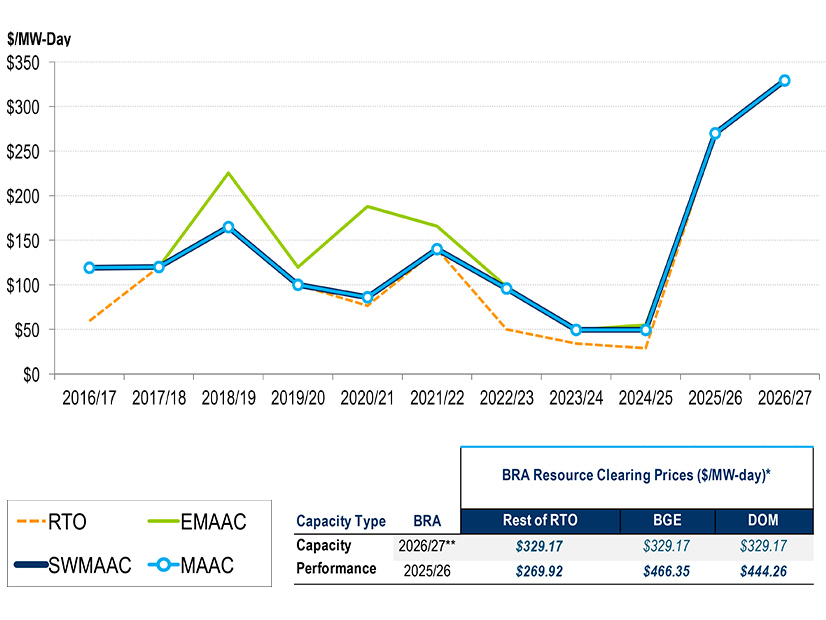

The Market Implementation Committee discussed the significance of PJM falling short of its reliability requirement and other details in the results of the 2026/27 Base Residual Auction, which cleared at the $329.17/MW-day cap across the RTO.

Gregory Poulos, executive director of the Consumer Advocates of the PJM States, said the RTO had buried the lede on the importance of failing to meet the reliability requirement, particularly because load is expected to surge higher in the 2027/28 auction scheduled to be conducted in December. (See PJM Capacity Prices Hit $329/MW-day Price Cap.)

Despite PJM’s efforts to speed interconnection studies and allow more resources to advance toward construction, only 2,400 MW of additional unforced capacity was provided by renewable resources and storage in the auction. Poulos noted that outgoing FERC Chair Mark Christie spoke during a press conference July 24 about his concern that a long-discussed reliability crisis is rearing its head in the 2026/27 BRA as slow generation growth meets data center load growth. (See Christie Says Farewell to FERC at Final Meeting as Chair.)

Poulos told RTO Insider the advocates are frustrated by the administrative levers PJM decided to pull in the design of the 2026/27 auction, but that those issues are dwarfed by the potential impact of the 30 GW of data center load growth the RTO is projecting. He said the RTO must engage in “ruthless prioritization” as it determines the best approach to meeting its resource adequacy needs, but he said he is not aware of any changes that could handle load growth of that magnitude.

Exelon Director of RTO Relations and Strategy Alex Stern said the extent of the capacity shortfall is fairly minor, with the auction procuring a reserve margin of 18.9% against a 19.1% requirement, which amounts to 309 MW of installed capacity. He questioned whether there are internal discussions ongoing at PJM related to expanding the options around how to get more generation online “so that we don’t just have customer bills going up but no new plants getting built.”

PJM Director of Stakeholder Affairs Dave Anders noted that staff brought an issue charge to the Planning Committee on Aug. 5 intended to allow new resources capable of partial operation while their network upgrades are under construction to receive provisional interconnection service. While that wouldn’t move the needle on the capacity market, he said, it could allow more energy to be available to dispatchers during critical periods.

PJM’s Pete Langbein said there are several initiatives that have resulted in changes effective for the 2027/28 auction, including expanding the availability window for demand response resources and the Reliability Resource Initiative (RRI), which added 51 resources totaling 11,793 MW of nameplate capacity to the Transition Cycle 2 study cluster. (See “Expanded Demand Response Modeling Endorsed,” PJM MIC Briefs: Feb. 5, 2025 and PJM Selects 51 Projects for Expedited Interconnection Studies.)

“By all means, we are trying to be proactive to look at what can be done,” he said.

PJM Senior Vice President of Operations Mike Bryson also said the executive leadership team has set resource adequacy as its top focus since the publishing of the RTO’s “4R’s” white paper finding that load growth, generation deactivations and slow new entry could compromise reliability. “It’s a focus of the entire executive team,” he said.

Langbein said the RTO cleared very close to the requirement, and almost all generation cleared in the auction, aside from some resource owners who did not understand the process to request removal of capacity status or those with external contracts who did not realize they needed to go through the must offer exemption process.

But “this is not horseshoes. ‘Very close’ is not same as meeting the requirement,” Independent Market Monitor Joe Bowring told RTO Insider in an email. “To the best of my knowledge, PJM has never been short in the capacity market at the total RTO level in the history of the capacity market. This is a clear warning sign. PJM needs to directly address the impact of large data center loads which will overwhelm the grid if not addressed in the very near term. Hand waving is not the appropriate response.”

Bowring said some of the resources that did not offer ran afoul of the rules because of deadlines, and the Monitor will be looking at the subject closely and release more information.

John Horstmann, senior director of RTO affairs for AES Ohio, asked if there has been any progress made on estimating the total amount of capacity that was removed from the market after the implementation of effective load-carrying capability (ELCC) and changes in accreditation, as well as the price impact on the total cost of capacity.

Bowring said the Monitor is working on calculating those values and likely will include them in its series of reports on the auction.

“The short answer is that ELCC removed a significant level of megawatts from the auction. The calculation of the exact amount requires analysis of the impact both on supply and demand of ELCC on the amount of capacity that would clear,” Bowring said.

Presenting the auction results, Langbein said 2,669 MW of UCAP in new generation and uprates were offered in the auction, reversing a trend of declining new entry across the prior three auctions. About 1,100 MW of capacity interconnection rights scheduled to be deactivated also were withdrawn, keeping that output in service. He said staff are in the process of updating the auction report to include a note with the amount of ICAP offered in response to stakeholder requests.