Facing surging electricity demand from data centers and artificial intelligence, NV Energy might soon be struggling to meet Nevada’s renewable portfolio standard.

That’s according to Janet Wells, NV Energy’s vice president of resource planning, who led a Jan. 14 stakeholder meeting on the company’s 2026 integrated resource plan.

Wells said the company expects to face challenges in meeting the RPS “for several years.”

“Federal policy has reduced the deliverability of new renewable resources while also increasing energy needs to support the [federal] AI action plan,” Wells said. “That combination will create challenges in meeting the RPS compliance.”

Among those challenges are soon-expiring federal tax credits for solar and wind projects, federal policy shifts on solar and wind, and potential tariff impact on imports, Wells said previously.

If the company misses the RPS target, it will ask regulators for a compliance waiver, Wells said.

NV Energy thus far has been meeting the state’s RPS, which requires a certain percentage of electricity sales to come from renewable resources. The RPS increased from 29% in 2022-23 to 34% in 2024-2026, 42% in 2027-2029, and 50% in 2030 and beyond. In 2024, the company exceeded the standard with 46.8% renewables.

Load Forecasts Unveiled

The stakeholder meeting was a follow-up to one held in December regarding NV Energy’s 2026 integrated resource plan, which it expects to file in late April. (See NV Energy’s Early IRP Filing Reflects Load, Resource Challenges in 2026.)

At the January meeting, Wells provided more detail on the load forecast on which the new IRP will be based.

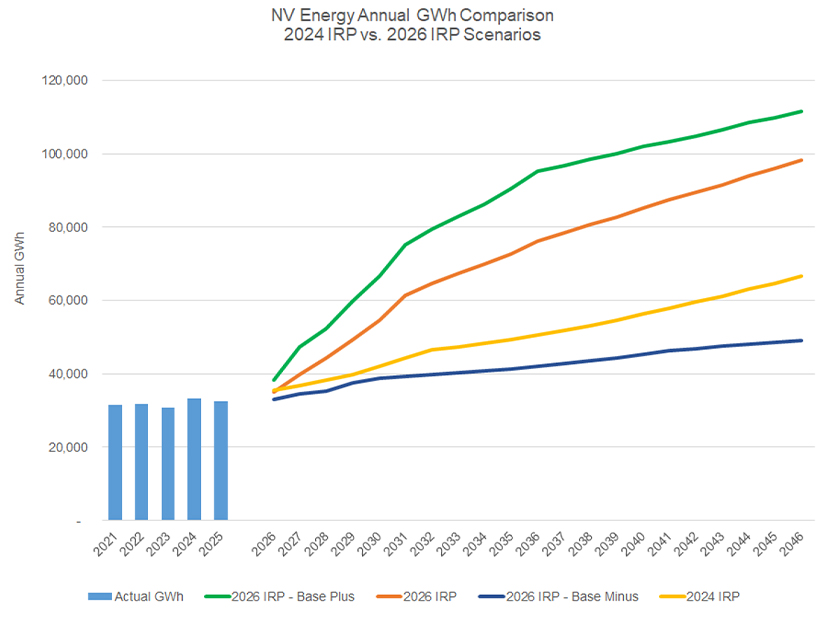

A load forecast for the company’s 2024 IRP predicted system growth of 31,000 GWh over 20 years, or a compound annual growth rate of 3.2%.

In the new forecast, electricity sales from 2026-2046 are expected to reach 43,400 GWh, a 40% increase from the previous forecast, with a compound annual growth rate of 5.3%. Much of the growth will be concentrated in the northern part of the state.

“The main reason for the difference is a continued increase in the large customer requests, specifically data centers and AI-driven load,” Wells said.

As for the RPS, existing and approved renewable resources will be enough to meet the standard in 2027, NV Energy’s projections show. But more renewables will be needed starting in 2028 for RPS compliance.

To help meet its surging demand, NV Energy issued a request for proposals in 2024. The RFP drew 198 bids — a company record.

From there, the company developed a shortlist of 15 projects totaling 8 GW of capacity. About 3,800 MW is new generation and about 4,200 MW is storage, Wells said. NV Energy has requested regulatory approval for one project: a 150-MW power purchase agreement for the Dodge Flat battery storage system in northern Nevada.

Approval for other projects will be sought through the 2026 IRP. Wells said the expected ratio of renewables and storage to thermal resources is roughly 3:1. She noted that the earliest new gas combustion turbines could be in operation would be 2029 or 2030.

Allocating Costs

NV Energy’s base load forecast for its 2026 IRP includes “mitigation” for large loads — meaning requested loads are reduced by half if a line-extension contract has been signed or by 85% if there’s no contract, Wells said during the December meeting.

In addition, the company developed a “base minus” forecast that excludes growth from data centers and AI. Wells said resource costs to meet the two forecasts would be compared, and the extra costs seen in the base forecast could then be allocated to large load customers.

A third forecast called “base plus” assumes that all load will materialize from large customer projects with signed contracts.

In another consequence of surging demand, NV Energy is delaying plans to close its open position, which refers to resource needs that are met through short-term market purchases rather than by the utility’s own resources or long-term contracts.

Wells said the goal now is to gradually reduce the company’s open position from around 2,000 MW in 2027 to 500 MW by 2031.

NV Energy is required to file an IRP at least every three years. Legislation passed in 2023 authorized the company to file an IRP more often “if necessary.” The 2026 IRP is coming only two years after the company’s 2024 plan.

NV Energy plans to host a third stakeholder session on the 2026 IRP in February, with a focus on the company’s distributed resource plan, the transportation electrification plan and the demand-side management plan.

A consumer session also is planned.