ISO-NE and stakeholders discussed market performance, capacity auction reforms, the RTO’s 2026 budget and asset condition spending at the summer meeting of the NEPOOL Participants Committee.

Annual State of the Market

HARWICH, Mass. — Amid extreme temperatures and the highest peak demand experienced in years, ISO-NE and stakeholders discussed market performance, capacity auction reforms, the RTO’s 2026 budget and asset condition spending at the summer meeting of the NEPOOL Participants Committee on June 24-26.

The three-day meeting at a luxury resort on Cape Cod was preceded by the news that CEO Gordon van Welie, who has led the RTO since 2001, will retire by the end of the year. He will be replaced by COO Vamsi Chadalavada. (See ISO-NE CEO Gordon van Welie Announces Retirement.)

David Patton of Potomac Economics, ISO-NE’s External Market Monitor, presented his annual assessment of the region’s markets, which found they “performed competitively” but concluded that “key improvements will be increasingly important in the coming years.”

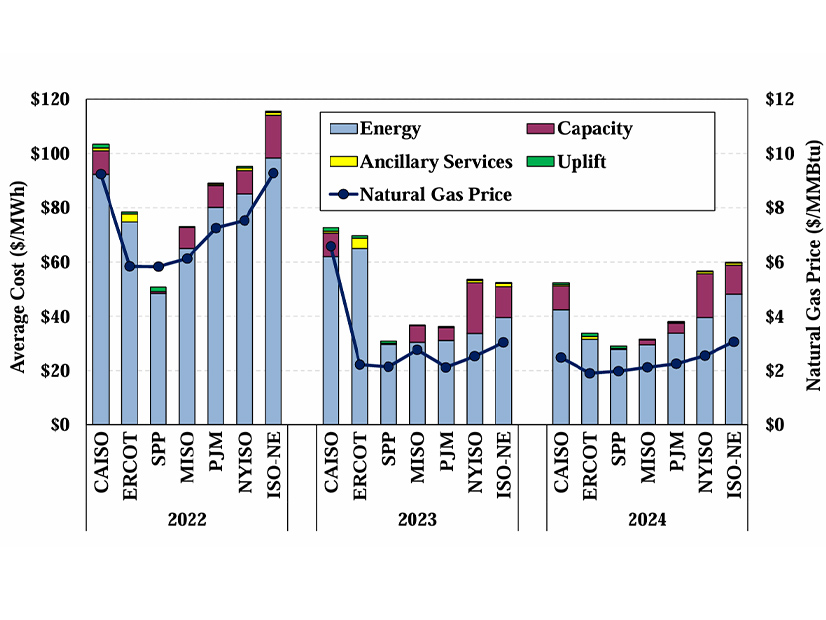

ISO-NE had the highest overall wholesale market costs of all RTOs in 2024 because of high gas costs, Patton said. New England’s reliance on natural gas generation has increased in recent years; according to ISO-NE data, gas generation hit a record high in 2024, accounting for 51% of net energy for load in the region. (See New England Gas Generation Hit a Record High in 2024.)

Patton added that New England faced inflated capacity costs because of overforecast demand in its Forward Capacity Auctions, which is “slow to correct in the [Forward Capacity Market].”

The region also continues to have extremely high transmission rates, which were “more than double the average rates in other RTO markets,” Patton said. He noted that the region’s transmission investments have led to low congestion costs. ISO-NE continued to have the lowest congestion costs of all RTOs in 2024, estimated to be “8 to 17% of other RTOs per megawatt-hours of load,” Patton added.

However, some stakeholders said this calculation of congestion costs does not appear to fully account for transmission constraints in Maine, which have limited the development of renewables and are the target of the first ISO-NE Longer-Term Transmission Planning solicitation. (See ISO-NE Releases Longer-term Transmission Planning RFP.)

Patton also expressed concern about a lack of liquidity in ISO-NE’s day-ahead market because of “inefficient allocation of costs to virtual transactions.”

Patton supports ISO-NE’s ongoing efforts to overhaul its capacity market, which are focused on improving resource accreditation, reducing the time between auctions and capacity commitment periods (CCPs), and splitting CCPs into summer and winter seasons.

He also called for a reduction in ISO-NE’s Pay-for-Performance (PFP) rate, which he said often overstates the value of reserves and could cause the premature retirement of some fossil units. He said the RTO should align PFP charges with the severity of reserve shortages and charge exporters the PFP rate.

Reflecting on two capacity deficiency events in the summer of 2024, Patton said “extraordinary prices” caused significant charges imposed on steam turbine and combined cycle plants, “most of which were available but not committed in the day-ahead markets.”

High PFP charges on resources that were not committed in the day-ahead market could cause “lower net revenues that may lead to premature retirements” and “inefficient incentives to self-commit such resources,” Patton said.

As states look to transition away from fossil generation, Patton concluded that the region is “well positioned to handle the renewable transition” but recommended that the RTO develop a “a look-ahead dispatch model to address ramp needs and [the] optimization of storage resources.”

Multiyear Road Map

Chadalavada outlined some “key future focus areas” for the RTO over the next few years, including the development of “forward-looking intraday market-clearing and pricing systems,” intended to help optimize storage deployment and meet increasing ramping requirements.

“To cost-effectively address operational uncertainties in a dynamic power system, costs will need to be incurred now to position the system with sufficient flexibility later,” Chadalavada said. “This will require new real-time, ‘multi-interval’ optimization and pricing algorithms incorporating probabilistic forecasts.”

Chadalavada said ISO-NE aims to develop probabilistic forecasts for load and renewable production, which should help the RTO manage increasing uncertainty on the system.

He said ISO-NE is researching methods for multi-interval pricing and probabilistic forecasting, and said the RTO “may recommend a sequence of phased and interdependent market enhancements over the course of this initiative.”

Other focus areas Chadalavada highlighted include system planning coordination, modeling of inverter-based resources, resource adequacy and cybersecurity.

2026 Budget

ISO-NE outlined its initial 2026 budget proposal: a revenue requirement of $315.2 million, which would be a $4 million increase over the 2025 requirement.

This includes a $15.6 million reduction associated with the annual revenue true-up. Without the true-up, the 2026 budget is 1.8% lower than ISO-NE initially projected in 2024.

“The budget for 2026 represents the ISO’s commitment to supporting the region as it continues to experience an evolving resource mix and changing customer use patterns, ensuring that markets and grid operations are efficient and reliable,” said Kelly Reyngold, director of accounting.

Notably, the budget “includes ‘placeholder’ funding for asset-condition review work that will only be used for this purpose and, if not needed, will not be reallocated for use elsewhere.”

Earlier in 2025, ISO-NE announced that it is open to taking on a nonregulatory role in reviewing asset-condition spending, responding to state and consumer advocacy concerns about a lack of transparency and oversight on the projects. (See ISO-NE Open to Asset Condition Review Role amid Rising Costs.)

Chadalavada said it likely will take about 18 months to develop in-house asset-condition review capabilities but that ISO-NE hopes to hire a consultant to help review the most important projects in the interim period. He said the RTO is working with transmission owners to establish the criteria for reviewing projects in this interim period and eventually will include all stakeholders in these discussions.