By Rich Heidorn Jr.

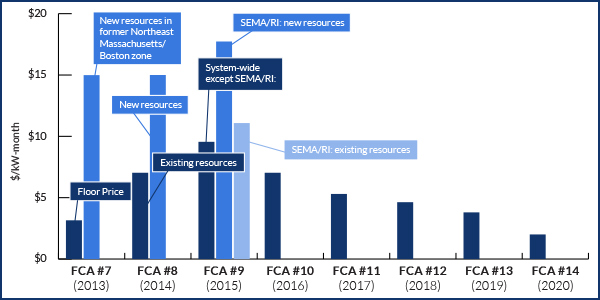

ISO-NE’s 2020 capacity auction cleared at a record low of $2/kW-month, a nearly 50% drop from $3.80/kW-month in 2019.

Forward Capacity Auction 14, which began Monday, cleared 33,956 MW of capacity for 2023/24 after five rounds of bidding. That gives the region a 1,466-MW surplus over the net installed capacity requirement of 32,490 MW, at a total cost of about $980 million.

ISO-NE noted that auction rules allow it to acquire less than the capacity target or more if it can ensure “enhanced reliability at a cost-effective price.”

More than 600 MW of new resources cleared the primary auction, including 317 MW that received their capacity obligations under the renewable technology resource (RTR) designation, which allows a limited amount of renewables to participate in the auction without being subject to the minimum offer price rule.

The exempt resources included land-based and offshore wind, solar PV, and solar PV paired with batteries. About 19 MW remain under the exemption for the 2021 auction, which will be the last to include the RTR.

Generation represents 85% of the capacity acquired, followed by demand resources (e.g., energy efficiency, load management, distributed generation) at 12% and imports from New York, Québec and New Brunswick at 3%.

Some 42,219 MW, including 34,905 MW of existing capacity and 516 new resources totaling 7,314 MW, qualified to participate in FCA 14.

“New England’s competitive wholesale electricity markets are producing record low prices, delivering unmistakable economic benefits for consumers in the six-state region,” Robert Ethier, ISO-NE vice president for system planning, said in a statement.

Auction rules allow existing resources interested in retiring to trade their capacity supply obligations with new state-sponsored resources that did not clear in the primary auction. But no such trades occurred, the RTO said.

Before the auction, 258 MW of resources submitted retirement bids, and another 21 MW filed permanent delist bids to leave the capacity market. All of the bids cleared before the auction.

Outside of the auction, ISO-NE has contracted to keep Exelon’s Mystic 8 and 9, which had been slated for retirement, operating for fuel security in 2023/24.

The RTO said the results are preliminary. Final results, with resource-specific results, will be submitted for approval by FERC by the end of February.

The results of FCA 13 became effective “by operation of law” Sept. 24 because FERC was unable to muster a quorum following the departure of Commissioner Cheryl LaFleur and the recusal of Commissioner Richard Glick. (See FCA 13 Results Stand Without FERC Quorum.)

Reaction

Generators tried to put the best face on the low prices, with the Electric Power Supply Association calling it “great news.”

“With one of the cleanest generation fleets in the US, the region should enjoy reliable, clean, cost-competitive power for years,” said Dan Dolan, president of the New England Power Generators Association.

Dolan said the prices were depressed because of the Inventoried Energy Program for reliability and the retention of the Mystic station, noting that neither program is expected to be in place for next year’s auction.

Dolan said the Competitive Auctions with Sponsored Policy Resources (CASPR) program was not needed this year because of the Mystic plant, the RTR renewables exempt from MOPR, and “ongoing siting challenges for state-sponsored projects.”

“Next year’s auction may provide a clearer window of the efficacy of the CASPR program. Longer term, NEPGA continues to believe that the region should move toward a meaningful price on CO2 emissions to match environmental and clean energy goals.”

Other observers were ready to call CASPR a bust.

“Well NE governors,” tweeted Joe LaRusso, the EE and DR finance manager for the city of Boston. CASPR “which was supposed to `balance state public policies [supporting increasing renewable generation] with the competitive wholesale electricity market’ has failed. What will you do?”

“So much for @isonewengland approach to [accommodating] state policy,” agreed consultant Rob Gramlich, executive director of Americans for a Clean Energy Grid (ACEG). “CASPR approach cleared 0 MW this time and 50 MW (for $0) last time. Meaning renewables are not getting paid for the capacity they provide and consumers are paying twice. #MOPRmadness.”