PJM and several stakeholders presented proposals to define the contours of RTO’s capacity market design for the 2028/29 Base Residual Auction (BRA) and the three following auctions as part of the market’s Quadrennial Review.

The review aims to update the variable resource requirement (VRR) curve — which defines the amount of capacity the market procures and at what cost — to address changing market conditions. In a report commissioned by PJM, the Brattle Group said the key challenges that must be addressed are tightening supply and demand, uncertainty in the cost to build new capacity and accounting for several changes PJM has made to how it identifies reliability risks and determines the capacity value for different resource types.

The review also looks at the inputs to the VRR curve such as the reference resource technology class, whose costs are key inputs across the market; the cost of new entry (CONE) to build the reference resource in various regions of PJM; and the energy and ancillary services (EAS) offset, which estimates revenues outside the capacity market to net against CONE.

The Market Implementation Committee is set to vote on the proposals during its Aug. 6 meeting, followed by same-day Markets and Reliability Committee and Members Committee votes Aug. 20. The proposals also would require the approval of PJM’s Board of Managers. PJM aims to file its recommendation with FERC by Sept. 30.

Stakeholders Divided on Reference Technology

Much of the discussion during the July 9 first read on the proposals at the MIC centered on whether to retain the combustion turbine reference resource or adopt PJM’s recommendation to shift to a combined cycle unit in all regions except ComEd, where a four-hour battery electric storage system (BESS) would be the reference resource.

PJM’s Skyler Marzewski said staff believe a CC is best situated for meeting demand. Developers have shown interest in building new resources based on submissions to the reliability resource initiative (RRI), a fast-track interconnection queue the RTO opened earlier this year. Six of the projects selected for expedited interconnection studies through the RRI were new CC resources. (See PJM Selects 51 Projects for Expedited Interconnection Studies.)

“There was no clear winner, but when we really had to sit down and pick one, it seemed like a combined cycle was the best resource … what that means is it was the most economical,” Marzewski said.

PJM’s proposal includes several changes to other Quadrennial Review components to account for the higher EAS revenues for a CC over a CT to prevent the midpoint of the VRR curve from “collapsing” — an issue that led PJM to reverse a shift to a CC reference resource in 2022. Marzewski said the viability of new CC units is helped by emissions standards proposed under EPA’s power plant rule being held in abeyance by the D.C. Circuit Court of Appeals, with a new rule likely being issued by the end of the year. (See FERC OKs Changes to PJM Capacity Market to Cushion Consumer Impacts and EPA Proposes Repealing Limits on Power Plant Greenhouse Gas Emissions.)

The net EAS parameters would remain the same aside from updating unit-specific parameters to account for the CC and BESS reference resources, Marzewski said.

Requirements for gas generation to implement carbon capture technology under the Illinois Climate and Equitable Jobs Act led to storage being the most economic capacity resource, Marzewski said.

Independent Market Monitor Joe Bowring said the goal of the capacity market is to solve the “missing money” problem by ensuring capacity resources can recoup any costs to provide capacity above what they earn through the energy and ancillary service markets. While a CC has been the most common resource over the past few decades, the economics of their development are based on EAS revenues. Combustion turbines, however, would go bankrupt almost immediately without capacity revenues, making the capacity market critical to ensuring the viability of peaking units and defining the missing money.

The Monitor’s proposal would use a dual-fuel CT as the reference resource, with some changes over the status quo for characteristics such as heat rate and operating and maintenance costs.

LS Power proposed to use a four-hour battery for ComEd and a dual-fuel CT for all other regions, with updated CONE values. Director of Project Development Tom Hoatson said the goal of the Quadrennial Review should be to stabilize the capacity market while stakeholders address more holistic issues in other stakeholder processes.

Hoatson said CCs are not dependent on capacity revenues to be viable in PJM, whereas CTs and battery storage cannot subsist on energy revenues alone.

Pennsylvania Public Utility Commission Vice Chair Kimberly Barrow proposed a four-hour battery in ComEd and for all other regions a CC reference resource based on unit characteristics included in earlier IMM proposals, which would result in lower CONE values than the PJM proposal.

Changes to VRR Curve Shape

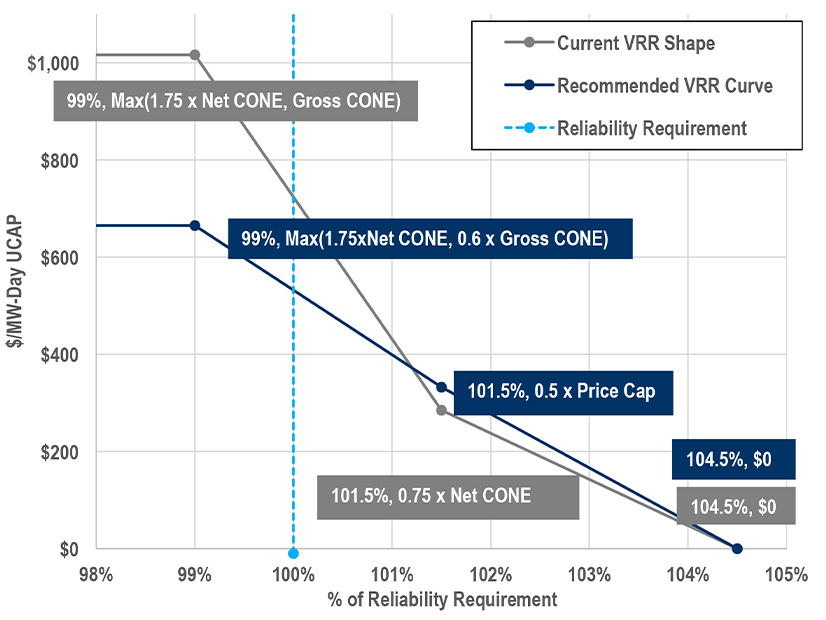

The PJM proposal also would revise the calculations defining the three points on the VRR curve: the maximum price would be set to the greater of 1.75 times net CONE or 0.6 times gross CONE, while the midpoint would be half of the price cap. The status quo shape has a maximum price that is the greater of 1.75 times net CONE or gross CONE and a midpoint at 0.75 times net CONE. The minimum price would remain zero.

Marzewski said tying the midpoint to the maximum price instead of net CONE would prevent it from falling to zero when EAS revenues for the reference resource are high.

He said the proposed curve’s performance is similar to the existing shape, resulting in a loss of load expectation of 0.084 events per year if net CONE is estimated accurately compared to 0.073 if the current shape is applied to a CC. With an accurate net CONE, Brattle’s modeling estimated an average clearing price of $380 MW/day with a standard deviation of $155 and the price hitting the cap 9.5% of the time. An underestimated net CONE would have a clearing price of $532 MW/day and hit the cap 37.7% of the time, while an overestimate would clear at $228 MW/day and have a 0.5% chance of hitting the cap.

Marzewski said PJM opted not to follow Brattle’s recommendation of a marginal reliability impact curve as most of the expected benefits also could be achieved by implementing a sub-annual capacity market design. During the June 18 Markets and Reliability Committee meeting, Pennsylvania Gov. Josh Shapiro’s office introduced a problem statement and issue charge to shift to a seasonal market. (See Pennsylvania Brings Seasonal Capacity Issue Charge to PJM.)

The Monitor’s proposal would set the maximum price at the lower of 1.5 times net CONE and gross CONE, consistent with the original PJM design, and set the midpoint at half of the maximum. Bowring said the gross CONE of a CC is significantly higher than the gross CONE of a CT and that PJM’s proposed 1.75 times net CONE generally was greater than gross CONE in the most recent auction.

Bowring said current conditions in the capacity market are almost entirely the result of adding large data center loads. The result is likely to be future auctions clearing at the maximum price. He argued that the potential resultant triggering of the PJM backstop auction would mean the return of cost-of-service regulation for new generation. That would be inconsistent with the competitive market design and unfair to existing generators, he said. The Monitor has recommended repeatedly that the best solution in the capacity market would be to require new data center loads to bring their own generation.

Barrow’s proposal would set the maximum price at 1.15 times gross CONE minus 0.75 times the EAS offset, with the midpoint at half that value. Unlike all other proposals and the status quo, the minimum price would be reached at 106% of the reliability requirement rather than 104.5%.

The LS Power proposal uses the status quo VRR curve shape.