By Rich Heidorn Jr.

A PJM task force considering the implementation of carbon pricing continued its education sessions Tuesday with an analysis on the impact of Virginia and Pennsylvania joining the Regional Greenhouse Gas Initiative (RGGI).

At its sixth meeting since its formation last summer, the Carbon Pricing Senior Task Force heard PJM officials walk through an analysis of the impact on emissions, prices and interregional trading of a “carbon price region” composed of up to five PJM states.

RGGI, which includes New York and the six New England states, currently has only three PJM states: Delaware, Maryland and New Jersey.

However, Virginia would join RGGI under the Clean Economy Act currently before the legislature.

Pennsylvania Gov. Tom Wolf issued an executive order in October directing state officials to develop a rulemaking by July 31 for joining RGGI, although his authority to do so has been challenged by the Republican-controlled legislature. (See Critics: Pa. RGGI Hearing Stacked with Detractors.)

Although PJM officials have taken pains to emphasize that the analysis is theoretical and that the RTO is not proposing a carbon price, it has said a carbon price could provide a way for ensuring states’ clean energy policies do not distort wholesale markets. (See PJM: Carbon Pricing the Answer to Subsidy Dispute.)

Analysis

PJM’s analysis compared the status quo with a region pricing carbon at a low-end reference of $6.87/short ton (the trigger price for the RGGI Emissions Containment Reserve) and a high-end reference of $14.88/short ton (the trigger for the RGGI Cost Containment Reserve). The analysis modeled the year 2023, the most recent planning case from the Regional Transmission Expansion Plan and market efficiency process.

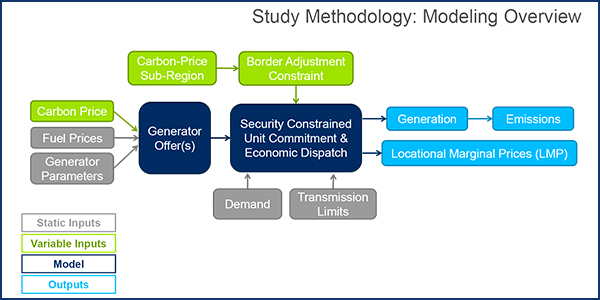

It used PLEXOS software to simulate the commitment and dispatch of resources and the resulting market and emissions outcomes. Resources both internal and external to PJM were included in the optimization.

The analysis of adding Virginia without Pennsylvania found that at a price of $14.88/ton, emissions in the carbon zone would decrease from 52 million tons of CO2 for the year to 35 million tons. That reduction would be almost entirely offset by an increase in emissions in the rest of PJM, resulting in only a small reduction in total emissions from 278 million tons to 277 million. Meanwhile, NOx and SO2 emissions for the entire RTO would actually increase.

But the analysis also found that PJM would increase its net exports from about 37,000 GWh to more than 45,000 GWh, meaning that the PJM region would be providing substantially more power to its neighbors without increasing its emissions.

“If you look at emissions across the entire [Eastern] Interconnection outside of PJM, it’s not a wash,” said economist Paul Sotkiewicz of E-Cubed Policy Associates, representing Elwood Energy. “But I think what that also tells us is that trying to cure leakage within PJM is a fool’s errand because it’s going to leak to outside of PJM. … It’s going to leak one balancing area away from PJM [where] PJM has no control.”

When including Pennsylvania in the carbon region, PJM-wide CO2 emissions would drop from 278 million tons to 259 million tons at a $14.88/ton price, with reductions of NOx and SO2 emissions as well. In this case — without any border adjustments to capture leakage — PJM’s net exports would drop substantially.

Leakage

PJM also found that a one-way border adjustment would have very little impact on generation in either the carbon region or the rest of the RTO at either the low- or high-end price for carbon. The modeling of the one-way adjustment — capturing transfers into the carbon region — was based on the 2013 draft final proposal for CAISO’s Energy Imbalance Market.

But the two-way border adjustment — covering transfers into and out of the carbon region — would result in a big increase in generation inside the carbon zone and a smaller decrease in generation outside of it, with a large increase in net generation exports.

“One way doesn’t do much,” PJM’s Anthony Giacomoni said.

PJM officials cautioned that their analysis did not consider state-specific approaches such as programs that reduce electricity demand or load-based greenhouse gas compliance obligations.

It also did not capture how higher power prices could affect power demand. “We can add a low-demand sensitivity” in the future, PJM’s Natalie Tacka said in response to a request for that data.

Next Steps

Task force facilitator Jennifer Tribulski said the group will meet next on March 27, when it will consider the legal, regulatory and technical considerations of a carbon pricing program.

Tribulski said the RTO will also issue a call for speakers for that meeting. “We want to hear about … what you expect to see; what you’d like to see in future meetings so we can really gauge where we are and what comes next.”