LITTLE ROCK, Ark. — In what Lanny Nickell called one of his “toughest meetings” as SPP’s CEO, the Board of Directors approved a framework for demand response and a peak demand assessment (PDA) despite the Members Committee’s opposition.

The committee shot down the proposed tariff change (RR703) with its advisory vote for the board, 4-12, with five abstentions. However, the directors approved the measure in their separate ballot, signaling it was time to move forward over stakeholders’ calls for more time to work on DR and to sever the PDA from the framework.

“This is the most contentious meeting I have ever seen here,” whispered one stakeholder during the Feb. 3 discussion.

Board Chair Ray Hepper recapped the history of RR703, which began in early 2025. It was endorsed by several stakeholder groups, but the Markets and Operations Policy Committee in January voted to delay its approval for three months over the load forecast’s evaluation and potential financial penalties for not meeting resource adequacy requirements. (See “Peak Demand Assessment Delayed,” SPP’s MOPC Adds Conditional IC Process for Large Loads.)

Stacey Burbure, vice president of FERC and RTO strategy and policy for American Electric Power, called the proposal’s approval a “failure of our stakeholder process.”

“The fact that we are having such a meaningful debate here when the proposal is before the board; when we hear a call for more time; when we hear substantive issues and people expressing concern around imminent litigation that will result — I encourage my team always to pick up your pencil and not to bring rocks alone,” Burbure said. “Pick up your pencil, lean into the problem and bring a solution forward. So I would encourage us to take this one back and pick up our pencils.”

“When I voted for this [during a Resource and Energy Adequacy Leadership Team meeting in December], it was because I was afraid on the reliability side that we had gone too far in trying to meet everybody’s needs,” Hepper said. “I think it’s time to move forward with this. I understand that PDA is never going to be popular. I understand why nobody wants to be subject to financial consequences for any of their actions.”

“Not everybody’s equally happy, but we accomplished what we needed to accomplish, and I appreciate everybody’s patience,” Nickell said.

The board sided with a recommendation brought forward by the Regional State Committee, which endorsed the implementation of a load-modifier cap for load-responsible entities in 2027 and full implementation in 2028 subject to the following provisions:

-

- Controllable non-registered DR programs will be capped at 2,152 MW, based on 2025 workbook-forecasted non-registered DR for the 2027 summer season.

- Limiting LRE load-modifying DR resources to 2027’s forecasted amount, unless they opt into PDA for the summer 2027 season.

- Market-registered and reliability-registered DR will be available to all LREs in 2027 to serve resource adequacy needs and will not count against the 2,152-MW cap.

SPP says DR is “increasingly critical” as it faces rapid load growth, evolving resource mixes and tighter energy conditions. It says a structured DR policy provides stakeholders with multiple participation pathways while helping defer the cost of new generation and supporting resource adequacy compliance.

Still, the policy will likely draw protests at FERC, including one from SPP’s Market Monitoring Unit, which has filed three sets on comments on RR703, saying the policy design is “overly complex” and that it does not address all the issues in the original initiative. The MMU urged the board to postpone approval to explore alternatives, including not capping load-modifying DR.

“If we move forward with the PDA policy and have a fight at FERC, that could derail the DR policy,” said Christy Walsh, with the Natural Resources Defense Council’s Sustainable FERC Project. “I ask you all to think about either filing these two things separately at FERC so that any controversy over PDA doesn’t bring down the DR policy.”

Competitive Short-term Projects

The board’s public session ended with the approval of four short-term reliability projects, including two 765-kV lines, that are eligible for competitive upgrades, overcoming stakeholder concerns about the process, cost management and timelines. Transmission-owning members urged the board to competitively bid the projects, asserting that it would ensure they are constructed on time and at the least cost.

Members approved the proposal 12-9, with transmission owners outvoting transmission users. An amended motion to remove the 765-kV lines from the recommendation failed 10-11, with the members essentially reversing their votes. The board also rejected the amended motion with its ballot.

As the board adjourned for its closed session, several stakeholders gathered on the sidelines to plot next steps.

“The TOs win again!” one stakeholder said, raising his arms in exasperation.

Addressing what he called the “elephant in the room,” OGE Energy’s Adam Snapp said there is a perception that “costs will double overnight” and utilities “will run wild and spend … because we don’t care about our customers.”

“That’s the furthest thing from the truth,” said Snapp, OGE’s transmission planning senior manager. “We are uniquely incentivized to keep the projects costs low because it’s our customers who pay for them. When we invest in transmission, it puts pressure on our rates and our ability to invest in generation and distribution, and if the project gets out of hand, we won’t be able to make other investments that we need to make in our system. We are the only ones that are inherently incentivized to do that.”

Staff committed to work with the incumbent TOs to develop an agreement addressing cost overruns and delays and report back to the May board meeting.

The four projects are:

-

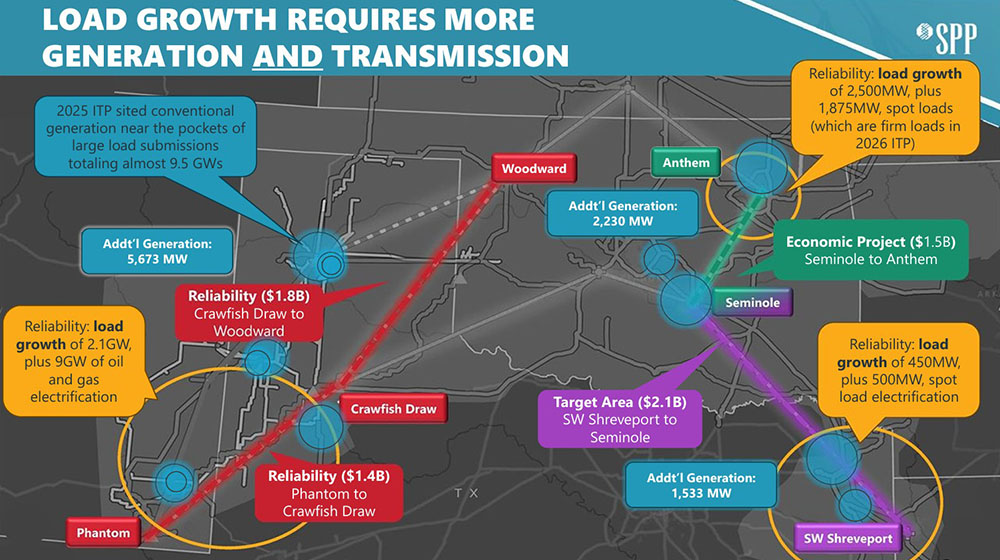

- Southwestern Public Service’s $1.37 billion, 239-mile, 765-kV Crawfish Draw-Phantom project in New Mexico and Texas;

- Evergy’s $21.6 million, 6-mile, 161-kV Crosstown-Blue Valley Station project in Missouri;

- Midwest Energy’s $23.3 million, 8-mile, 115-kV North Hays-Chetolah Creek project in Kansas; and

- the $2.4 billion, 315-mile, 765-kV Seminole-Southwest Shreveport project between central Oklahoma and northwestern Louisiana.

The two 765-kV projects form the southern legs of SPP’s proposed extra-high-voltage backbone. Both regions experienced load-shed events in 2025 and are seeing “massive amounts of reliability needs,” said Casey Cathey, SPP’s vice president of engineering. They were approved in November as part of the 2025 Integrated Transmission Plan’s record $8.6 billion portfolio. (See SPP Board Approves 2025 ITP with 4 765-kV Projects.)

Construction permits will be issued for the projects within 45 days of the board’s approval.

The proposals met SPP’s requirements as short-term reliability projects because they are competitive upgrades and are needed in three years or less to address reliability needs.

Conditional Load Process Approved

TOs also helped push through a tariff revision that builds on a previous change to integrate and operate high-impact large loads (HILLs) and was previously approved by MOPC and the RSC.

RR720 complements the FERC-approved study process for new HILLs and associated generation through the HILL generation assessment (HILLGA) by providing a path for conditional transmission service and interconnection. (See “Large Load Integration OK’d,” SPP Board Approves 765-kV Project’s Increased Cost.)

The conditional high-impact large load (CHILL) framework has two paths for large loads looking to interconnect: they have adequate generation but are contingent on transmission upgrades; or when accredited, equivalent supporting generation reaches commercial operation.

“I like to characterize that as speed to information, getting the info that you need in order to determine the cost and the necessary upgrades required to bring on large loads,” said Carrie Simpson, vice president of markets. “The second piece is speed to power. So maybe not all the transmission is in place. Maybe not all the full studies have been done to be a full [designated network resource]. This enables you to get your load on faster, so speed to power now.”

The RR doesn’t place a cap on the amount of the footprint’s CHILL load because it will be supported by generation. However, a CHILL will be curtailed if supporting generation is not available and/or if there is a net effect to the transmission system during system CHILL curtailments.

When FERC approved the HILL and HILLGA processes in January, it called them “pragmatic steps” that support economic growth. (See FERC Approves SPP Large Load Interconnection Process.)

“This policy takes the next step, adding yet another option that will enable even quicker interconnections without materially affecting market prices and without materially reducing reliability,” Nickell said.

The Members Committee endorsed the change 11-0, with 10 abstentions from renewable interests and other transmission users.

“We are at the end of our designated resource pipeline, and we are looking for more flexibility to address the loads that are requesting to be connected to our system, so I hope this gets filed quickly,” Evergy’s Denise Buffington said.

It was. On Feb. 10, SPP staff filed the tariff-revision proposal with FERC.

Competitive Project Process Changes

Several tariff changes and other items fared much better when they were considered.

Following members’ 19-1 endorsement, the board approved five of six recommendations by a task force meant to improve the RTO’s TO selection process for competitive projects and FERC Order 1000 compliance.

“Our goals were to improve the quality of the process, accelerate the process, and ensure that it continues to be fair and objective,” said Director Irene Dimitry, who chaired the task force.

The board and members asked staff to develop a proposal for the sixth recommendation that transfers the industry expert panel’s work to SPP, augmented by consulting expertise. The panel evaluates and scores the proposals before recommending a designated TO. It is reconstituted for each project, leading to a lack of consistency, Dimitry said.

Staff will have to develop communication protocols and protect staff from being lobbied by market participants, she said. Staff committed to bringing its proposal to the board meeting and hope to have a process in place for the 2026 transmission plan.

The Advanced Power Alliance’s Steve Gaw, a former speaker of the Missouri House of Representatives, raised a point of order, noting the measure passed as a substitute motion that did not require a vote on the base motion. He was overruled by SPP General Counsel Paul Suskie, leading to a second vote with identical results as the first.

“I’ve been overruled many times, but that does not mean I’m wrong,” Gaw cracked, drawing laughter.

Three other measures were approved after members endorsed them with voice votes:

-

- staff’s recommendation to modify a 115-kV competitive project in New Mexico by changing a termination point. The action will save $8 million to $9 million but will require SPP to solicit new proposals for what is now the Battle Axe-Phantom project. A previous request for proposals will be withdrawn.

- RR704, which establishes a business practice that formalizes the baseline modeling assumptions, data inputs and study parameters used in the loss-of-load expectation study.

- RR729, which changes the cost of new entry’s value from $85.61/kW-year to $139.85/kW-year for the 2026 summer season.

Nickell Says JTIQ Loan ‘Retained’

Almost lost in Nickell’s quarterly president’s report was this sentence: “We retained a $464.5 million grant in funding for the interregional [Joint Targeted Interconnection Queue] projects.”

It was SPP’s first public mention of the U.S. Department of Energy’s grant for its $1.7 billion JTIQ portfolio developed with MISO. The grant was awarded in 2023 under DOE’s Grid Resilience and Innovation Partnerships (GRIP) program but was among 321 loans that were canceled in early October. (See DOE Terminates $7.56B in Energy Grants for Projects in Blue States.)

DOE has not responded to RTO Insider’s requests for comment. However, its website lists the JTIQ grant as having been awarded to the Minnesota Department of Commerce — which led the GRIP funding application with help from the Great Plains Institute — in October.

Minnesota has said little about the grant beyond that its status has not changed and the projects are proceeding as planned. A Great Plains staffer at the board meeting declined comment. MISO CEO John Bear said during his board’s December meeting that the funding had been restored. (See MISO, Minn. Say Federal Funds for JTIQ in Play.)

The GRIP funds offset about 25% of the capital costs for the JTIQ portfolio’s five projects. The projects are centered on the RTOs’ northern seam and have been framed as enabling 28 GW of primarily renewable generation. Each grid operator would have two projects in its footprint and share the fifth.

FERC has approved the RTOs’ request to allocate 100% of the portfolio’s costs to interconnecting generation assessed on a per-megawatt basis. (See FERC Upholds MISO and SPP’s JTIQ Cost Allocation over Criticism.)

Rebranding Effort Begins

Nickell also gave the board, members and other stakeholders a sneak peak of the SPP’s rebranding effort, which will be officially revealed after April’s RTO expansion into the West.

He said his platform is for SPP to “boldly lead the industry. And that’s not just staff. That’s this entire organization.” Through focus groups and interviews, Nickell said staff heard two things: to continue SPP’s focus on its core mission of reliability and to remain committed to “facilitating consensus among diverse stakeholder groups in pursuit of innovative solutions.”

“We all have a part in boldly leading this industry that we all love,” Nickell said. “We want to be more visible. We want to communicate the value that we provide better and more often toward that goal.”

A two-minute video showed a quick glimpse of the logo and the catchphrase intended to reflect who the grid operator is: Powering the Future.

SPP’s logo has been tweaked only once since its creation in the 1990s, but Nickell said stakeholders should still recognize its elements in the new logo.

“A lot of really, really important work needs to be done, and I trust that you all will work with us to achieve what I believe are really, really important goals for the organization,” he said.