Markets and Reliability Committee

Stakeholders Endorse SATA Issue Charge

VALLEY FORGE, Pa. — The PJM Markets and Reliability Committee endorsed by acclamation an issue charge by Constellation Energy focused on how storage as a transmission asset (SATA) could be implemented in the RTO.

Constellation’s language built on a PJM issue charge and sought to add consideration of potential market impacts when a SATA unit responds to a constraint. It added key work activities to identify the transmission use case for SATA, identify and address market impacts, develop rules for prioritizing SATA dispatch over market-based resources and consider rules to mitigate price impacts. (See “Stakeholders Bring Alternative SATA Issue Charges, Endorsement Delayed,” PJM MRC/MC Briefs: June 18, 2025.)

An additional issue charge was offered by Exelon, which its director of RTO relations and strategy, Alex Stern, said was distinguished from Constellation’s proposal by including a deeper exploration of overlapping benefits that SATA could have in planning and operations. Stern withdrew the utility’s proposal and threw his support behind Constellation’s offering.

All of the issue charges shared a six- to nine-month timeline and assigned the work to the Operating Committee.

PPL’s Robin Lafayette, co-sponsor of the Exelon proposal, said there has been a lot of education and discussion on SATA over the years and, while he does not want to shortchange generation owners’ concerns about market impacts, by ensuring the rules will be clearly defined, there can be progress on developing proposals.

“We need to get this out of the issue charge space and get this to the place where we can get some practical progress on storage. We see this as one tool in the toolbox” to address the transmission needs PJM is forecasting, he said.

Vistra’s Erik Heinle said the company wants to ensure storage has the capability to serve as a market asset in PJM, while avoiding the possibility for rate-based storage to cause negative impacts to resources participating in the markets.

Independent Market Monitor Joe Bowring said it’s essential that transmission owners not own assets that are directly competing with market resources, a possibility he said could arise from PJM’s language. He said that’s especially true as some utilities state they support going back to cost of service.

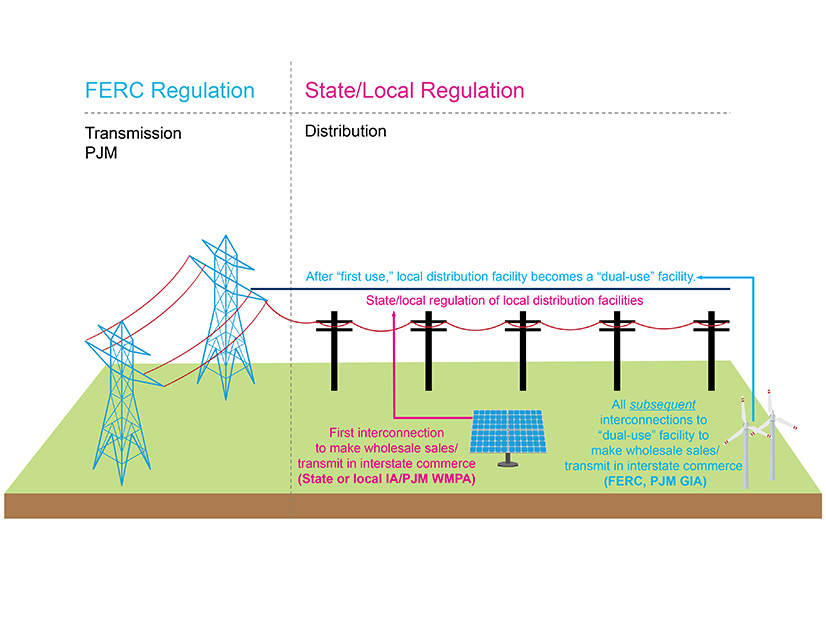

PJM’s Dave Anders said staff support considering a ruleset for dual-use storage providing both market and transmission services, but doing both at once would be “exceptionally time consuming,” and there is a preference for ensuring the transmission solution is fully thought through first.

Stakeholders originally considered the subject about five years ago before deferring the subject in February 2021. PJM revived the topic earlier in 2025, leading to a series of educational sessions at the OC.

Balancing Operating Reserve Revisions Endorsed

Stakeholders endorsed a proposal to rework the calculation of uplift credits and deviation charges to look at how resources follow dispatch instructions over time. (See “Stakeholders Narrowly Endorse Uplift Changes,” PJM MIC Briefs: April 2, 2025.)

The new tracking ramp-limited megawatt desired (TRLD) metric would look at the difference between what a resource’s output would be had it followed its economic basepoints versus its actual output for each five-minute interval. The current metrics are limited to considering output during each interval, which can lead to resources facing little to no deviation charges, or collecting uplift, while keeping their output flat contrary to PJM instructions.

PJM Senior Director of Market Settlements Lisa Morelli said the proposal also includes changes to the balancing operating reserve (BOR) calculation intended to simplify the calculation and limit make-whole payments to the amount of uplift that would be owed if a resource owner followed instructions. The proposed formula would determine a unit’s BOR credit to be the lesser of its real-time output or TRLD value. The start and end points for uplift eligibility would be revised to align with when a market seller’s commitment began and to run through either the end of that commitment or the unit’s minimum run time.

The proposal includes a phased rollout, where simulated settlement results would be presented to market participants a year before the changes are fully implemented. It was jointly sponsored by PJM and the Monitor at the Market Implementation Committee, where it was endorsed with 53.3% support.

Heinle said there are concerns about the proposal, but the soft launch is a good idea to provide market participants an opportunity to adjust to the changes and so any unintended consequences can be addressed.

Reworked Dual-fuel Definition Endorsed

The committee endorsed by acclamation a quick-fix proposal to revise the definition of dual-fuel gas generation to include resources where the alternate fuel is stored off-site but connected with “a firm pipeline that is solely dedicated to the market seller’s resource(s).”

The quick-fix process allows an issue charge to be voted on concurrent with a proposed solution.

While stakeholders workshopped the precise Reliability Assurance Agreement revisions included in the proposal during the July 23 meeting to avoid it applying to configurations where there would not be a firm supply of the alternative fuel, there was widespread support for the changes.

Bowring said the proposal illustrates the difficulties of trying to pursue changes in a quick-fix space and suggested deferring another meeting to allow the language to be tightened. He said there is not underlying disagreement with the language brought by Dominion Energy, but rather with its precision.

Members Committee

PJM Presents Capacity Market Feedback Poll

PJM Executive Vice President of Market Services and Strategy Stu Bresler presented the results of a poll querying stakeholders on what changes to the capacity market they believe should be prioritized.

When asked if any additional items should be added to the scope of the Quadrennial Review of the capacity market, 105 respondents said no additional issues should be considered, followed by “other components” with 74 votes and a prompt auction design with 58. When considering what should be tackled alongside how large load additions (LLAs) are incorporated into PJM’s load forecasts, there was wide support for enabling greater participation for demand response and load flexibility. Outside of the Quadrennial Review and LLA issues, 161 stakeholders said a sub-annual market design should be a priority.

Bresler said the RTO is considering an expedited stakeholder process to reckon with large loads, which are a significant contributor to a capacity shortfall PJM is forecasting around the 2029/30 delivery year, along with generation deactivations outpacing new entry.

“We need to get a handle on these large load adjustments and do it quickly,” he said.

The next step will be updating PJM’s market design project road map to add high-priority items, with the aim of having those changes ready to present to the MIC on Aug. 8.

PJM Board of Managers Chair David Mills said the RTO barely cleared the reliability requirement in the 2026/27 Base Residual Auction, the results of which were posted on July 22, and unconstrainted, dramatic load growth is expected for the next few auctions. (See PJM Capacity Prices Hit $329/MW-day Price Cap.)

Load forecasting must be a priority, he said, along with any improvements that can be made to the 2028/29 BRA given that will see the sunsetting of a settlement between PJM and Pennsylvania to temporarily lower the maximum capacity clearing price and establish a price floor. Mills questioned if there is time within the stakeholder process to take on additional issues that don’t move those needles.

Mills also said he worries that there has not been an adequate discussion with PJM states about the political consequences that could result from the RTO requiring data centers to bring their own generation, including the possible impact on job creation. Pushing for large load to self-serve a portion of their load was one of the solutions PJM discussed during a resource adequacy technical conference held by FERC. (See RA Technical Conference Comments Urge a Variety of Market Reforms.)

While semiconductor and water availability could prove to be constraining factors on data center growth, the clock is ticking, and stakeholders must move quickly, Mills said. “The demand impact of the data centers is going to completely outrun any gains we get.”

Board member Margaret Loebl said one lens to view how PJM should prioritize addressing resource adequacy over the coming years is by identifying the subjects that present the greatest risk to ratepayers and the RTO’s mission.

Once stakeholders figure out prioritization, board member Vickie VanZandt said, there will need to be a lot of speed with which solutions are pursued. There may need to be a “best evaluation and a leap of faith because we are out of time.”

Gregory Poulos, executive director of the Consumer Advocates of the PJM States, said load growth is outstripping not only the available resources in the RTO, but also the amount of new entry that is expected. He said the bring-your-own-generation concept needs to be a core focus to ensure resource adequacy. He also faulted the PJM board for siding with members who supported delaying the implementation of a wider availability window for DR resources for the 2026/27 BRA, which he said would have improved reliability and added supply when it is needed.

Bill Fields, deputy of the Maryland Office of People’s Counsel, said part of the discussion has to involve how to integrate data centers without burdening consumers. Acknowledging there is some rising data center growth in Western Maryland, he said by and large the state has done well at keeping its load flat. Nonetheless, it is seeing rising prices because of load growth in other regions. He said state legislators are growing increasingly frustrated with PJM’s messages and skeptical of the benefits of remaining part of the RTO.

Paul Sotkiewicz, president of E-Cubed Policy Associates, said much of the tightening of supply and demand is from political interference and years of low prices causing premature resource retirements. Now that prices are coming back up, he said there is a growing backlash.

“Markets can work if we allow them to work. If we continue fiddling with them … they’re not going to work,” he said.

Old Dominion Electric Cooperative’s Mike Cocco said creative solutions will be needed, such as requiring interruptible service for some large load customers. There is also a growing concern about PJM’s effective load-carrying capability causing a paper shortage on top of a real capacity shortfall.

While there is a need to recognize correlated outages, Cocco also said PJM’s recent efforts to provide transparency show that much of the modeled risk comes from two events: the 2014 polar vortex and Winter Storm Elliott. PJM has made market and operational changes, such as the conservative operations protocol, since those events that have not been reflected in how the RTO values system risks, he said.