Electricity demand will grow by 50% over the next 25 years, according to a report released April 7 by the National Electrical Manufacturers Association (NEMA).

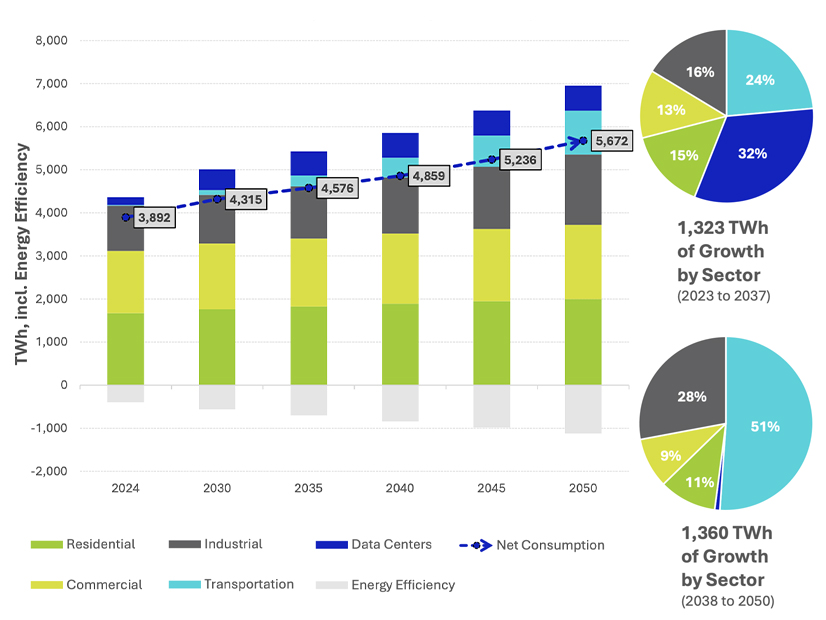

Data center demand is expected to grow by 300% over the next 10 years, with most of that happening in ERCOT and PJM, the study says. That represents 32% of the 1,323 TWh of forecast growth through 2037, while electrification of transportation makes up 24%.

For the 1,360 TWh between 2038 and 2050, transportation makes up 51% of the forecast, followed by industrial demand at 28%, while data centers represent just 1%.

The overall projected growth works out to 2% per year and follows years of low load growth across most of the U.S. as energy efficiency offset new sources of demand, NEMA CEO Debra Phillips said on a call with reporters April 4.

“This 50% growth that we’re looking at over the next 25 years is fairly remarkable, and our grid wasn’t designed really to meet that,” Phillips said. “So, we’re going to have to get creative around the technology and policy solutions that are going to help us meet the demand.”

The new growth will require new generation, transmission and other infrastructure, but Phillips said the industry would need to do more to maintain reliability.

“We’ve grown more efficient over time,” Phillips said. “It’s been key to us keeping that demand curve flat in recent years, and we’re going to continue to get better in that efficiency space. And so that, I think, is the real difference maker in our study versus others, is that we’re really leaning into that concept of efficiency, and our products really enable that.”

NEMA represents manufacturers of the grid’s backbone infrastructure, including lighting, motors, wire and cable, she said.

While demand is forecast to grow the fastest in PJM and ERCOT in the first half of the forecast, the shift to EVs in the second means the West and Northeast should see the highest rates of growth, Phillips said. Between now and 2050, electricity is expected to grow from 21% of final energy use to 32%.

In terms of new generation, the report forecasts its capacity will grow by 43% to 1,761 GW nationally, with most of the growth in renewables and storage as fossil generation declines slightly. NEMA’s forecast has 409 GW of gas running by 2043, while the U.S. Energy Information Administration expects the gas fleet to total just 126 GW by 2050 and a National Renewable Energy Laboratory study has it falling to 189 GW by 2050.

NEMA is releasing the study after President Donald Trump announced wide-ranging tariffs, which will impact manufacturing supply chains around the globe, include the group’s members. Since 2018, NEMA members have invested $185 billion in domestic manufacturing, and its goal of reshoring some industry aligns with Trump’s goals, Phillips said.

“Another aspect of the trade world that the electrical industry finds itself in is an ecosystem that’s very connected in North America,” Phillips said. “So, trade with our Mexican and Canadian partners is really important.”

The three largest North American countries have designed their entire power systems together, so NEMA values certainty and predictability around the trading rules and tariff rates between them, she added.

Predictability is important to the future of that continental trading relationship, ABB Executive Vice President Michael Plaster told reporters on the NEMA call.

“We have a switch gear plant in Mebane, N.C.,” Plaster said. “We have a switch gear plant in Mexico, and they make the same thing. And to be able to flex when there is a crisis is really important, without having to wonder how much is it going to cost us to flex like that.”

Predictability is important, but the tariffs are going to have cost implications because going back to a world where everything is made for domestic consumption in each country is not cost effective, S&C Electric CEO Anders Sjoelin said on the call.

“There will be a cost adder,” Sjoelin said. “And we’re going through that because some of the components and parts that [go] into your product [are] hard to make yourself because [they’re] not part of your core. … I’m discussing that today with my team.”