As NYISO continues its Capacity Market Structure Review, the Market Monitoring Unit used its second-quarter State of the Market report to highlight potential issues with how the ISO forecasts resource availability, with the late June heat wave as a test case.

Load for the quarter peaked around 31.9 GW on June 24, right in the middle of the three-day heat wave that led NYISO to issue an energy emergency. (See NYISO BIC Dissects Power Prices During June Heat Wave.)

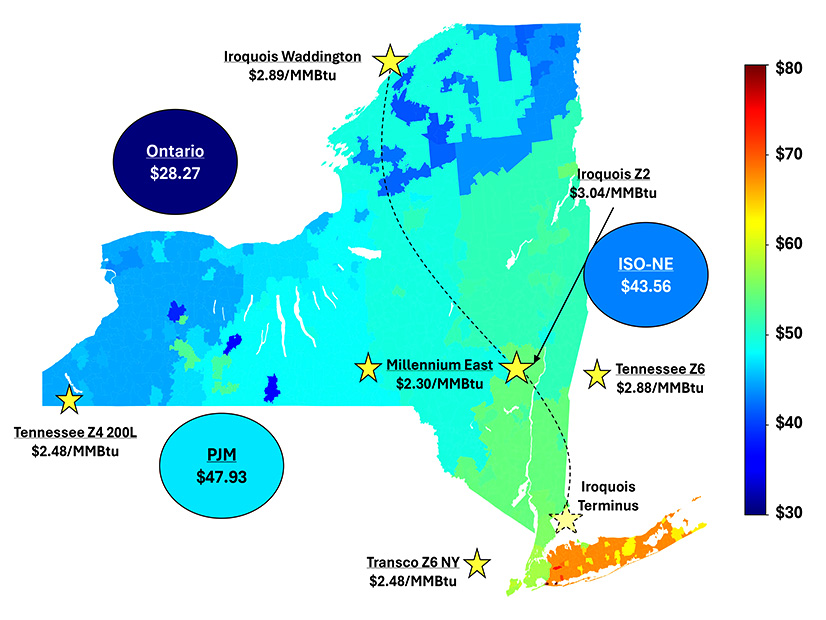

All-in prices were up across all zones of the New York Control Area, driven by an increase in natural gas prices. But “in addition to the gas prices, I think the extraordinarily high load level that peaked in late June … certainly added a lot to real-time prices,” Pallas LeeVanSchaick, vice president of Potomac Economics, told the Installed Capacity Working Group on Sept. 8.

LeeVanSchaick offered a breakdown of the performance of fossil fuel generators, emergency capacity and large curtailable loads during the heat wave. He said the MMU wanted to highlight these resources because they have not been the focus of prior capacity accreditation discussions.

“It’s sort of outside the standard analyses that we do,” he said. “It has to do with capacity accreditation. … Obviously we and … NYISO and other regional market operators have spent a lot of time on how to improve capacity accreditation.”

The analysis compared the performance of fossil fuel resources systemwide during the June heat wave against their weighted average equivalent demand forced outage rate (EFORd), which measures how much capacity a resource could reliably provide when in demand. During peak hours in the heat wave, the MMU found that units were out of service more than predicted by their average EFORd.

“The concern here is if you look at the stuff that was unavailable due to either forced outages or performance, the number comes out to 24.9% on the 24th, compared to an average EFORd of 5.9%,” LeeVanSchaick said. This means that EFORd is being calculated too low because it is not taking into account how certain generators are being used, he said.

Some fossil fuel plants, like peakers, are dispatched to run at high outputs very rarely. These plants are aging, which reduces their ability to operate at high output. If they aren’t called on to push high power out frequently, EFORd will not capture when they fail to function at those levels, leading to far more optimistic rates. This problem also occurred with steam turbine units during the heat wave.

“This heat wave presented a unique opportunity because we haven’t seen conditions where so many units were asked to operate at high levels,” he said.

In addition, some capacity that was available to the ISO was not recognized by its real-time model as available. About 213 MW that previously participated in the Capacity Limited Resource and Emergency Capacity programs were not scheduled and did not produce energy; 73 MW of capacity that were not scheduled but produced voluntarily were also not recognized.

“What we found was that there was not an operating procedure to utilize these megawatts that was ready to be used on these days,” LeeVanSchaick said. “Although the conditions and operating reserve shortages would have warranted using this capacity, it wasn’t actually scheduled.”

Roughly 90% of large loads across 600 MW of demand response programs voluntarily curtailed during the peak load hour June 24, he said. These were resources participating in the Special Case Resource (SCR), Demand-Side Ancillary Service (DSASP), distributed energy resource and Behind-the-Meter Net Generation programs.

These DR actions had some inefficiencies. Over 200 MW of SCRs were curtailed when they could have provided DSASP reserves; 70 MW of SCRs curtailed for four hours as requested but then increased consumption during the peak, meaning they weren’t deployed when they were most valuable.

“We’re going to need to think further about how to potentially refine these programs so that these things are consistent for resources to be participating efficiently,” LeeVanSchaick said.