A recent study that contributed to El Paso Electric’s decision to join SPP’s Markets+ rather than CAISO’s Extended Day-Ahead Market (EDAM) has raised questions among New Mexico regulators.

The results of the Brattle Group analysis were presented to the New Mexico Public Regulation Commission (PRC) during a March 13 workshop.

The workshop followed EPE’s announcement Jan. 24 that it would join Markets+. The announcement surprised commissioners, who were expecting to see results of additional studies before EPE selected a market. (See related story, EPE’s Markets+ Decision ‘Not Transparent,’ NM Regulators Say.)

In the new analysis, Brattle updated results from an earlier study for Public Service Company of New Mexico (PNM) and EPE with a “sensitivity case” that includes the value of the Eddy County tie. The tie is a 345-kV transmission line that links EPE with Southwestern Public Service, which is a member of the SPP RTO in the Eastern Interconnection.

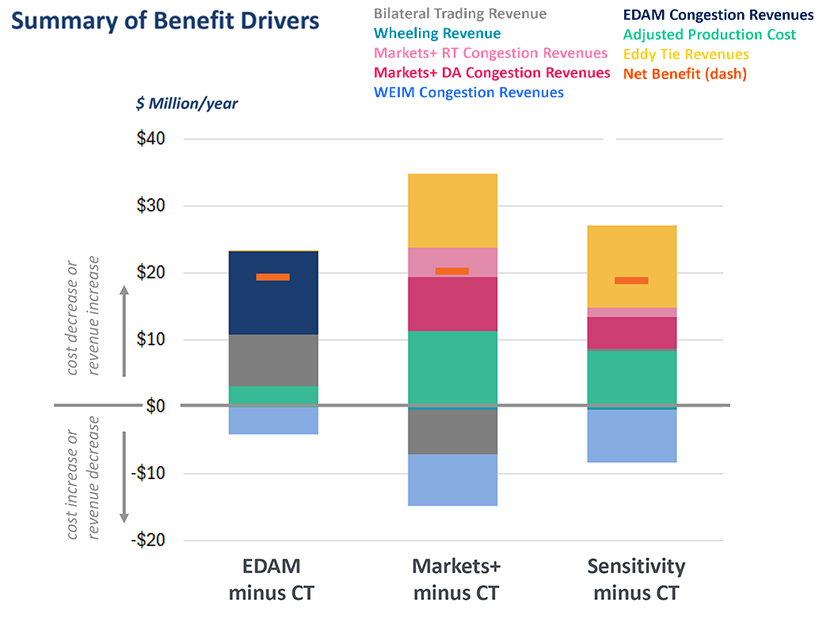

Under that case, EPE’s annual benefits would be $19.3 million if both New Mexico utilities join EDAM, $20.1 million if they join Markets+ and $18.8 million if EPE goes with Markets+ while PNM joins EDAM, Brattle projected in the new analysis.

That contrasts with results from Brattle’s previous study, which projected EPE’s benefits would be $19.1 million a year if both utilities joined EDAM versus $9.1 million if both joined Markets+. The benefits are in comparison to a “current trends” (CT) case in which PNM and EPE remain in CAISO’s Western Energy Imbalance Market (WEIM) and don’t join a day-ahead market.

PNM announced its choice of EDAM in November. (See PNM Picks CAISO’s EDAM.)

Eddy Optimization

In its new analysis, Brattle “optimized” the Eddy County tie to SPP East for scenarios where EPE joins Markets+, assuming that trade flows freely across the tie. The model assumes the SPP East market is liquid enough to supply or receive all Eddy tie flows at prices comparable to those of Markets+.

“Whenever El Paso is purchasing power, we assume that the tie’s importing; whenever they’re selling power, we assume that they’re exporting,” Brattle Group principal John Tsoukalis said during the workshop.

In the cases where EPE is in EDAM or only in WEIM, the Eddy tie isn’t optimized; instead, its value is assumed to be the same as it was in 2023.

The optimization is only in the Markets+ cases because Markets+ and SPP East have the same market operator, said Tsoukalis, who said his understanding is that SPP is planning for the optimization. While Tsoukalis said it’s possible that SPP would optimize flows with EDAM, he said he’s not aware of any discussions to do so.

Commission Chair Pat O’Connell questioned the assumption, saying it implies something “kind of remarkable.”

“You have to accept that SPP would not work to optimize interregional transfer unless you’re in Markets+,” O’Connell said.

Commissioner Gabriel Aguilera also wondered whether there would be an opportunity for Eddy County tie optimization through a seams agreement in a case where EPE joins EDAM. Aguilera asked if Brattle could calculate benefits in two additional ways: one in which the Eddy tie is not optimized in any of the four scenarios, and another in which it is optimized in all four scenarios, including cases where EPE joins EDAM or remains solely in WEIM.

“It seems like all of those have an equal possibility of occurring,” Aguilera said.

EPE representatives agreed to bring those variations of the analysis to the commission.

EPE and PNM are co-owners of the 200-MW Eddie County tie: EPE has rights to two-thirds of the capacity, and PNM has rights to the remaining third. That prompted questions from the commission on why the Brattle analysis optimized the tie’s entire 200 MW in the two cases where EPE joins Markets+.

“PNM owns part of this, and yet your sensitivity analysis relies so heavily on using 200 MW,” Aguilera said.

Weighing the Choices

After the latest Brattle analysis found similar monetary benefits in the different scenarios, EPE turned to additional factors in making its day-ahead market decision.

SPP’s experience as an RTO operator and its record of expanding renewable energy resources make “it a trusted partner in this endeavor,” EPE said in its announcement. (See El Paso Electric to Join SPP’s Markets+ in 2028.)

During the PRC workshop, EPE representatives said another advantage of Markets+ relates to resource adequacy. Markets+ will require all participants to join Western Power Pool’s Western Resource Adequacy Program (WRAP).

“It is important to make sure that everybody is on equal footing on how you’re calculating your resources,” said Emmanuel Villalobos, EPE’s director for market development and resource strategy.

Instead of facing a WRAP requirement, EDAM participants will undergo a daily resource sufficiency evaluation (RSE). EDAM participants have the option to join WRAP, but it’s not required.

Aguilera questioned EPE’s ability to meet WRAP’s requirements. He said the utility might need to accelerate resource procurement, with a resulting cost impact to customers.

“As a regulator who is concerned about affordability, I would see that as a benefit in EDAM to have more of that flexibility” on resource adequacy, Aguilera said. “Especially given that WRAP hasn’t taken off. It’s been delayed. It’s been having its own issues.” (See WRAP Members Align on Key Issues to Prioritize.)

EPE did not participate in Phase 1 of Markets+ development and has not yet signed a Phase 2 funding agreement with SPP — a move Villalobos said EPE is likely to make in the first quarter of 2026. The funding commitment would be in the form of collateral rather than money given upfront, he added.

Consultant Utilicast is wrapping up a gap analysis for EPE, looking at steps the utility needs to take before joining Markets+.

EPE expects to begin Markets+ implementation activities next year and start participating in the market in 2028.