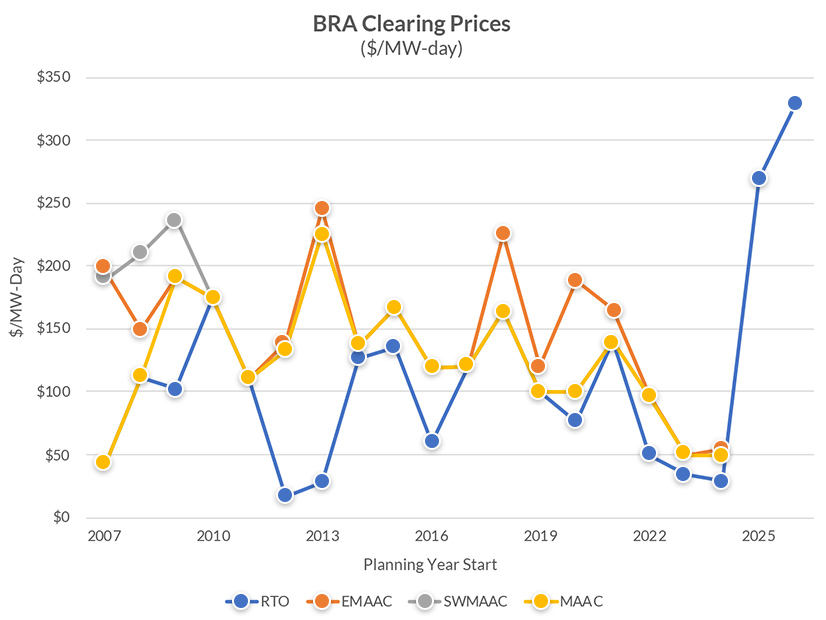

The clearing price is the highest in PJM history and an increase of $59.22 (22%) from last year’s record for the RTO.

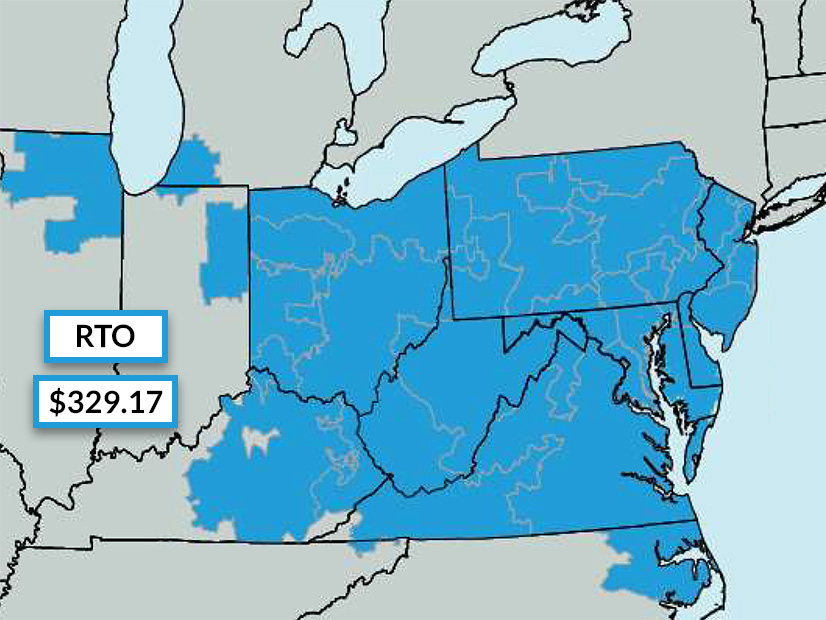

PJM capacity prices soared to $329.17/MW-day (UCAP) RTO-wide for delivery year 2026/27, hitting the price cap approved by FERC after prices rose nearly 10-fold in the July 2024 auction.

The clearing price is the highest in PJM history and an increase of $59.22 (22%) from last year’s record for the RTO.

Prices would have hit $388.57/MW-day without the cap, PJM said in its report on the auction. The cleared supply totals $16.1 billion, up 9.5% from the $14.7 billion last year.

“This is a continuation of trends that we’ve been seeing: a tightening of the supply and demand conditions,” Stu Bresler, executive vice president of PJM market services and strategy, said in a press briefing after results were announced July 22.

PJM’s forecast peak load for 2026/27 increased by 5,446 MW from last year due to data center expansion, electrification and economic growth. “It’s probably a true statement to say that the majority of the demand increase we saw was … those data center additions,” Bresler said.

However, prices fell in the Baltimore Gas and Electric (BGE) and Dominion zones, which cleared at $466.35/MW-day and $444.26/MW-day respectively last year. Thus, although the increased capacity costs will boost many retail customers’ bills by 1.5 to 5%, Dominion customers could save money, Bresler said.

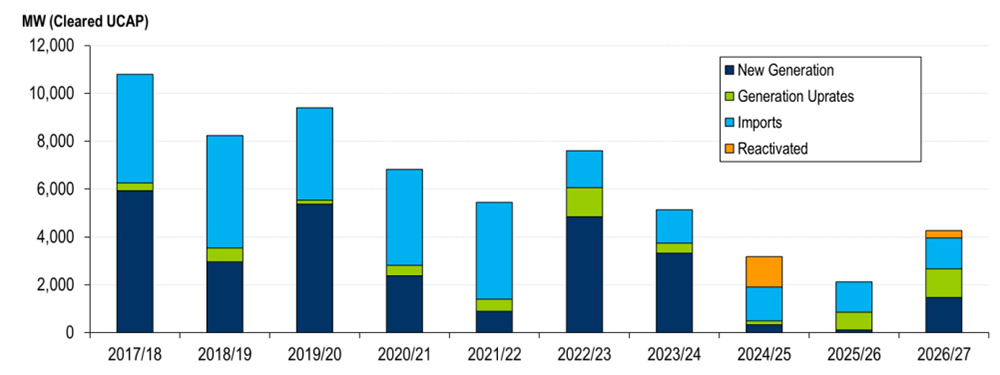

Supply offered dropped 500.5 MW (UCAP) to 135,191.8 MW. New generation and uprates totaled 2,669 MW, the first increase in the past four auctions. In addition, 17 generating units with 1,100 MW of Capacity Interconnection Rights withdrew their retirements since the 2024 results were announced.

“We were pleased to see the new resources and the uprates that came in,” Bresler said. “We’re pleased to see the reversals of retirements, because that’s the kind of thing we need and the kind of thing that one would expect from the collection of information that’s out there, including the results of the last capacity auction.” The Base Residual Auction (BRA) procured 134,311 MW of unforced capacity generation (UCAP) and demand response. Regions under the Fixed Resource Requirement acquired an additional 11,933 MW (UCAP) for a total of 146,244 MW (UCAP).

The reserve margin is 18.9%, 309 MW ICAP lower than the target of 19.1%.

Cleared resources were dominated by natural gas (45%), nuclear (21%) and coal (22%), with contributions from hydro (4%), wind (3%) and solar (1%). Declining fleetwide accreditation values pushed the amount of supply offered down by about 326 MW from the 2025/26 BRA. PJM’s auction report stated that 3 GW less gas was offered in the 2026/27 auction.

An additional 2 GW of wind generation cleared in the auction, followed by 867 MW of coal and 578 MW of oil. While the amount of DR offered was nearly flat, the resource class saw a significant drop in its effective load-carrying capability (ELCC) rating, causing the amount of UCAP clearing to fall by 224 MW.

Bresler said almost every resource that submitted offers cleared, aside from one that had its minimum offer set above the maximum clearing price. He said the results follow a trend of tightening supply and demand in recent auctions, which PJM has argued could lead to a capacity shortfall in the 2029/30 delivery year.

“I think this auction, just as the last one, served its purpose and very transparently reflected supply and demand,” Bresler said.

RMR Impact

Bresler said including generators on reliability-must-run (RMR) agreements as supply helped dampen prices and reduced constraints, allowing BGE and Dominion to clear along with the rest of the RTO.

“I think that there was a significant impact from including the RMRs at zero [dollars] in the supply stack, and … there were probably transmission upgrades going into place that changed the transmission import capabilities for those two zones as well,” Bresler said. “So, even without the lower cap, we still would not have had price separation in this auction.”

In the 2024 auction for 2025/26, the clearing price for most of the RTO jumped to $269.92/MW-day, the result of load growth, generation deactivations and changes to risk modeling that shrank reserve margins. (See PJM Capacity Prices Spike 10-fold in 2025/26 Auction.) The 2024/25 auction had seen a price of $28.92/MW-day for most of the RTO, with BGE hitting $73/MW-day.

Pa./PJM Settlement Lowered Clearing Prices

The 2026/27 auction design has been the subject of several rule changes and FERC complaints, including a settlement between PJM and Pennsylvania Gov. Josh Shapiro (D) to lower the maximum clearing price to $325/MW-day and establish a $175/MW-day floor. The settlement is effective for the 2026/27 and 2027/28 auctions (ER25-1357). (See FERC Approves PJM-Pa. Agreement on Capacity Price Cap, Floor.)

While the price band initially would be set at $175 to $325/MW-day, those values would be readjusted annually based on the accreditation of the reference resource.

PJM and the governor argued the settlement would stabilize prices while several market changes are implemented. A complaint filed by Shapiro’s office said a lower maximum price was needed as the capacity market is unable to send adequate price signals under a compressed auction schedule and while the interconnection queue remains backlogged, preventing developers from bringing new supply in response to high prices (EL25-46).

In a statement following the posting of the auction results, Shapiro said the settlement avoided “grossly excessive price increases” and saved consumers $8.3 billion.

NRDC Senior Advocate Tom Rutigliano said the settlement prevented windfall payments to generation owners without compromising on reliability. He said the resulting price signals are ample to maintain existing resources and support new development and so long as there are barriers to new entry, such as the backlogged interconnection queue, higher prices would have served no purpose.

In a statement, Illinois Citizens Utility Board Executive Director Sarah Moskowitz noted the settlement blunted capacity prices but argued the spike in capacity prices remains unacceptable and follows policy shortcomings at PJM.

“The power grid operator’s policy decisions too often favor outdated, expensive power plants and needlessly block low-cost clean energy resources and battery projects from connecting to the grid and bringing down prices. This extended price spike was preventable. It ramps up the urgency of implementing long-term reforms at PJM and comprehensive energy legislation in Illinois, such as the Clean and Reliable Grid Affordability Act, to protect customers from price spikes that serve only to give power generators windfall profits,” she said.

Auction Design Changes

PJM also received FERC approval to rework several market components, including modeling some resources operating on reliability-must-run agreements as supply in the capacity market (ER25-682). One of the factors that drove a spike in capacity prices in the 2025/26 BRA was two generators leaving the supply stack to begin running as RMR resources — the 1,289-MW Brandon Shores coal plant and the 843-MW H.A. Wagner oil-fired plant. (See FERC OKs Changes to PJM Capacity Market to Cushion Consumer Impacts.)

The filing also established an RTO-wide non-performance charge rate and maintained the reference resource for the 2026/27 auction as a combustion turbine, rather than going through with a scheduled shift to a combined cycle unit.

This is the first auction in which intermittent, storage and hybrid resources holding capacity interconnection rights (CIRs) were required to submit capacity offers. FERC granted PJM’s proposal to eliminate an exception from the capacity must-offer requirement for those resource types after the RTO said there was about 1.6 GW of capacity not offered. PJM argued that requiring all resources holding CIRs to submit capacity sell offers will prevent the exercise of market power and more accurately reflect supply and demand (ER25-785).

The order eliminating the must-offer exemption also established an alternative market seller offer cap (MSOC) set at a resource’s capacity performance quantified risk (CPQR). The filing argued the change would allow intermittent and storage resources to more accurately reflect the risks they face by taking on a capacity obligation.

Rising capacity clearing prices, and wholesale market costs generally, have been a source of consternation for consumer advocates and political leaders across many PJM states. Both Pennsylvania and New Jersey have raised the specter of leaving the RTO if reliability and cost concerns go unanswered. In July, nine governors signed onto a letter requesting that the qualifications for candidates to replace CEO Manu Asthana and to fill two open Board of Managers positions include the ability to restore public confidence and address “difficult decisions that could substantially raise consumer bills.”

“In the past, other regions looked to join PJM due to its many strengths; today, across the region, discussions of leaving PJM are becoming increasingly common,” the letter said. “These unwelcome developments reflect legitimate concerns about PJM’s trajectory. We write, as a bipartisan group of governors elected by the many millions of citizens of our respective states, to tell you that fundamental changes, and new leadership, are needed to restore confidence in PJM’s ability to meet the many challenges of this moment.”

Rutigliano said prices increased due to the combination of increasing data center demand and risk modeling capturing reliability issues with gas generation. Without the increase in wind generation, he said PJM would not have been able to meet reliability standards, underscoring the need for PJM to continue clearing its interconnection queue and for states and the federal government to address siting and permitting barriers.

“The bright spot in this auction is a 75% increase in wind and solar. That jump will save PJM from an unacceptable risk of blackouts in 2026. PJM will stay reliable in 2026 thanks to the increase in renewable power. However, these low-cost resources still only account for 4% of the PJM’s supply, so PJM must continue to significantly speed up approvals of the 85 GW waiting to connect. The only real solution to higher energy prices is to keep adding more renewable energy and storage to the grid,” he said in a statement.

Rutigliano told RTO Insider that states pushing for winterization of gas plants and PJM easing its restrictions on external resources selling capacity into PJM could buy the RTO at most two years before reliability issues become paramount, but the long-term solution lies in ensuring that renewable penetration accelerates.

Advanced Energy United Policy Director Jon Gordon said the auction results show that new resources are needed to meet forecast demand. However, long interconnection queues prevent developers from bringing new supply to market. He said fast-track study processes, advanced transmission technologies, load flexibility and virtual power plants can facilitate new entry while PJM advances its cluster-based interconnection study process.

“When prices go up, it’s meant to send a signal to energy developers: ‘We need more supply.’ But at the same time, PJM is holding up a big red ‘STOP’ sign to energy developers,” Gordon said. “Many projects have been stuck in the closed queue for over six years, a significant delay that adds additional risk and cost for developers and is likely to contribute to some otherwise viable projects never getting built.

“Given the magnitude of this crisis, PJM, transmission owners, project developers and states need to do everything they can to move projects in the current interconnection process through to completion while finding additional ways to accelerate the interconnection process immediately. The high auction prices underscore the urgency of allowing project developers to begin to propose new projects for the queue that reflect today’s economic realities and come online in time to lower prices and ensure resource adequacy.”

PJM Power Providers Group (P3) President Glen Thomas said the capacity market is successfully delivering reliability at a price that remains below surrounding regions.

“The auction results show a market that is responding but remains tight. New generation is being added, existing generation retained, external capacity imported and retired capacity reactivated. The resource mix remains diverse, and it is important for the market to continue to send the signal that more capacity is needed. In the meantime, consumers should feel comforted that PJM has secured capacity commitments sufficient to maintain reliability through May of 2027 at a price below what many other regions of the country are paying,” he wrote in a statement.

Electric Power Supply Association CEO Todd Snitchler said the auction prices show new resources, not political interventions, are urgently needed.

“Higher prices are a signal to build more generation resources, and reflect increasing stress on the system,” Snitchler said. “In recent years, a combination of state and federal policy shifts and poor market signals led to the premature retirement of essential generation. Now, as demand grows and supply tightens, we can’t ignore the consequences of past decisions, and we must accept that reliability comes at a cost. Investment follows clear, consistent rules.”

He argued that competitive wholesale markets have kept energy prices stable and efficient, whereas rising retail rates can be attributed to state policy mandates, as well as transmission and distribution spending not subject to the same transparency and market pressures.