FERC has affirmed the ability of an independent transmission developer to include an RTO adder in its CAISO formula rate, rebuffing a request by the California Public Utilities Commission to reject the company’s use of the incentive.

But the federal regulator still declined to sign off on the increased rate proposed by NextEra Energy subsidiary Horizon West, instead referring the issue to settlement judge procedures to determine the reasonableness of the company’s return on equity (ROE) calculation.

“Based on our preliminary analysis, we find that Horizon West’s proposed rates may yield substantially excessive revenues, and thus suspend them for five months,” the commission wrote in its July 29 order (ER25-2395).

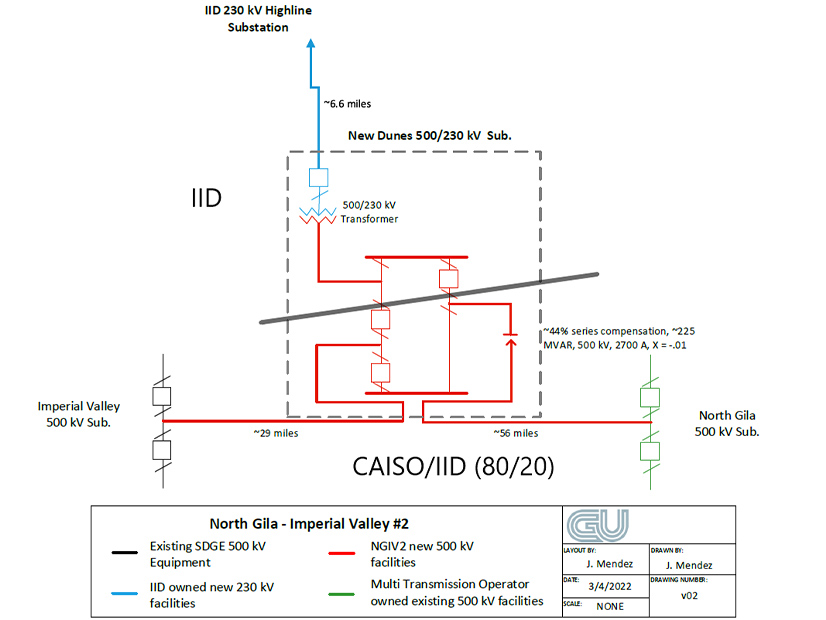

CAISO in 2024 selected Horizon West to build, own and operate two competitively bid 500-kV transmission projects included in the ISO’s 2022/23 planning process: the Imperial Valley-North of SONGS line and the Ironwood (formerly North Gila-Imperial Valley #2) line, intended to help California tap low-cost renewable resources in the Desert Southwest.

In its filing with FERC, Horizon West requested authorization to increase the base ROE in its formula rate from 9.7% to 11.98%, resulting in a total ROE of 12.48%, including a previously approved 50-basis point RTO participation adder, arguing the rate fell within a “composite zone of reasonableness” ranging between 8.81% and 13.56%.

The company also sought permission to update its formula rate template with a prior period adjustment to its true-up mechanism and authorization to replicate its transmission owner tariff — including the formula rate — for any affiliates or subsidiaries it creates in the future to develop CAISO transmission projects.

To support its case for the ROE increase, Horizon cited the expert testimony of Adrien McKenzie, a chartered financial analyst, who contended the proposed ROE would ensure the company could fund its 500-kV projects in light of increasing long-term capital costs stemming from increased interest rates.

“Horizon West asserts that its ROE must be reflective of the upward shift in investor risk perception and required rates of return for long-term capital to maintain Horizon West’s financial integrity and ability to attract capital,” FERC noted in its order.

McKenzie’s testimony also pointed to the growing investment risk for projects located in California, largely because of the state’s “inverse condemnation” law, which holds utilities strictly liable for costs and damages stemming from wildfires sparked by their equipment.

Protests

Horizon’s request prompted a flurry of protests.

The California Department of Water Resources (CDWR) and Northern California Power Agency (NCPA) contended the proposed ROE is excessive compared with other California utilities, saying no transmission owner has been granted an ROE at that level in nearly 20 years.

Other protestors argued that McKenzie “improperly” placed Horizon’s ROE at the high end of the middle third of the range of reasonableness despite FERC precedent putting average-risk utilities in the middle of that range.

The CPUC and the Six Cities group of Southern California publicly owned utilities contested whether the proxy group of utilities McKenzie relied on to calculate Horizon’s ROE “is comparable in terms of risk, capital structure and regulatory framework,” according to the order.

The CPUC also argued Horizon’s claim that it faces increased wildfire risk “is unsubstantiated due to the fact that it owns new transmission assets spanning limited areas and benefits from longstanding wildfire mitigation efforts in California,” FERC noted.

The order pointed out that CDWR and NCPA also raised concerns “that it is ratepayers rather than shareholders that will bear wildfire-related financial risks through insurance and regulatory cost recovery mechanisms, and that it would be imprudent for ratepayers to compensate shareholders for such risk.”

In its ruling, FERC said its “preliminary analysis” indicated Horizon’s proposed rates “may yield substantially excessive revenues” and found the filing “raises issues of material fact that cannot be resolved based on the record before us and that are more appropriately addressed in the hearing and settlement judge procedures.”

The commission likewise found that Horizon’s proposed revisions to its formula rate template “raise issues of material fact that cannot be resolved based on the record before us” and should be addressed in the settlement judge procedures.

Regarding the company’s request to replicate the formula for future affiliates, the commission said: “We find that there is no reason to open a new proceeding to re-litigate the justness and reasonableness of a formula rate that is identical to the one being accepted in the instant filing.

“We clarify, however, that the Horizon West affiliates or subsidiaries will each be subject to the resultant ROE that is determined through the hearing and settlement judge procedures ordered above, or any subsequent ROE that is ordered by the commission.”

Participation in CAISO Voluntary

But the commission outright rejected the CPUC’s argument that Horizon West should be ineligible for an RTO adder because the company’s participation in CAISO is involuntary due to its contractual obligation to turn over operational control of its transmission facilities to the ISO under its approved project sponsor agreement.

“Horizon West was formed ‘to develop, construct, finance, own, operate and maintain electric transmission facilities in the CAISO region,’” the commission wrote. “Horizon West thus voluntarily chose to pursue transmission projects within CAISO. Turning over operational control of its transmission facilities to CAISO once constructed is part and parcel of that process.”

The commission noted it has “previously granted RTO adders to entities seeking to participate in Order No. 1000-compliant competitive solicitations conducted as part of RTO/ISO regional transmission planning processes — which necessarily entails turning over functional control of facilities to the RTO/ISO — and CPUC does not provide a convincing rationale for us to depart from this precedent.”

FERC pointed out that, unlike Pacific Gas and Electric, San Diego Gas & Electric and Southern California Edison, which have been denied use of the RTO adder because California law requires them to participate in CAISO, “Horizon West is not required by state statute to join” the ISO.