By Michael Kuser

New York started 2019 with big promises around renewable energy that it fulfilled in summer as it quickened the pace of the most ambitious decarbonization goals in the country.

New York Gov. Andrew Cuomo speaks offshore of Jones Beach State Park in August 2019. | NYDPS

Gov. Andrew Cuomo last January announced that New York would aim to get 70% of its electricity consumption from renewable energy resources by 2030, with a 100% carbon-free electricity target for 2040. He also nearly quadrupled the state’s offshore wind energy target to 9 GW by 2035. (See New York Boosts Zero-carbon, Renewable Goals.)

The state’s clean energy goals also included doubling distributed solar generation to 6 GW by 2025, deploying 3 GW of energy storage by 2030 and upping its energy efficiency savings to 185 trillion BTU by 2025.

Leading the Transition

Talk became action on July 18 when Cuomo signed the Climate Leadership and Community Protection Act (A8429), the same day he announced the state was awarding a combined total of 1,700 MW in offshore wind contracts to Equinor’s Empire Wind project and to Sunrise Wind, a joint venture of Ørsted and Eversource Energy.

Regional setting and bathymetry of the New York Bight study area for offshore wind | NYSERDA

“We want to get to a 100% renewable, clean economy — no fossil fuels, no gas,” Cuomo said in August while expanding an artificial reef program off Jones Beach State Park, on Long Island. “How do you power cars? How do you heat a home? How do you fly a plane? Where do the renewables come from?”

Cuomo emphasized that those “details” constitute the essence of the decarbonization effort.

“We have not made this major a transition in society in this short a period of time probably ever. So, the ‘How do you do it?’ is not just a tedious question; it is actually everything,” he said.

“Now, how do you do it? That’s where New York has to lead,” he continued. “New York already leads in the most aggressive goals. We have to lead in this transition: how you actually make it happen.”

Carbon Pricing

Meanwhile, NYISO market participants hashed out how the state’s new energy law and mandated influx of renewables would affect a parallel effort to price carbon in the ISO’s wholesale electricity markets.

In order to include the new statutory energy targets in the modeling, NYISO over the summer delayed wrapping up its 30-month carbon pricing effort. (See “New Energy Law Could Affect CO2 Market Design,” NYISO Business Issues Committee Briefs: June 20, 2019.)

NYISO’s Market Issues Working Group took over last January from the Integrated Public Policy Task Force, a joint effort between the ISO and the state’s Public Service Commission that spent a year-and-a-half developing the carbon pricing proposal released last December.

The state must put a price on carbon in its electricity market if it hopes to meet the aggressive timelines of the decarbonization goals set out in the new law, the co-author of NYISO’s carbon pricing study said in October. (See Carbon Pricing Vital to NY Goals, Study Author says.)

“If New York does not do this in the electric-sector engine that the law hopes to rely upon to decarbonize the economy, it’s tying two hands behind the state’s back,” Analysis Group’s Sue Tierney said Oct. 22 in delivering a summary of the study to ISO stakeholders. “You will not get the efficiency, or timing, or depth, or pace of change without having this electric system engine on acceleration to get it.”

In addition, the state Department of Environmental Conservation last year revised its Clean Air Act regulations to lower allowable NOx emissions from simple cycle and regenerative combustion turbines during the ozone season. The rules are effective May 1, 2023, with generator compliance plans due by March 2, 2020. (See NY DEC Kicks off Peaker Emissions Limits Hearings.)

Aligning Plans and Law

The carbon pricing study was not the only thing affected by the new energy law. Meeting for the first time in two years, the New York State Energy Planning Board last month approved the issuance of proposed amendments to the state’s energy plan for public comment.

New York State Energy Research and Development Authority CEO Alicia Barton, who serves as chair of the planning board, highlighted “tremendous growth in the clean energy sector,” with employment for 2019 expected to have grown 7.7% year-over-year to nearly 171,000 jobs.

The Climate Act mandates a minimum of 35% of overall benefits from clean energy investments be realized by disadvantaged communities, which Barton said “are inured to” injustice. The benefits include spending on clean energy and energy efficiency programs, and investments in housing, workforce development, pollution reduction, low-income energy assistance, transportation and economic development.

The planning board also directed the PSC to arrange stable funding for the transition of power plants through the state’s Electric Generation Facility Cessation Mitigation Program, which supports localities that lose 20% or more of their tax base through the closure of a power plant.

“We’ve already seen communities turn to the fund since retirements have occurred, so that leads to a need to be thoughtful about the effect on host communities,” said PSC Chair John Rhodes, who also serves on the planning board. “The time is right to work on stability for those future needs.”

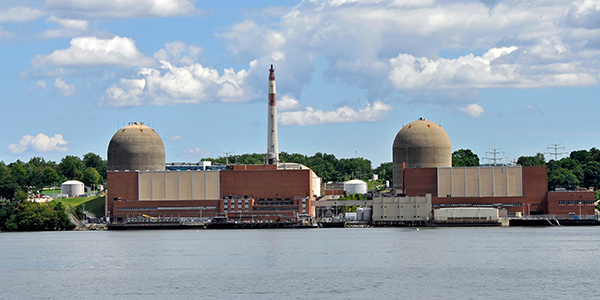

For example, this year will see Entergy shutter the first of two units being decommissioned at its Indian Point nuclear plant on the Hudson River, with the second reactor scheduled to go offline in 2021. A third reactor at the site was decommissioned in 1974. Cuomo had pushed to shut down the nuclear plant because it is only 24 miles from New York City.

Indian Point nuclear plant | Entergy

ZEC Program Stands

Far from the city, Exelon’s three upstate nuclear power plants — James A. FitzPatrick, R.E. Ginna and Nine Mile Point — all qualified for the state’s zero-emission credits (ZEC) program approved by the PSC in 2016 to prevent their retirements. The commission created the program as part of the state’s Clean Energy Standard (CES).

Acting Justice Roger D. McDonough of the New York Supreme Court in Albany County dismissed a challenge to the state’s ZEC program by Hudson River Sloop Clearwater and others, a decision that in November was appealed to the state’s highest court, the Court of Appeals. (See NY Court Rejects Challenge to ZEC Program.)

The 2nd U.S. Circuit Court of Appeals in September 2018 also upheld the ZEC program, rejecting the argument that it intrudes on Appeals Court Upholds NY Nuclear Subsidies.)

The PSC said the ZEC program avoided the issues behind the U.S. Supreme Court’s April 2016 ruling in Hughes v. Talen, which voided Maryland regulators’ contract with a natural gas plant as an intrusion into federal jurisdiction over wholesale power markets.

“Plaintiffs point to nothing in the CES order that requires the ZEC plants to participate in the wholesale market,” the 2nd Circuit said. “As the district court concluded, a generator’s decision to sell power into the wholesale markets is a business decision that does not give rise to pre-emption concerns.

“Until 2019, the ZEC price cannot vary from the social cost of carbon, as determined by a federal interagency workgroup. After 2019, the ZEC price is fixed for two‐year periods and does not fluctuate during those periods to match the wholesale clearing price,” the court said.

Public Policy Tx

NYISO’s Board of Directors in April selected two 345-kV transmission projects intended to address persistent transmission congestion in New York and foster delivery of renewable energy to population centers in the southeastern part of the state. (See NYISO Board Selects 2 AC Public Policy Tx Projects.)

New York’s AC Public Policy Transmission projects are intended to relieve congestion in key corridors. | NYISO

The projects — part of the broader AC Public Policy Transmission Project — address transmission capacity at the Central East (Segment A) electrical interface and Upstate New York/Southeast New York (UPNY/SENY or Segment B) interface.

“The projects will add the largest amount of free-flowing transmission capacity to the state’s grid in more than 30 years,” the board said in a statement.

In December 2018, the board rejected one of two project selections made by the NYISO Management Committee, which along with ISO staff had backed two joint proposals by North America Transmission and the New York Power Authority. Cost estimates for each project ranged from $900 million to $1.1 billion.

Storage Rules

FERC in December partially accepted NYISO’s plan to comply with a mandate that grid operators provide energy storage resources (ESRs) full access to their wholesale markets. (See FERC Partially Accepts NYISO Storage Compliance.)

The commission found that “NYISO has demonstrated that all [ESRs], including those located on the distribution system or behind the meter, will be eligible to provide all capacity, energy and ancillary services that they are technically capable of providing” (ER19-467).

However, the Dec. 20 order also faulted NYISO’s filing for a lack of details on its “metering methodology and accounting practices for [ESRs] located behind a customer meter,” directing the ISO to add descriptions to its Tariff within 60 days of the issuance of the order.