ small DERs and sell the extra energy back to the grid.

Load interests continued to oppose PJM’s proposal to change the market seller offer cap, a month after it failed to meet the two-thirds endorsement threshold.

ERCOT’s Board of Directors approved a protocol change that eliminated unsecured credit.

ERCOT’s Board of Directors unanimously approved a nodal protocol revision request that will lower unsecured credit limits from $50 million to $30 million.

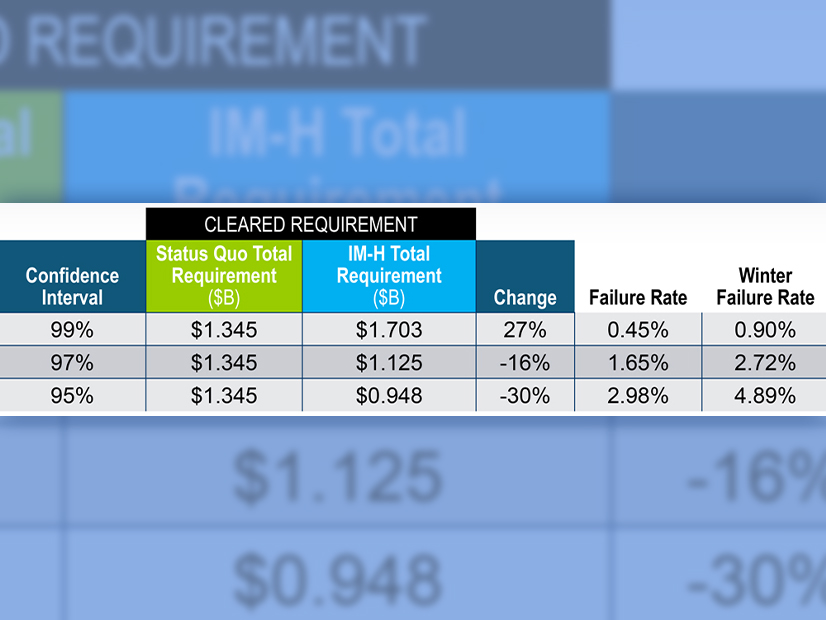

FERC wants more information to determine whether it should require a 99% confidence level in setting collateral for FTR traders or the 97% level PJM sought.

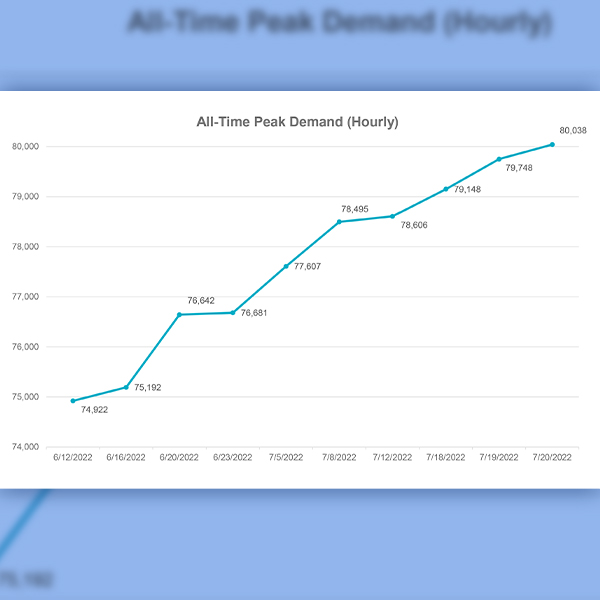

The New York grid performed well in the summer’s 1st heat wave July 20-24, NYISO vice president of operations Aaron Markham told the NYISO Management Committee.

Want more? Advanced Search