Stakeholders Endorse Reworked Interconnection Jurisdiction

PJM’s Markets and Reliability Committee endorsed by acclamation a PJM proposal to rework how it determines whether a new generation point-of-interconnection (POI) falls under federal jurisdiction — and therefore under the RTO’s purview — or state oversight. (See “Stakeholders Endorse POI Jurisdiction Changes,” PJM PC/TEAC Briefs: July 8, 2025.)

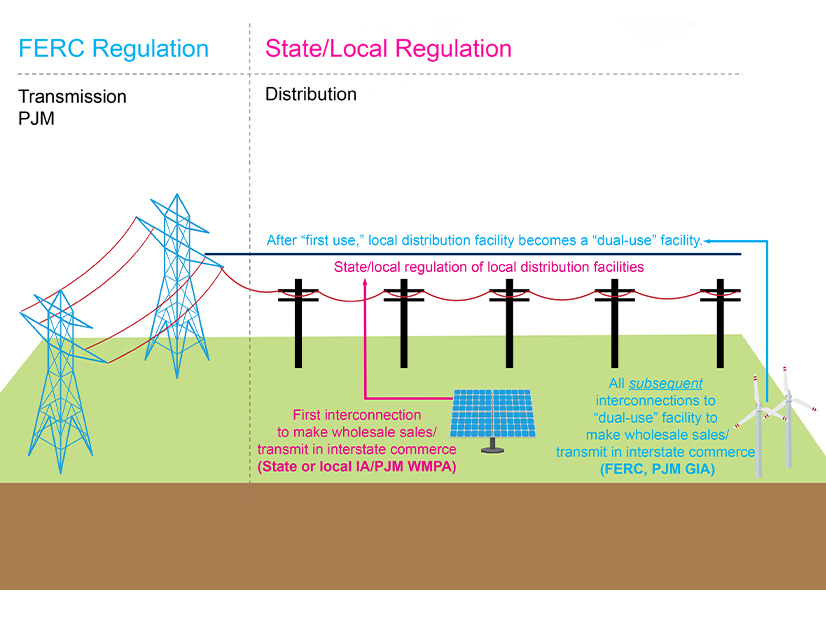

The changes would establish a “bright-line” test where a POI of 69 kV or higher would fall under FERC jurisdiction, while lower-voltage facilities would be delegated to the states. A backstop provision could override that determination if the cost-recovery methodology approved by FERC, the transmission owner or relevant electric retail regulatory authority (RERRA) has classified the POI as either transmission or distribution. The existing “first-use” test considers the first wholesale resource to interconnect at a distribution asset as falling under state or local jurisdiction, with all subsequent interconnections being federal.

PJM associate general counsel Thomas DeVita said resources interconnecting with distribution-level facilities tend to be simpler in nature and better lend themselves to a wholesale market participation agreement (WMPA) compared with a more complex generation interconnection agreement (GIA). Placing more resources on the path to receiving a WMPA would free up interconnection staff to focus on more demanding applications. The RTO has estimated that around 12 to 15% of interconnections approved since the introduction of the WMPA pathway would have been affected by the proposal if it had been implemented at that time.

He compared PJM’s proposal to ISO-NE’s shift to require distributed energy resources (DERs) to go through state or local interconnection processes, a change the commission approved in August 2022 (ER22-2226). (See FERC Approves Changes to ISO-NE DER Interconnection Process.)

DeVita said PJM is aiming to file the changes with FERC in October, followed by implementation in spring 2026.

1st Read on Expanded Provisional Interconnection Service

PJM Director of Interconnection Planning Donnie Bielak presented a first read on a proposal to allow more flexibility around when new resources can begin operating while network upgrades are being completed. The proposal is set to be voted on by the Planning Committee on Sept. 9, followed by the MRC on Sept. 25.

The change would allow interim deliverability studies to determine that a resource is capable of partial operations and receive provisional interconnection service. The studies currently only look at whether a resource can reach its full output without causing transmission violations and prohibit them from coming into service if issues are identified. When provisional interconnection service is granted for a resource capable of partial operations, an operational guide would be produced for dispatchers to understand conditions under which the unit could be dispatched.

The revisions to Manual 14H: New Service Requests Cycle Process would allow resources to operate as energy-only for a specific delivery year, with their output determined by the interim deliverability study. They would not receive capacity interconnection rights (CIRs) or a capacity commitment for that delivery year. Bielak said the proposal is intended to allow resources to enter service faster and make more energy potential available for dispatchers as load growth is expected to continue to eat away at the reserve margin.

Independent Market Monitor Joe Bowring said the plan seems like an excellent idea to improve an interconnection process that has long been criticized as being backlogged.

Stakeholders requested there be more transparency on resources that would receive provisional interconnection service to ensure a level playing field on hedging.

Exelon’s Amber Thomas said there needs to be more information about the study cases PJM plans to use on this to ensure the RTO does not assume network upgrades will be complete in time for a unit to achieve partial operations, only to find that transmission will not be completed on time. Bielak responded that the cases would only include upgrades set to be complete by the delivery year in which the unit would begin provisional operations.

Market Design Project Road Map

PJM presented a “refresh” of its Market Design Project Road Map to include several new stakeholder efforts, including a Critical Issue Fast Path (CIFP) process the board initiated in August addressing large load growth and exploring a sub-annual capacity market. Executive Director of Market Design Rebecca Carroll said the RTO’s goal is to update the road map twice a year to ensure that all stakeholders are aware of what the market design team is focused on.

Much of the road map centers on addressing a tightening balance between supply and demand as load growth runs up against resource deactivations and lagging new entry. PJM presented a conceptual proposal to create a non-capacity-backed load (NCBL) service that could be triggered as a reliability backstop.

Once initiated, new large loads could elect or be assigned to accept interconnection service without a corresponding capacity obligation, reducing the amount of load participating in a particular Base Residual Auction (BRA) and allowing the large load to avoid capacity charges. The first stage of the CIFP process is to begin Sept. 2, with the final meeting scheduled for Nov. 19 and a FERC filing targeted for December. (See PJM Board Initiates CIFP Addressing RA, Large Loads.)

The MRC voted in July to endorse an issue charge brought by Pennsylvania Gov. Josh Shapiro calling on PJM to hire a consultant to draft a report exploring the possible benefits and drawbacks of implementing a sub-annual capacity market design. Supporters argued that a more granular market could allow capacity auctions to be more tailored to the risks inherent in each season or interval. The issue charge anticipates the report will be completed by December, after which the road map includes a “capacity market reforms” item including further exploring a sub-annual or prompt auction design between early 2026 and halfway through 2027. (See PJM Stakeholders Support Sub-annual Capacity Issue Charge.)

Ongoing efforts to revise PJM’s effective load-carrying capability (ELCC) accreditation and risk modeling paradigm, a pro forma reliability-must-run (RMR) agreement and the Quadrennial Review of parameters for the 2028/29 BRA are all set to continue through the second quarter of 2026.

Additional efforts on the energy and ancillary service markets include evaluating how resources with advance commitments fit into the day-ahead energy market, renewable dispatch, load flexibility and reserve certainty. The road map also includes work on energy storage modeling beginning in 2026 and “additional essential reliability service products” starting in 2027.

The PJM Board of Managers letter outlining the CIFP process envisions faster interconnection studies and capacity market changes to boost resource adequacy.

LS Power’s Dan Pierpont said it’s important that PJM is willing to discuss how each of the work items might interact with each other. In particular, he said the market parameters defined by the Quadrennial Review could be impacted by market changes arising from the CIFP process focused on large load additions.

PJM Exploring Refiling CIR Transfer Proposal

PJM is drafting changes to its proposal to expand the process for transferring CIRs from a deactivating resource in the wake of a FERC rejection (ER25-1128). The commission faulted the proposal’s inclusion of an indefinite extension of the replacement resource’s in-service date, finding that it could lead to withholding of transmission access. (See PJM Stakeholders Endorse Coalition Proposal on CIR Transfers.)

“We find that PJM’s lack of a maximum time limit for the one-time option for an extension of a Replacement Generator Resource’s Commercial Operation Date regardless of cause renders PJM’s proposal unjust and unreasonable because it undermines the purpose of the generator replacement process,” the commission wrote in its order. “That is, the main purpose of the generator replacement process is to avoid duplicative study costs and operational costs that otherwise would occur when the request to replace an existing generating facility must proceed through the interconnection study queue process, which will in turn avoid delaying the replacement of older resources with more efficient and cost-effective resources.”

Bielak said staff is planning to bring a proposal to the Sept. 9 Planning Committee meeting alongside any stakeholder alternatives. An endorsement vote is anticipated at the Sept. 25 Members Committee meeting.

NRDC advocate Claire Lang-Ree encouraged PJM to consider also the ambiguous language around the in-service requirements for resource types with long development timelines, an issue about which the commission recommended PJM include more information. While it was not included as a rationale for rejecting the filing, the commission wrote that exempting resources with “industry-recognized significant construction timelines” from the three-year commercial operation date requirement lacks clarity.

“We also agree with PJM’s goal of offering Replacement Generation Resources that face long lead times a certain degree of flexibility with respect to achieving commercial operation, and agree that such resources ‘can make a significant contribution to meeting resource adequacy needs, at a time when PJM needs additional resources to maintain reliability,’” the commission wrote.

Stakeholders Endorse RPM Seller Credit Requirements

The MRC endorsed by acclamation a proposal to add a creditworthiness review before capacity market participants are offered Reliability Pricing Model (RPM) seller credits — unsecured credit available to satisfy BRA participation requirements. The credit available amounts to twice the average total net monthly bills over the prior year, up to the $50 million unsecured credit allowance cap.

Senior Director of Credit Risk and Collateral Management Gwen Kelly said the proposal is consistent with credit evaluation required in other instances where PJM offers credit and would not change the credit calculation or limit. The changes are set to be voted on by the MC on Sept. 25.

PJM Reviews Proposal on Regulation Resources at NEM Sites

PJM’s Pete Langbein presented a first read on a proposal to allow demand response resources seeking to offer regulation-only service to participate in the market at sites where there is the capability for energy injections. It would allow a DR customer to offer regulation when there is no load or a net injection at its POI if they have received authorization from the relevant electric distribution company (EDC) and it’s reflected in a net energy metering (NEM) agreement. (See “Stakeholders Endorse Changes to Storage Participation in Regulation Market,” PJM MIC Briefs: July 9, 2025.)

The change is part of PJM’s planned implementation of the distributed energy resource (DER) requirements in FERC Order 2222 and scheduled to be rolled out in 2029.

Market Monitor Joe Bowring stated that the proposal is a one-off proposal that represents special treatment for a specific stakeholder and should not be an exception to the broader process that had been approved by FERC for implementation in 2029 for all market participants.

Members Committee

PJM Seeks to Codify Process for Filling Committee Chair, Vice Chair Vacancies

PJM’s Michele Greening presented a first read on revisions to Manual 34 to establish a process for filling a temporary vacancy in the MC chair or vice chair position.

Under the proposal, if the chair takes a temporary leave, the vice chair would fill in and the most recently elected chair to have finished their term would cover the vice chair position. If that individual is unavailable, a past chair can be selected to fill the vice chair position. A similar process would be used to cover a temporarily absent vice chair. The revisions also include a statement that candidates for either position “should have a reasonable expectation that they will be able to serve a complete term.”