A report from the American Clean Power Association (ACP) argues that slowing down renewable development in PJM could cost ratepayers $360 billion over the next decade.

The analysis, released Jan. 21, compared a base case assuming wind, solar and storage development follows current expectations and reaches 137 GW of nameplate capacity by 2035 with a scenario in which only projects already under construction or legally mandated are built. With the amount of growth expected in PJM’s 2025 Load Forecast, the report finds that without that renewable buildout, the RTO will increasingly rely on aging fossil fuel resources and imports, dispatching of which would increase by 20% and 292%, respectively.

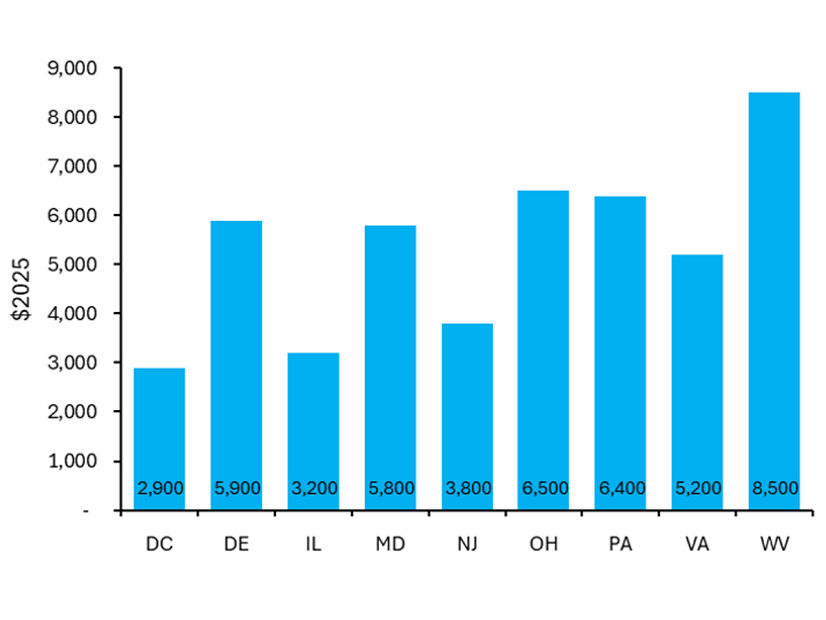

West Virginia would see the largest residential rate increase over the next decade at $8,500 for a typical customer, followed by Ohio and Pennsylvania at $6,500 and $6,400. Illinois and D.C. would be lowest at $3,200 and $2,900.

“These findings make clear that delaying clean energy deployment comes at a steep cost,” Senior Vice President of Markets and Policy Analysis John Hensley said in a statement. “Timely investment in wind, solar and energy storage is essential to maintaining reliability, reducing dependence on imports, and protecting families and businesses from sharply higher electricity bills as demand continues to grow.”

Hensley told RTO Insider the impact of a slowdown in renewable development would come in three areas: rising rates, diminished reliability, and the economic impact of data centers and manufacturing facilities siting outside of PJM as a result.

While 50 GW of new gas generation are included in the analysis, the report says that efforts to push for more resources would quickly lead to higher costs so long as turbine availability remains constrained.

“This reliance on imports and gas peaking units increases exposure to fuel price volatility, drives more high-priced hours, and heightens reliability risks during peak demand periods,” the report says.

Hensley told RTO Insider he views gas as playing a role in meeting the reliability challenges posed by rapid load growth in the coming years, but there is a timing disconnect with how long those resources take to construct. Renewables have strong supply chains allowing for rapid construction.

He said the starting point for efforts to bring more generation online should be a non-discriminatory approach that recognizes the contributions of all technologies. He pointed to PJM’s effective load-carrying capability model for determining the capacity contribution for different resource classes.

The No Clean Power scenario assumes states end their renewable portfolio standards and no renewable energy credits are available, while the base case includes tax credits being available in full for wind and solar through 2030 and for storage through 2032. Hensley said the base case assumptions about renewable development were based on projects in PJM’s interconnection queue, an ACP database of renewable projects, Energy Information Administration data and projections from organizations such as Bloomberg and S&P Global.

PJM’s 2026 Load Forecast tamped down the expected growth over the next five years, though peaks still are expected to increase from 160 GW in 2027 to 191 GW by 2031. By 2046 the summer peak is expected to reach 253 GW. (See Pessimistic PJM Slightly Decreases Load Forecast.)

The RTO’s two transition cycle queues include 1,669 MW of wind, 7,051 MW of storage, 17,075 MW of solar, 1,503 MW of nuclear and 5,460 MW of gas, according to its planning webpage. There are 27,537 MW of solar under construction, as well as 3,876 MW of storage, 8,059 MW of wind, 5,796 MW of gas and 2,930 MW of hybrid resources.

PJM did not respond to a request for comment.