By Rich Heidorn Jr.

FERC’s Dec. 19 order expanding PJM’s minimum offer price rule (MOPR) prompted outrage among some officials in the RTO’s 13-state footprint and shoulder shrugs from others (EL16-49, EL18-178).

Filings by officials in Delaware, Virginia, West Virginia and D.C. show they share some of the concerns that regulators from Illinois, Maryland, Pennsylvania, Ohio and New Jersey expressed last week in a webinar with RTO Insider. (See related story, PJM’s MOPR Quandary: Should States Stay or Should they Go?)

But regulators in Indiana, Tennessee, Kentucky, Michigan and North Carolina — which are only partly within the PJM footprint — say they expect little impact from the ruling. Here’s a summary of where regulators in the nine jurisdictions not represented in the webinar stand.

D.C.

The D.C. Public Service Commission sought rehearing or clarification on the MOPR’s impact on new renewables, new demand response and the district’s default service procurement program, which provides 28% of the district’s electricity, including 85% of residential customers’ usage.

It noted that Maryland and Delaware have similar procurement processes for their default customers.

The PSC said it is unclear if the commission intended the MOPR to apply to the default service procurements. Commissioner Richard Glick said in his dissent that the MOPR could apply to New Jersey’s similar default program, but the PSC noted that the order suggested such programs could be protected under the competitive market exemption or unit-specific exemption.

D.C. also is concerned that the order could make it more expensive for it to comply with district law requiring a 50% cut in greenhouse gas emissions by 2032 and reaching carbon neutrality by 2050.

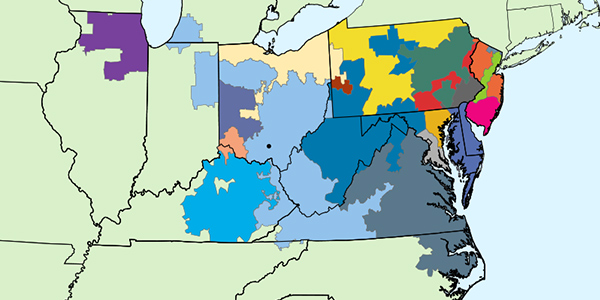

PJM transmission zones | PJM

It said only 7% of PJM’s power comes from renewables, below the national average (17%) and the shares in MISO (15%), ISO-NE (18.8%) and ERCOT (21.5%).

Using the net cost of new entry (CONE) to set the price floor for renewables could leave PJM further behind, the PSC said. “Thus, we request that FERC consider exempting new renewable resources from the MOPR or treat such resources as an exception — using the net ACR [avoided-cost rate] as opposed to the net CONE for the price floor for new renewables.”

The district also raised concerns about the order’s directive that PJM average the last three years’ DR offers to determine the default offer price floor value for DR that has not previously cleared a capacity auction. A new DR program targeting water heating would have no history, it noted.

It said new and existing DR should have a zero floor price “due to the fact that demand response programs are producing negawatts, not kilowatts.”

“Inasmuch as customer participation in demand response programs is ‘voluntary’ and the programs produce benefits greater than their costs, we do not fully understand why demand response is considered as a subsidized resource. Furthermore, the demand response programs from [electric distribution companies], due to their proximity to load, offer significant reliability values and lead to reduced market power and reduced final price to consumers especially during scarcity hours.”

Delaware

The Delaware Division of the Public Advocate’s rehearing request sought a declaration that the MOPR does not apply to the Regional Greenhouse Gas Initiative, which includes Delaware, Maryland and New Jersey in PJM. Pennsylvania Gov. Tom Wolf is attempting to join also but is facing opposition from the Republican-controlled legislature. (See Critics: Pa. RGGI Hearing Stacked with Detractors.)

The advocate expressed concern that the order appeared to limit the MOPR exemption for existing renewable resources based on the PJM Tariff’s definition of “intermittent resources,” which it said does not cover all renewable resources that have generated or received renewable energy credits (RECs) and solar RECs (SRECs).

“For example, Delaware’s [renewable portfolio standard] statute includes geothermal energy technologies, biomass generators, landfill gas generators and fuel cells as electricity generators that are eligible to produce RECs, SRECs or their equivalencies,” it said. “These resources are not intermittent.”

Virginia

The Virginia State Corporation Commission filed a brief rehearing request that referred back to its October 2018 comments in the docket, in which it called for continuing the self-supply exemption for vertically integrated utilities in regulated states. The order exempted existing self-supply resources but indicated new self-supply would be subject to MOPR. (See Is Self-supply Suppressing Prices?)

“Customers in vertically integrated states should not bear the risk of paying twice for capacity, because the states in which such customers reside have made no out-of-market payments to generators,” it said. “What the commission concluded [in 2013] remains true today: Utilities in regulated states have no incentive to attempt to artificially suppress capacity prices, and a properly configured self-supply exemption would fully address the intent of an expanded MOPR.”

West Virginia

West Virginia, which remains fully regulated, has one load-serving entity that meets its capacity obligation through PJM’s fixed resource requirement (FRR): American Electric Power’s Appalachian Power and Wheeling Power, which together serve a little over half of the state’s load. Appalachian also serves significant retail load in Virginia.

The remainder of the state’s load is served by FirstEnergy’s Monongahela Power, which owns or controls 3,580 MW of generation, and Potomac Edison, which owns no generation but is supplied by Mon Power.

Mon Power’s load is almost entirely in West Virginia, while three-quarters of Potomac Edison’s load is in Maryland. Mon Power bids its capacity into PJM and buys its requirements, and those for Potomac Edison’s West Virginia operations, from the PJM market.

“The commission is still reviewing the order, but it appears that the decision to grandfather existing regulated plants that have been selling capacity into the PJM capacity market means that there is no immediate MOPR-related effect on our RPM [Reliability Pricing Model] LSE,” said Susan Small, communications director for the Public Service Commission of West Virginia.

The ruling would not impact the current operating decisions of the AEP companies, but their “option to elect to switch to RPM is now compromised,” Small said.

“We are concerned that new or existing regulated power plants that have not been selling into the PJM capacity market in the past will be subject to the MOPR, a treatment that we believe is unreasonable and discriminatory. This will mean that future options for West Virginia capacity additions and existing FRR regulated plants may be limited.

“By regulating the bid price of only certain unfavored power supply, including regulated power supply, not only will our options regarding how to serve West Virginia load be limited, but the cost of RPM capacity will grow over time because of the discriminatory treatment of resources that are bidding at a price that is considered by some to be too low.”

Indiana

Indiana Michigan Power (I&M), a subsidiary of AEP, is the only investor-owned utility in Indiana operating in PJM and meets its capacity obligation through the FRR, said Stephanie Hodgin, deputy director of communications and media for the Indiana Utility Regulatory Commission.

“Indiana also has rural electric membership cooperatives and municipal electric utilities that may participate in PJM; however, the IURC does not have information on how FERC’s MOPR order may or may not affect them,” she added.

Tennessee

Only a small portion of the northeast corner of Tennessee is within PJM. It is served by AEP’s Appalachian and its affiliate Kingsport Power, according to Tim Schwarz, chief of the communications and external affairs division for the Tennessee Public Utility Commission.

AEP, which serves about 47,000 customers and does not generate any power in the state, is exempt from the MOPR because it uses FRR.

Kentucky

Four Kentucky utilities participate in PJM, including AEP’s Kentucky Power and Duke Energy Kentucky, which use the FRR, and Big Rivers Electric, which is an “other supplier” in PJM but participates in the market through MISO.

Only East Kentucky Electric Cooperative participates in PJM’s capacity market, according to Andrew Melnykovych, director of communications for the state’s Public Service Commission. In its request for rehearing, EKPC called the expanded MOPR a “frontal attack” on practices used by cooperatives for decades.

EKPC said FERC’s ruling was “the most drastic and likely most destructive measure taken by the commission to date” in its attempt to transform PJM’s “resource adequacy market away from a residual capacity auction … to a mandatory sole source for PJM and its LSEs to meet regional capacity obligations.” (See MOPR Ruling Threatens to Upend Self-supply Model.)

Michigan

The only Michigan utility in PJM is AEP’s I&M, which uses FRR.

“It’s a very minimal impact, if anything,” said Matt Helms, spokesman for the Michigan Public Service Commission.

North Carolina

Dominion North Carolina is the only FERC-jurisdictional utility regulated by the North Carolina Utilities Commission. Dominion, which serves about 120,000 customers in the state, uses FRR. Only about 5% of North Carolina’s load is in PJM.