By Tom Kleckner

SPP‘s Market Monitoring Unit said it is not looking to end self-commitment but that a reduction in the practice would result in a more efficient market.

“We do note that a high volume of make-whole payments [for self-commitments] is not considered desirable. It creates inefficiencies in the market,” Monitor Executive Director Keith Collins said Monday during a webinar on a report it released in December on self-commitments.

Collins capitalized on the previous day’s Super Bowl to put the issue into terms that might make more sense to his audience. “Imagine your favorite sports team, and imagine it’s the players who decide will play, rather than the coach,” he said. “The outcome you get may not be as efficient as the coach optimizing that for you.”

In the report, “Self-committing in SPP markets: Overview, impacts, and recommendations,” the Monitor recommends SPP and stakeholders work to reduce the number of self-commitments to improve price formation and market efficiency. The Monitor also suggests SPP modify its market design by adding another day to the market optimization period.

The report says a smaller distortion of prices and investment signals “will likely help market participants make better short-run and long-run decisions, which tends to coincide with improved profit maximization.

“Enhanced profit maximization, combined with effective regulation and monitoring, will likely lead to ratepayer benefits in the form of cost reduction,” the Monitor said.

Monitor staff studied offer behavior from March 2014, when SPP’s day-ahead Integrated Marketplace went live, to August 2019. They re-solved past market cases by running two simulation series of a week per month from September 2018 to August 2019, assuming all generation was offered in market status and that it could be started economically by the day-ahead market.

The analysis found that:

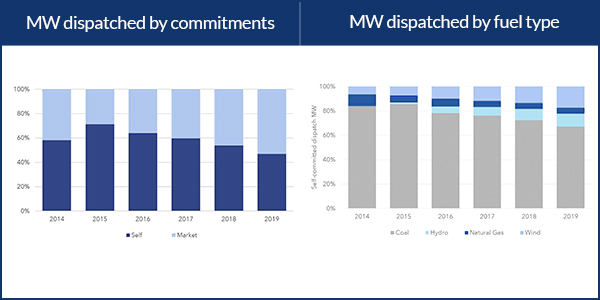

- The volume of self-committed MW has declined over time but remains nearly half of the total MW volume generated during the study’s time frame.

- Prices and production costs were systematically lower when at least one self-committed unit was on the margin.

- In almost all cases, self-committed generators had lower revenues because of negative congestion prices. Market-committed generators typically had a more balanced congestion profile.

- Resources with long lead times and/or high start-up costs tended to be self-committed instead of market-committed.

- Self-committed units generally had much higher capacity factors than those that are market-committed. The largest portion of self-committed dispatch MW were from coal units, exceeding the second-largest fuel type by a 4-to-1 ratio.

In its simulations, the Monitor found that:

- When the market made unit commitment decisions and lead times were unchanged, both market-wide production costs and market-clearing prices for energy increased.

- When the market made unit commitment decisions and lead times were modified to allow the day-ahead market to commit the resources with long lead times, market-wide production costs were essentially unchanged and market-clearing prices for energy increased about 7% ($2/MWh) on average. Congestion prices fluctuated from -$1/MWh to $1/MWh on average.

Having the economic commitment process solve over a two-day period rather than one would optimize long-lead time resources’ participation in the market, the report says.

“Simply eliminating self-commitment without any additional changes could result in an increase in total production costs,” the report warns. “However, when lead times were shortened to reflect an additional day in the market optimization and self-commitment was eliminated, producers were paid more and production costs declined.”

The Monitor is taking its presentation on the road. Having already shared its recommendations with the Market Working Group, it also plans to meet with the Cost Allocation Working Group.

“We’ll be speaking in different committees and venues,” Collins said.