A new study commissioned by the Environmental Defense Fund (EDF) finds Public Service Company of Colorado (PSCo) would earn millions of dollars more in annual benefits from participating in CAISO’s Extended Day-Ahead Market (EDAM) than SPP’s Markets+.

The study, conducted by Aurora Energy Research, found EDAM could provide the Denver-based utility $11.2 million more in average annual savings from 2028 to 2040 compared with Markets+, rising to $13.2 million through 2060.

The analysis comes three months after PSCo, a subsidiary of Xcel Energy, asked the Colorado Public Utilities Commission (CPUC) for permission to join Markets+ and fund its share of the Phase 2 implementation stage of the market. (See PSCo Seeks to Join SPP’s Markets+.)

“It’s important to recognize that not all markets are created equal,” Alex DeGolia, director of state legislative and regulatory affairs at EDF, said in a May 27 statement accompanying the release of the study.

Like other prominent environmental organizations, EDF has advocated strongly for a single Western electricity market that pointedly includes California and rests on the existing framework of CAISO’s Western Energy Imbalance Market.

“Coloradans deserve for this decision — which could have decadeslong implications for their utility bills, as well as the state’s ability to meet its climate targets — to be informed by thorough, robust analysis. Recent analysis suggests that the Extended Day-Ahead Market is a clear winner among currently available options in terms of delivering both lower costs and more reliability to our state,” DeGolia said.

In an email to RTO Insider, Joe Taylor, senior director of Western markets for Xcel Energy-Colorado, said the Aurora study “was very recently submitted in public comments in our application to join the Markets+ market.”

“We are taking part in that proceeding at the Public Utilities Commission and have not had the opportunity yet to review this document,” Taylor wrote.

Breakdown of Benefits

In its February filing with the CPUC seeking to join Markets+, PSCo said it was swayed by the SPP market’s independent governance, greenhouse gas emissions tracking and accounting system, and benefits “overall and in relation to costs relative to the other markets studied, including EDAM.”

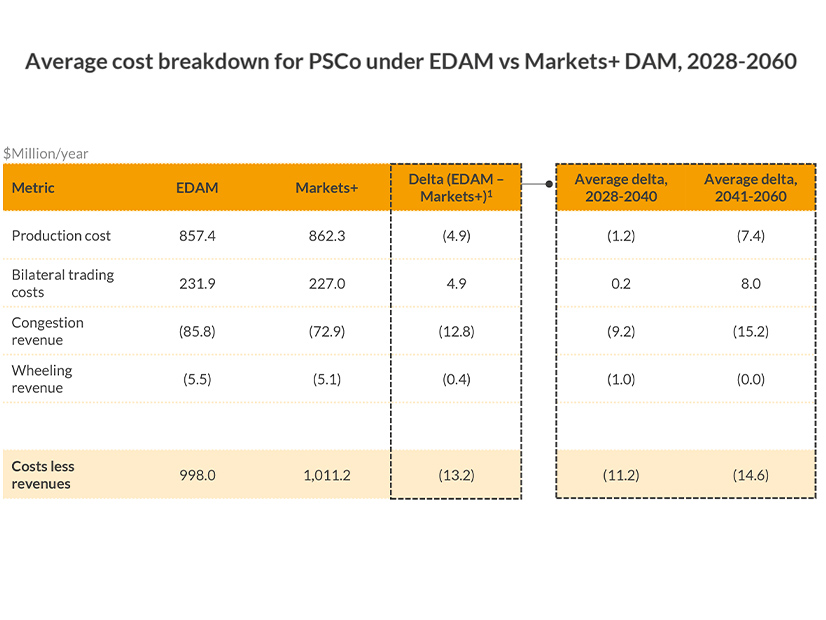

It’s unclear what impact the Aurora study might have on the PUC’s response, but it could raise questions about PSCo’s cost-benefit claim based on its examination of four metrics, including estimated production costs, bilateral trading costs, congestion revenues and wheeling revenues under both markets.

The study found that under EDAM, PSCo’s average annual productions costs would be $4.9 million lower than in Markets+, in large part because the CAISO market would allow the utility to more significantly increase its use of wind generation and reduce its reliance on gas-fired generation.

Aurora also found that PSCo’s participation in EDAM would bring increased use of its transmission system to facilitate energy transfers between EDAM members PacifiCorp and PNM, whose balancing areas border PSCo. Those transfers would translate into $12.8 million more in congestion revenues compared with Markets+, along with $0.4 million more in wheeling revenues.

The study does show Markets+ outperforming in one area: PSCo’s bilateral trading costs in EDAM are expected to exceed those in the SPP market by $4.9 million, something largely attributed to “friction charges” for imports from the Western Area Power Administration’s neighboring Rocky Mountain Region balancing area, which plans to join SPP’s full RTO.

Aurora noted that, in modeling the Western Interconnection, the study considered transfer limits between BAs, basing its transfer capacity assumptions on both the historical record and assumptions about planned upgrades to interstate transmission capacity affecting Colorado, including three lines expected to begin service in 2032.

But even in excluding those planned interstate projects in the modeling, EDAM’s benefits would exceed those of Markets+ by $4.2 million a year, the study found, while the EDAM benefits advantage would continue to increase with the additional inclusion of each project.

The study also found PSCo would be able to comply with Colorado’s ambitious emissions targets under either market. State law requires utilities to reduce their emissions from retail sales by 80% by 2030 compared with a 2005 baseline and move to 100% clean energy by 2050.

“Emissions are similar between the two modeled scenarios for PSCo participation in EDAM and Markets+, given the capacity mix was held constant. Marginal differences in emissions are driven by variation in carbon intensity of imports and exports,” the study says.

Aurora’s study modeled the makeup of each market based on confirmed and likely commitments by participants.