NYISO continues to find a reliability need for New York City this summer and two peaker plants in the city should be allowed to continue operations into 2027 if necessary, according to sensitivity results for the first-quarter Short Term Assessment of Reliability (STAR), presented April 7 to the Transmission Planning Advisory Subcommittee.

Ross Altman, NYISO senior manager of reliability planning, said the city would be deficient by 281 MW for five hours on a hypothetical summer peak day during normal weather conditions if the Gowanus and Narrows peaker units are offline. Both barge-borne floating plants were built in the early 1970s and are owned by AlphaGen.

The ISO said it continues to believe the plants should be allowed to operate beyond their planned retirement in May, until May 2027 or a “permanent solution” is in place.

But NYISO also is concerned about unplanned outages at aging plants; the accelerated retirement of other, smaller New York Power Authority gas plants; the impact of heat waves; and delays on the Champlain Hudson Power Express transmission project.

The status of the fossil fuel fleet and NYISO’s assumptions about their retirements occupied much of the discussion. Altman said the ISO was not forecasting retirements; rather, the intent of the analysis was to understand how many old plants were at risk of failure.

“What we’re showing with aging fossil fuel [power plants] isn’t purely economic or policy driven,” Altman said. “As complicated, spinning heavy machines age, they are more likely to fail.”

Chris Casey with the Natural Resources Defense Council asked NYISO to make it clear in the final Q1 STAR report, due to be released by April 14, that it wasn’t talking about normal retirements. He said the language of the presentation made it confusing as to whether the “deactivations” were a normal process or from catastrophic failure.

Doreen Saia, chair of the energy law practice at Greenberg Traurig, asked whether the ISO was implying with this analysis that it was worried that if a fossil fuel generator went offline, it would not get it back.

“If that’s part of your analysis, it needs to be said someplace because I think it’s an absolutely fair assumption,” Saia said. “I don’t know why you would think you could get them back in this environment where gas turbines aren’t favored and the owner could very well sell or repurpose their very attractive real estate.”

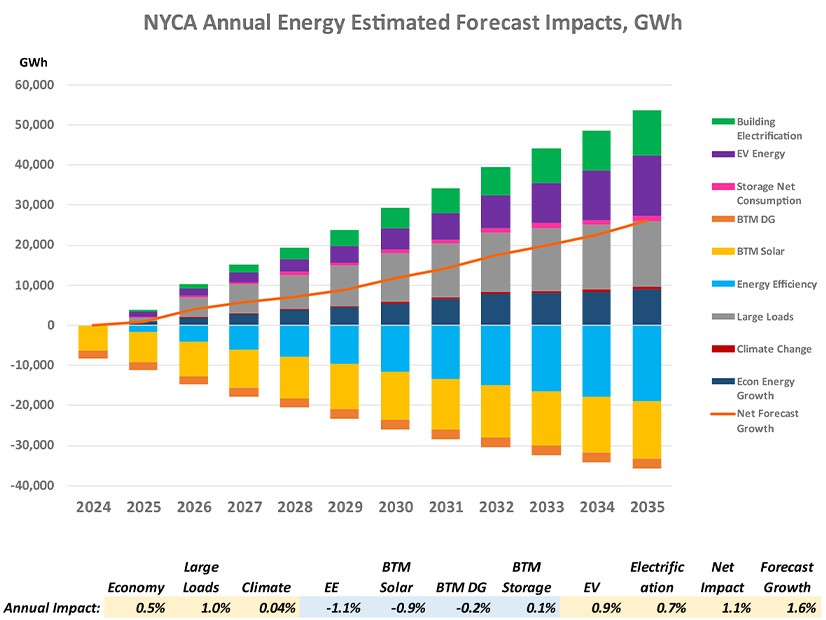

NYISO also presented its 2025 preliminary baseline forecast for the next 10 years of load growth for both the winter and summer capability periods.

The ISO projects roughly 3,700 GWh of large load growth in 2025, mostly concentrated in the North Country and Buffalo. In 2026, roughly 7,800 GWh of large load is forecast to be on the grid.

These large loads constitute the greatest driver of growth in New York. In the near term, they dwarf both electric vehicle and building electrification forecasts. Economy-driven demand growth is projected to remain relatively low through 2035 because of poor economic forecasts.

Without the large loads, New York likely would see declines in overall energy consumption because of outmigration and slowing economic growth through 2031. The forecasts did not consider the Trump administration’s tariffs.

The ISO also expects energy efficiency gains to mitigate load growth, with strong support from behind-the-meter solar and energy storage.

Casey said he agreed with several skeptical stakeholders that some of the sensitivity scenarios did not present credible possibilities. He went further, saying that given the tariffs from the Trump administration, the baseline forecast could be “way above” reality.

“There is a realistic possibility that things will stay as they are,” Casey said. “A lot of economic development and large loads that we anticipate coming are not going to come, or are not going to come when they are expected.”