ISO-NE’s External Market Monitor last week presented the New England Power Pool Markets Committee a conceptual design for mitigating market power in the RTO’s day-ahead ancillary services market.

Monitor David Patton led off with a memo describing the advantages of the conduct-impact approach, a two-step process that uses reference levels to test both a participant’s conduct as it relates to a competitive norm and its impact on the market.

The first part of the test considers whether a unit’s offer exceeds its reference level by some pre-established threshold. If the threshold is exceeded, then a second part of the test determines whether the conduct (i.e., the offer) has caused an impact on the market clearing price for energy or ancillary services or affected an uplift payment.

Patton said the conduct-impact framework has been effective in protecting MISO, Monitor Strengthening Mitigation Measures.)

“Our general recommendation is that the conduct-and-impact framework should be applied to the day-ahead ancillary products and should be effective at addressing the market power concerns,” Patton said.

“The nice thing about the conduct-and-impact mitigation framework is, if the market is very competitive, it will rarely if ever mitigate any offers, but the fact that it exists … actually does discipline the behavior of the suppliers of the products,” he said. “We think that this framework, regardless of the outcomes of the simulation analysis, will be effective to mitigate the potential competitive concerns.”

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to amplify their presentations.]

In addition to various components of short-run marginal costs, suppliers’ offer prices can be affected by their varied expectations around LMPs, risk preferences and price volatility, even if they have no market power, Patton said. Those differences can prompt suppliers to submit offers that vary substantially from supplier to supplier.

Under the ISO-NE External Market Monitor’s framework, the RTO would use a pre-established price threshold to check participants’ market power. | Potomac Economics

In his presentation, Patton pointed out that price volatility can cause suppliers to limit their exposure by adding a risk premium, to reduce the likelihood of covering an option at a loss. He said reasonable risk premiums should be allowed.

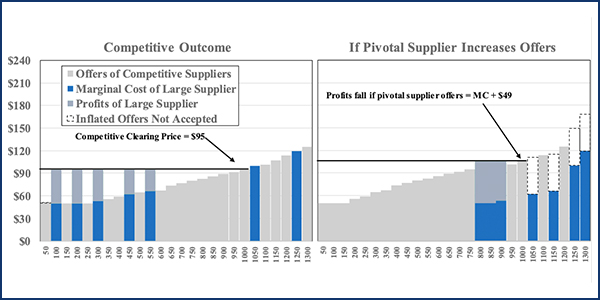

Such latitude would require a model to estimate the variation in such premiums to ensure that the pre-established thresholds accommodate the variation under a wide range of conditions, he said. Setting the thresholds appropriately can change the incentives of suppliers to offer more competitively, with the analysis showing that a pivotal supplier does not have an incentive to raise prices under conduct thresholds of $50/MWh.

The EMM recommended ex post market power mitigation measures to deter physical withholding and provide an alternative to a must-offer obligation. He said the most common forms of such measures are financial sanctions based on the impact of a market participant’s conduct or subjecting a supplier with market power to a must-offer obligation.

“We are worried about the overstepping of bounds,” Brett Kruse of Calpine said. “Traditionally, as we saw in the California Energy Crisis, FERC’s always had the ability to look at something and say, ‘You didn’t violate any rules; you didn’t violate the tariff; you didn’t violate any NERC criteria; but what you did, at its core, was to defraud. You had the intent to defraud people.’ … And they’ve held people accountable for that.” He pointed out that the ex post mitigation that Patton is proposing would occur many months after decisions on LNG arrangements were made and that the Monitor had effectively proposed a “backdoor” must-offer requirement.

“By definition, most exercises of market power do not violate any rules; it’s not fraudulent,” Patton said. “I’m an economist, and if you have market power, I expect you to attempt to exercise it. If you’re a rational economic actor in a market, and you have market power, you exercise it. In fact, you’re under an obligation to your shareholders to exercise market power, which is why market power mitigation must be effective.”

“FERC set up these markets with the notion that people were going to exercise market power, that we were going to get noncompetitive pricing, so either people have to not have market power, or it has to be effectively mitigated,” Patton said.

Market Power Assessment

ISO-NE is also making progress on the market power assessment (MPA) being conducted concurrently with the mitigation design work, Chief Economist Matt White said. (See “Market Power Analysis and Mitigation,” NEPOOL Markets Committee Briefs: Nov. 12-13, 2019.)

An MPA should determine whether market power is empirically supported, and if so, help to identify the specific conditions, frequency and extent to which individual participants may be able to profitably exercise market power, White said.

RTO staff have largely completed the first of four steps in the MPA, White said, presenting a memo.

The four major steps are: developing co-optimized market clearing software; producing study cases and input data; modeling participants’ option offers; and evaluating and analyzing of the market clearing outcomes.

White said the RTO is developing, coding and validating a day-ahead co-optimized market clearing engine model, or study model, by itself because the vendor would not be able to do so before 2024.

After the RTO assembles the data, White said, it must develop the assumptions and construct the offer behavior, using actual numbers, which has to be done under two scenarios: competitive conditions, and conditions in which a participant is able to exercise market power.

The model incorporates the functions and logic of the existing day-ahead market and includes the proposed new day-ahead ancillary services, pricing and co-optimization clearing logic.

ESI Central Case Update

Results for the critical winter months — or Central case — in the RTO’s latest model of its Energy Security Improvements initiative reflect limited changes in assumptions relative to those presented at the prior January MC meeting, Todd Schatzki of Analysis Group said.

The RTO has until April 15 to file a long-term fuel security mechanism with FERC (EL18-182). The Participants Committee plans to vote on the new market design at its April 2 meeting.

Modifications included minor changes to the hourly strike price inputs used in all cases and extending the date of the last barge refueling from Feb. 1 to 14, expanding the available fuel supply. In the cold snap of 2017/18, sea and river ice affected ship and barge deliveries to fuel oil terminals located in Maine and New Hampshire and on the Hudson River.

ESI increases total customer payments in some cases (Frequent, Infrequent) and decreases it in others (Extended). | Analysis Group

Changes result in minor decreases in total customer payments in the Frequent and Infrequent cases, with other results similar to those reported on Jan. 14. The full set of tables is provided in the presentation appendix, Schatzki said. (See NEPOOL Markets Committee Briefs: Jan. 14-15, 2020.)

Customer payments increase because of forecast energy requirement (FER) payments plus the net cost of new day-ahead energy options, with the higher payments partially or more than fully offset by reduced energy (LMP) costs caused largely by the incremental energy inventory under the market design, he said.

The new analysis showed that in the “frequent” stressed conditions scenario, total payments by load would increase 3.2% to $4.23 billion, with $250 million in FER payments and $66 million in net day-ahead option payments partially offset by a $184 million reduction in payments for energy and real-time operating reserves.

Under the “extended” stressed conditions case — based on 2017/18, with its one long cold snap — load costs would decrease $62 million (-2.3%) to $2.66 billion.

The “infrequent” stressed conditions case, based on 2016/17, showed $1.8 billion in load costs, a $35 million (2%) increase.

— Michael Kuser