With costs associated with ISO-NE’s new day-ahead ancillary services market far exceeding expectations, the RTO is working to fast-track changes to improve the efficiency of the market in time for next winter.

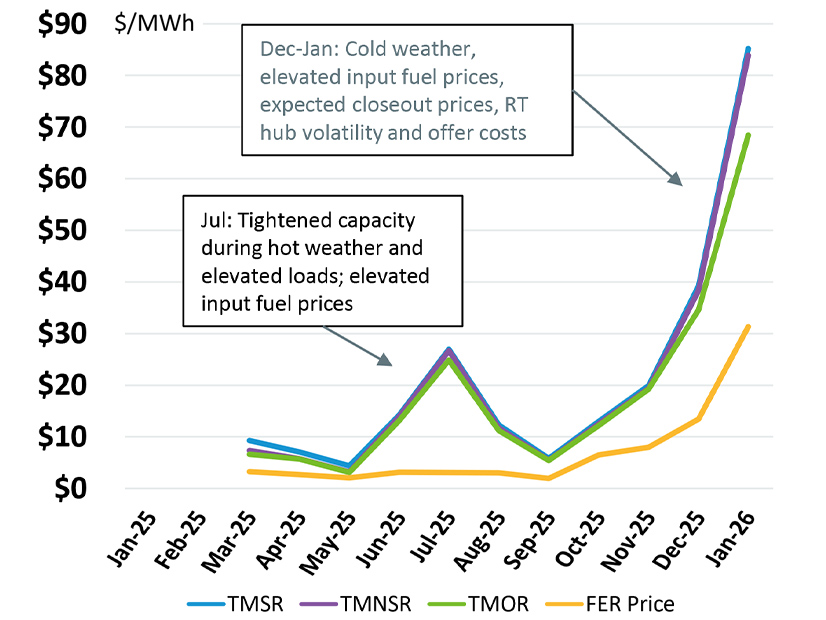

The DAAS market, launched in March 2025, has seen estimated incremental costs totaling $921 million over its first 11 months, dwarfing the RTO’s initial estimate of about $140 million in annual costs based on data from 2019 to 2021. (See FERC Approves ISO-NE’s Day-Ahead Ancillary Services Initiative.)

David Naughton, executive director of ISO-NE’s Internal Market Monitor, said he shares stakeholders’ concerns about high prices. He attributed the high market costs to a combination of higher-than-expected offer prices, lower-than-expected market participation, and changes to broader market fundamentals including increased power demand and gas prices.

While the DAAS market has brought significant reliability benefits to the region, there are clear tradeoffs between the strength of incentives for reliability and market costs, he said.

To address these concerns, the IMM has proposed market adjustments intended to “improve the cost-effectiveness” of the day-ahead energy market while “maintaining consistency with the core design objectives.” The proposed changes include:

-

- an upward adjustment to the strike price formula to reflect the significantly higher short-run marginal costs of most resources participating in the market;

- a decrease in the forecast energy requirement to reflect the impacts of front-of-meter renewables, which have tended to eschew participation in the day-ahead market; and

- a potential reduction in the non-performance factor associated with the ten-minute reserve requirement.

The proposed changes are intended to help lower offer prices and induce greater participation in the market, in part by reducing participants’ risk exposure. Without the changes, the tight conditions experienced in the market appear likely to persist long-term, Naughton said.

“If adopted, these changes are expected to place downward pressure on DAAS costs, are narrowly targeted in scope, can be implemented in the near term and present a low risk of unintended consequences,” the IMM wrote in a memo in early February.

At the NEPOOL Markets Committee meeting on Feb. 11, several stakeholders expressed strong support for implementing changes to the DAAS market as quickly as possible, supporting ISO-NE CEO Vamsi Chadalavada’s recent emphasis on the need to be nimble in the face of market issues. (See Prolonged Cold Drove Record Monthly Energy Costs in New England.)

Multiple NEPOOL members also expressed an interest in quantifying the reliability impacts of the DAAS market to better understand these benefits.

Fall Markets Report

Also at the meeting, Dónal O’Sullivan of the IMM discussed the performance of the ISO-NE markets in the fall season.

Total wholesale market costs increased by 28% relative to fall 2024, driven by a 58% increase in gas costs. The region relied heavily on gas-fired resources, which accounted for about 57% of all generation.

The estimated incremental costs of the DAAS market totaled $142 million in the fall, compared to $258 million over the prior six months.

The increased reliance on gas generation was driven by historically low import levels; for the first time in at least 20 years, New England was a net exporter of power over an entire season. Hydro-Québec continues to struggle with the effects of a multiyear drought, and it reduced exports in anticipation of its supply contracts associated with the New England Clean Energy Connect line taking effect. New England’s net imports from the province have rebounded since the project came online in mid-January.

Total demand increased by about 1.7% compared with fall 2024. The IMM attributed this to a change in the average temperature, which decreased by 3 degrees Fahrenheit.

O’Sullivan also provided more detail on the Nov. 23 capacity scarcity event, which occurred during relatively normal system conditions when a 900-MW thermal generator tripped during the evening peak. (See Unexpected Generation Loss Triggers Capacity Deficiency in ISO-NE.)

Pay-for-Performance credits from the event totaled $32.3 million, while the balancing ratio — which determines the responsibilities of each capacity resource relative to its capacity supply obligation — averaged 0.7.

“The best-performing generator types included flexible hydro and fast-start units and other non-fossil fuel units that were generally already online before the event,” O’Sullivan said. “Contracted imports underperformed their obligations, but uncontracted imports provided over 1,400 MW on average and earned over $7 million in credits.”

Long-lead-time oil generators took the biggest hit during the event, accumulating over $10 million in penalties.