Pay-for-Performance (PFP) credits accumulated during the capacity scarcity conditions June 24 totaled about $114 million, a major boost in revenue for resources that performed during the event, ISO-NE COO Vamsi Chadalavada told the NEPOOL Participants Committee on Aug. 7.

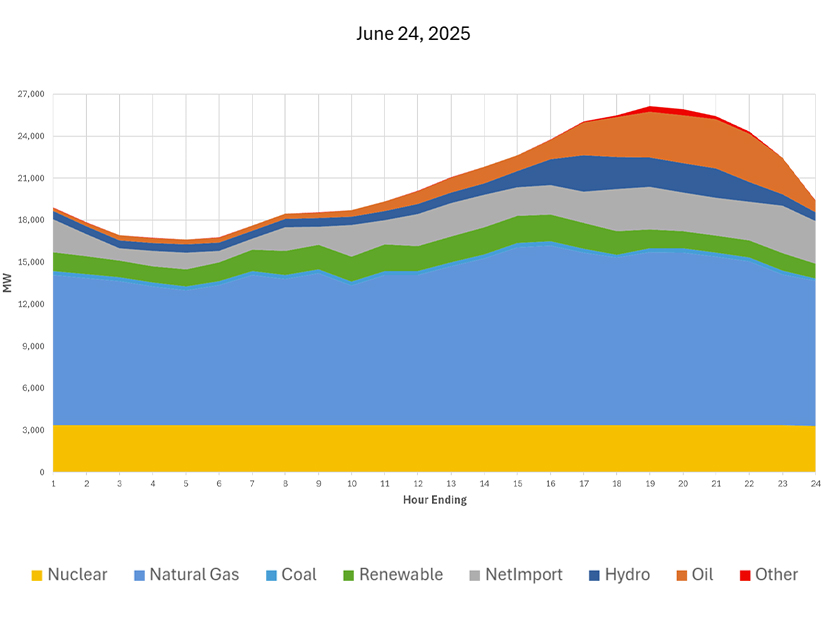

The event was caused by the highest demand ISO-NE has experienced since 2013 and about 2,560 MW of generator outages and reductions. (See Extreme Heat Triggers Capacity Deficiency in New England.)

ISO-NE’s PFP construct is intended to incentivize resource performance during capacity scarcity events. Resources earn credits by providing more power than their obligations, while resources that provide less power than their obligations face charges. Resources without capacity supply obligations (CSOs) also can earn credits by performing during shortfall events. On June 24, capacity resources earned about $67 million, while non-capacity resources earned about $47 million.

Credits and charges are intended to equal out, which is designed to protect ratepayers from the cost of incentives. However, ISO-NE has imposed a cap on the total monthly PFP charges a resource can accumulate, which caused a $26 million under-collection of PFP penalties on June 25. Under ISO-NE rules, the deficit between PFP credits and penalties is charged to capacity resources that have not hit the stop-loss cap.

In the wake of the scarcity event, the New England Power Generators Association (NEPGA) filed a complaint with FERC contesting ISO-NE’s rules on PFP charges, arguing the allocation method unfairly penalizes capacity resources that are below the stop-loss cap. (See related story, NEPGA Seeks Relief for ‘Improper’ Pay-for-performance Costs in ISO-NE.)

NEPGA also wrote that ISO-NE should cap its balancing ratio at 1.0, noting that the ratio exceeded that during the June 24 event, requiring capacity resources to provide more power than their capacity obligations. The balancing ratio determines the portion of each CSO that capacity resources are required to provide.

PFP charges and credits can have a major impact on each resource’s overall capacity revenue. The overall capacity market value in June was about $88 million, $26 million less than the credits awarded during the three-hour scarcity event.

Interregional imports earned the majority of PFP credits, taking in $70 million. The total imports across ties with New York and Canada surpassed 4,300 MW around the peak period of the event.

In-region generation resources earned about $36 million but racked up $99 million in charges. This calculation includes the reallocation of the deficit of funds caused by the stop-loss cap.

Monthly Operations Report

Energy market revenue totaled about $1 billion in July, compared to $672 million in July 2024, Chadalavada noted in his monthly report on system operations.

Chadalavada said the significant load fluctuations experienced in New England over the spring and summer demonstrate the increasing demand volatility challenges in ISO-NE. The RTO experienced its lowest recorded demand in April, more than 20,000 MW below the 26,000-MW system peak experienced on June 24. (See Growth of BTM Solar Drives Record-low Demand in ISO-NE.)