Stakeholders requested that the NYISO Market Monitoring Unit provide a comprehensive explanation of the difficulties in obtaining data from the ISO and market participants on supplemental commitments after it presented its State of the Market report for the first quarter Aug. 5.

Supplemental commitments to satisfy reserve requirements occurred on 75 days in the first quarter in the North Country load pocket — near the border with Canada — and 28 days in New York City load pockets, according to the MMU’s presentation to the Installed Capacity Working Group. Nearly half of these commitments could not be verified by the MMU.

“These are instances where we weren’t able to get information to substantiate the need for the commitment,” said Pallas LeeVanSchaick, vice president of Potomac Economics.

A supplemental commitment is an out-of-market action in which a generator is not committed economically in the day-ahead market but is needed for reliability. Transmission owners and NYISO operators may dispatch generators “out of merit order” to maintain lower-voltage reliability and manage constraints in high-voltage transmission that are not represented in the market model.

Stakeholders pointed out that this was a repeat issue for the MMU and asked whether there was a provision in the tariff or a technical issue that was preventing the MMU from obtaining the information. LeeVanSchaick said the data from the ISO are not detailed enough to make a determination in all cases.

Stakeholders also asked whether the MMU was able to ask transmission owners and generators for information. LeeVanSchaick said that while it can ask any market participant for information, the kind of information is different depending on what kind of participant it is.

“I don’t think it’s a matter of asking the MMU to identify who the bad guy is, so much as … providing more information about the … different rules and responsibilities for information requested from generators, the NYISO, TOs and other parties,” a stakeholder who did not identify themselves said. “Understanding that at a general level could show what the barrier to receiving information might be.”

Competitive and Congested

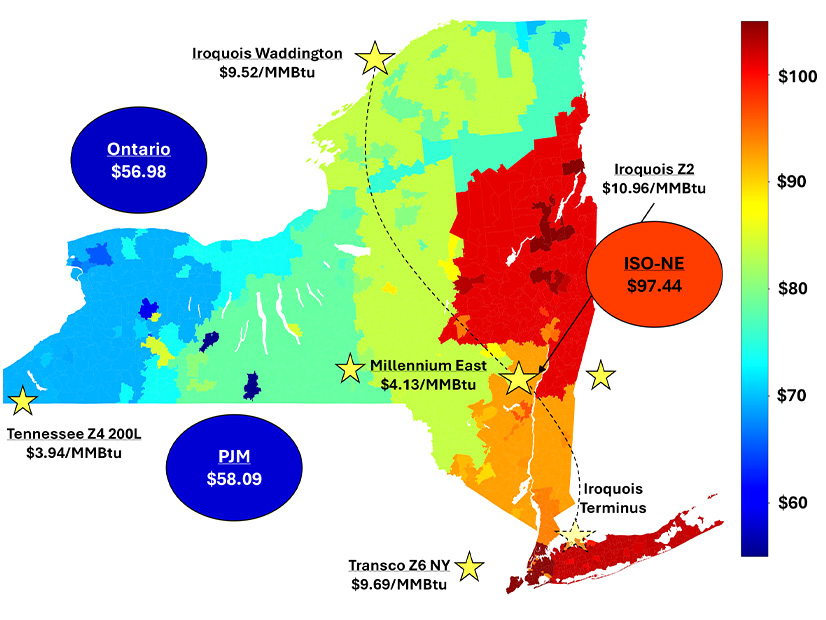

The NYISO markets otherwise performed competitively, the MMU said. Prices in each region were up year-over-year this quarter, ranging from 59 to 119%, mostly driven by higher natural gas prices, which rose 67% in Western New York and 188% along the border with Vermont. LeeVanSchaick said that this was from the extremely cold weather in January and February.

Load levels were higher across the state compared to 2024. The average daily load increased 4.5%, and the peak load increased by 3.4%. At the same time, congestion rose within the state and across the PJM-NYISO interface. This was partially because of transmission outages in New York but also from high demand.

Thirty percent of the congestion occurred in New York City, increasing 450% year over year. The Gowanus-Greenwood line was out of service throughout the quarter, and a parallel line was out of service in February.

Many generators were curtailed or out of service. During the coldest part of January, roughly 1.75 GW of oil generation was out of service because of planned outages. “As NYISO implements firm-fuel capacity accreditation in 2026/27 and designs a seasonal capacity market, it will be important to consider reasonable limits on planned outage scheduling under peak conditions and incentives for availability,” the MMU said.

NYISO and local TOs issued 28 GWh of wind curtailments manually because of unmodeled transmission constraints or generators not responding to economic curtailment instructions. The MMU found that TO-controlled communication equipment was not maintained well enough to send signals from NYISO to the control centers of many wind plants. It suggested implementing stronger penalties for failure to comply with curtailment instructions.