Western Resource Adequacy Program (WRAP)

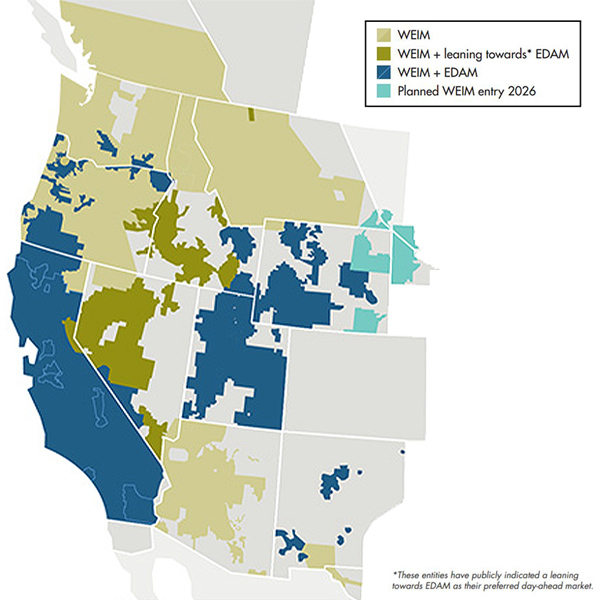

PGE is exploring an alternative to the Western Power Pool’s Western Resource Adequacy Program that better suits its upcoming participation in CAISO’s Extended Day-Ahead Market, the utility told Oregon regulators.

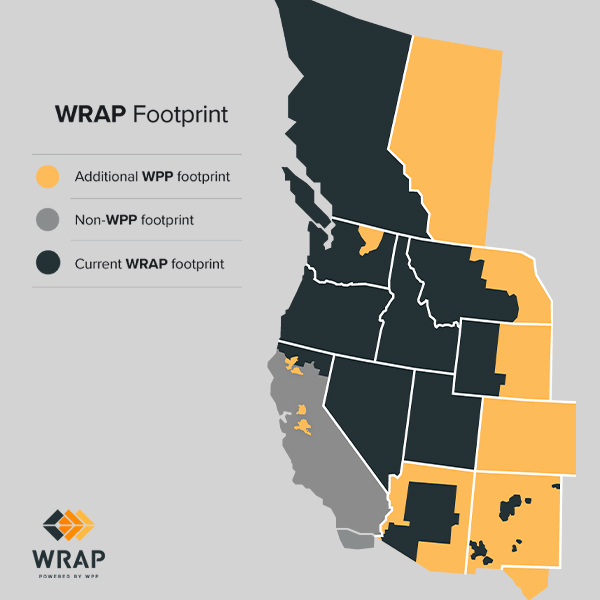

Calpine, Eugene Water & Electric Board, PGE and PNM joined NV Energy in leaving the Western Resource Adequacy Program, while Idaho Power signaled its continued commitment.

NV Energy said it is discussing a potential new resource adequacy program with other participants in CAISO’s Extended Day-Ahead Market.

The Western Power Pool’s Board of Directors denied PacifiCorp’s request to postpone the deadline by which Western Resource Adequacy Program participants must commit to the first “binding” phase of the program.

NV Energy notified the Public Utilities Commission of Nevada that it plans to leave the Western Power Pool’s Western Resource Adequacy Program, citing five critical issues with the program’s design.

PacifiCorp asked the WPP’s Board of Directors to allow WRAP participants to defer their decision to commit to the program’s binding phase by at least one year.

The Western Power Pool’s WRAP secured enough participants for the program to enter the first binding phase after 11 utilities reaffirmed their commitment.

Former SPP COO Carl Monroe's decades of outreach to Western Interconnection entities are evident in the RTO's various markets and service offerings in the West.

The WRAP DAM Task Force is finalizing a concept paper that outlines proposed principles for the program under the new day-ahead market landscape.

The Oregon Department of Energy’s new draft energy strategy points to the importance of new transmission development and expanding electricity markets for meeting the state's energy goals.

Want more? Advanced Search