FERC has ruled that MISO must name a point in development and describe how it will consider merchant HVDC lines in its transmission planning; however, the commission declined to order a more complete incorporation of the Grain Belt Express HVDC line in MISO’s recent transmission planning.

The directive to MISO was the sole issue FERC granted from Invenergy Transmission’s 2023 complaint, which sought to force MISO to consider the Grain Belt Express in its transmission planning (EL22-83).

FERC said Invenergy successfully argued that MISO’s tariff is unfair “insofar as it does not address when and how [merchant] HVDC transmission projects are incorporated into MISO’s transmission planning models.” The commission told MISO to decide on a juncture and explain how it would account for merchant HVDC lines in transmission planning and add it to the planning protocol section of its tariff within 90 days.

Elsewhere in its Oct. 16 order, FERC decided that Invenergy did not meet its burden to prove that MISO fumbled on its planning practices regarding the proposed 800-mile, 5,000-MW line.

Invenergy argued that MISO has an obligation to incorporate “advanced-stage” merchant transmission facilities in its base case analysis performed under the annual MISO Transmission Expansion Plan (MTEP) and in long-range transmission planning.

The company claimed MISO is forcing ratepayers to foot the bill on regionally planned transmission projects that could be redundant alongside planned merchant HVDC projects. Invenergy said MISO should not be able to ignore merchant transmission in its MTEP and long-range transmission planning exercises when MISO’s tariff prescribes that MISO should assess a “quantifiable benefit” of an “enhancement to the MISO transmission system.”

Invenergy had asked FERC to order MISO to edit its tariff so that it incorporates all advanced-stage merchant transmission projects in its annual and long-term transmission planning. It also asked FERC to direct MISO to perform an after-the-fact sensitivity analysis for MISO’s two long-range transmission portfolios that considers Grain Belt.

MISO said it performed such a sensitivity analysis for the second long-range portfolio and found no reason to change any of its project recommendations. FERC accepted MISO’s analysis and declined to mandate more studies.

Invenergy said MISO’s second long-range portfolio contains a 765-kV line in Missouri that duplicates some of Grain Belt’s capabilities. It said MISO planned the line over 2024 even though Invenergy had a transmission connection agreement with MISO. Invenergy also said MISO’s first long-range transmission portfolio from 2022 included three projects at a combined $1.46 billion in northern Missouri that would return just 40 cents for every dollar spent on them once Grain Belt is transporting power.

Invenergy argued that MISO’s interpretation of its tariff “leads to an absurd result and unjust and unreasonable rates” and that MISO’s decision not to account for Grain Belt betrays optimized transmission planning.

FERC said Invenergy did not demonstrate that MISO’s evaluation of the trio of projects was incompatible with its tariff requirements. The commission also noted that MISO assesses the benefit-to-cost ratio on a portfolio basis and doesn’t produce ratios for individual projects. FERC also pointed out MISO does not assess a line’s ability to cancel out lower voltage upgrades of 230 kV or below, per its long-range transmission planning procedures.

Commissioner Lindsay See, while concurring with the order, put MISO on notice that additional analyses are a smart move to prove the worth of several billion-dollar transmission portfolios.

“When billions of dollars in infrastructure projects are at stake, more confidence in the accuracy of MISO’s planning and cost-benefit assumptions is not too big an ask. Judiciously using sensitivity analyses to help ratepayers get the most value for their money may be one tool well worth its weight,” See wrote.

See said it’s unclear whether MISO “is providing stakeholders and the MISO Board with the best information possible to assess true grid needs” when it unveils a long-term transmission portfolio. She cited the pending North Dakota-led complaint questioning the value of MISO’s $22 billion, mostly 765-kV second long-range transmission portfolio. (See MISO States Split on FERC Complaint to Unwind $22B Long-range Tx Plan.)

Invenergy representatives have said for years in MISO public meetings that the RTO’s transmission planning modeling is deficient because it didn’t factor in Grain Belt Express operations. (See “The Grain Belt Express Question,” Members Call for More Tx Expansion Following MISO’s $20B LRTP Blueprint.)

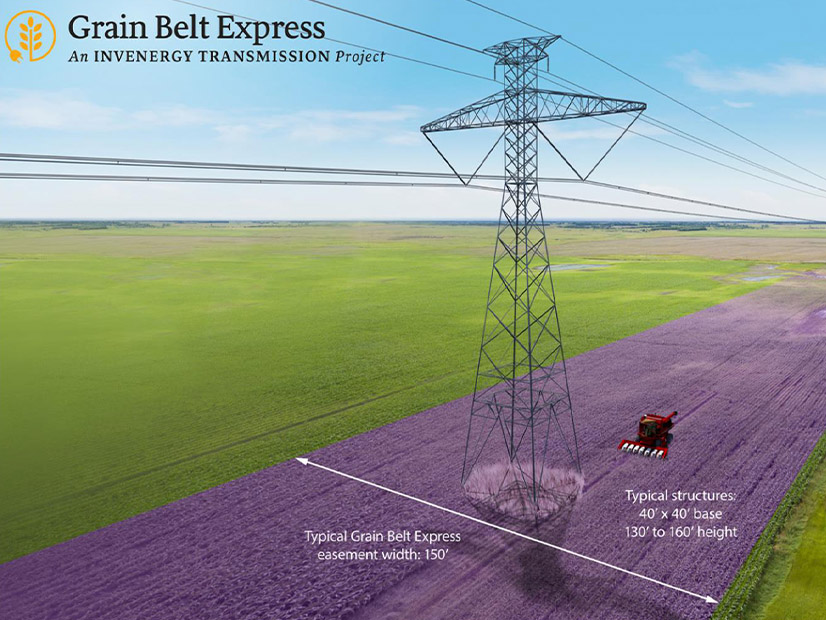

MISO did not include impacts from the Grain Belt Express merchant HVDC line in any of its 30-plus annual models under its 2024 Transmission Expansion Plan. MISO said Grain Belt Express did not sign its transmission construction agreement until about three weeks after the Feb. 1 cutoff date for members to submit projects for inclusion in MTEP 24 planning models. (See FERC OKs Grain Belt Express Connection Agreement with MISO; Invenergy Displeased with 2030 Target.)

MISO said it would include only approved segments of Grain Belt in its MTEP 25 planning modeling. Some MISO stakeholders have said Grain Belt Express stands to deposit substantial wind energy from Kansas into MISO.

Earlier in 2025, the U.S. Department of Energy Loan Programs Office revoked a $4.9 billion conditional loan commitment for Grain Belt. (See DOE Pulls $4.9B in Funding for Grain Belt Express.) Invenergy has vowed nevertheless to move ahead with the project.