ERCOT unveiled a long-term load forecast for 2031 on April 8 that adjusts projections provided by transmission providers and accounts for the uncertain nature of data centers and other large users.

The numbers still are staggering. Even reducing the amount of utilities’ projected loads based on historical data, the study forecasts demand to reach 145 GW in 2031. That is less than transmission providers’ projections of 218 GW in 2031.

The grid operator’s current peak demand is 85.5 GW, set in August 2023.

“Several people are looking forward to [this], with bated breath,” Bill Flores, chair of ERCOT’s Board of Directors, told COO Woody Rickerson before he presented the adjusted methodology to the directors.

The new treatment of load projections is a result of state legislation passed in 2023 (House Bill 5066) that updated regional transmission planning rules and required ERCOT to consider prospective loads identified by transmission providers. Previously, state laws prohibited the grid operator from factoring in load that was not financially committed or signed.

The legislation also directs ERCOT to file an annual report quantifying the capability of existing and planned generation and load resources. Staff plan to meet that requirement by using their semiannual Capacity, Demand and Reserves (CDR) report, as they did in December 2024 by using the TSPs’ load forecast.

However, that CDR revealed negative planning reserve margins as early as 2026. (See ERCOT’s Revised CDR Report Met with Doubts.)

“We’re going to pivot away from using that forecast in this year’s May CDR,” Rickerson told the board. He noted the legislation’s “most impactful difference” was ERCOT accepting transmission providers’ officer-attested letters, which he attributes to much of the future data center load growth.

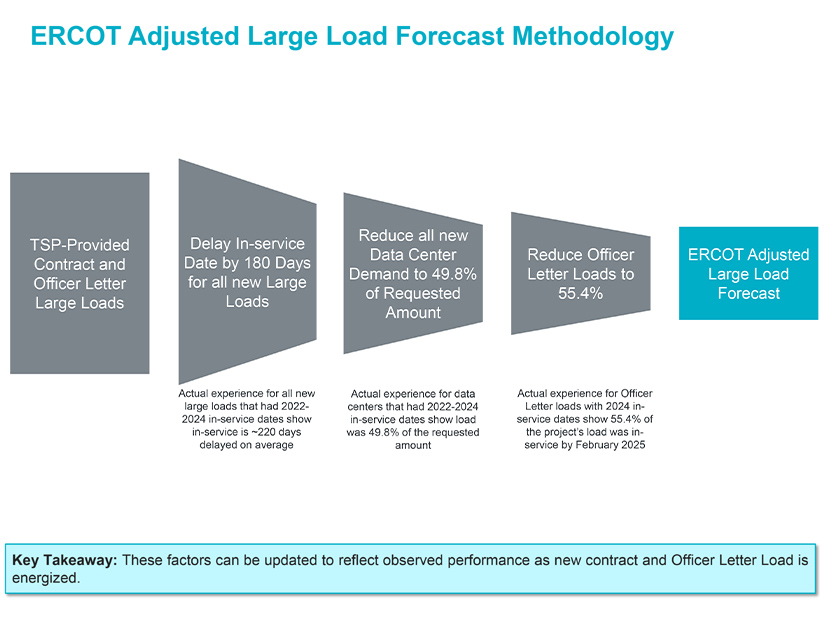

The adjusted load forecast is based on three adjustments:

-

- delaying the in-service date by 180 days for all new large loads;

- reducing new data center demand to 49.8% of the requested forecasts;

- reducing officer-attestation loads to 54.55% of forecasts.

Rickerson said the reductions represent a “measured percentage of power being used” versus the forecasts.

“An important part to keep in mind here is that this is a forecast based on the most recent data we have, and we’ll continue to update that as we move forward,” he said. “Those numbers were derived from loads that had been forecasted that we can now see and measure. Those numbers, as we move forward, can change as forecasts become more accurate.”

The problem, Rickerson said, is how to count the large loads (75 MW or more) that data centers, hyper-scalers and crypto miners are planning.

The board questioned Rickerson on the accuracy of data provided by transmission providers.

“Data centers are not something that we were forecasting or looking at four, five years ago, so this is new information. How fast it builds out is something we’re all going to learn together,” he said.

Rickerson said the quality of data needs to be adjusted “based on just the leading edge of historic numbers.” As ERCOT gets more of those numbers, he said, the grid operator’s adjusted load forecast and the transmission providers’ aggregate projections likely will merge into one.

ERCOT CEO Pablo Vegas said Senate Bill 6, an omnibus energy bill being considered in the 2025 Legislature, includes provisions addressing the inputs into transmission providers’ forecasts.

The ISO will begin incorporating the adjusted load forecast in transmission planning, resource adequacy and outage coordination analyses. Rickerson said a good-cause exception may be required from the Public Utility Commission.

There could be some good news in the future over the escalating demand ERCOT faces.

Pia Orrenius, a senior economist with the Federal Reserve Bank of Dallas, followed Rickerson’s presentation by saying the Texas economy is “likely slowing.”

“[Business] outlooks have recently turned pessimistic,” she told the board, noting surveys of Texas businesses are “flashing some warning signs.”

“Growth is likely to slow further … and will probably slow further than we’re currently forecasting,” she said. “The main reason is tariffs. They’re going to lead to higher prices. Consumption and investment will slow and possibly decline.”