By Rich Heidorn Jr.

PJM stakeholders on Friday got their first look at the price floors that could be applied for capacity resources under the expanded minimum offer price rule (MOPR).

PJM shared what it called “informational” net cost of new entry (CONE) values, while The Brattle Group, which was hired by the RTO, gave a presentation on its work to develop avoidable-cost rate (ACR) values, the default minimum price for existing units.

The MOPR previously covered only new natural gas-fired generators. Under Consumer Advocates Appeal MOPR Order to DC Circuit.)

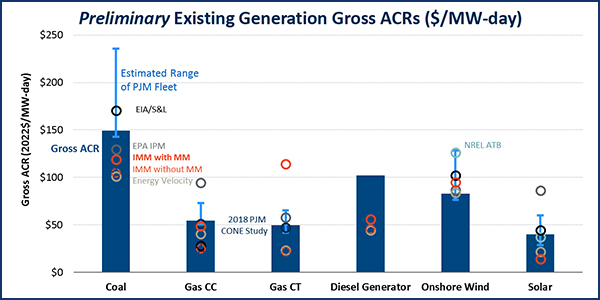

The Brattle Group’s preliminary gross avoidable-cost rate (ACR) for existing generating resources, showing low, high and “representative” costs ($/MW-day) | The Brattle Group

PJM’s informational net CONE numbers range from a low of $235/MW-day for a combined cycle plant to a high of $3,261/MW-day for offshore wind.

PJM’s Gary Helm said the RTO was terming the net CONE values “informational” because they include “placeholder” energy and ancillary services (E&AS) offsets from a 2018 FERC filing. “We feel pretty good” about the gross CONE values, he said.

Brattle’s preliminary gross ACRs for “representative” plants ranged from a low of $40/MW-day for solar PV to $892/MW-day for a single-unit nuclear plant (using 2022 dollars).

PJM’s capacity prices have never exceeded $245/MW-day, a peak set in the EMAAC region for delivery years 2013/14. The RTO’s most recent Base Residual Auction, held in 2018, saw a top price of $204/MW-day in the PSE&G zone.

Resources seeking to offer below the net ACR or net CONE values would have to seek a unit-specific exemption.

Both PJM and Brattle representatives emphasized during the special meeting of the Market Implementation Committee that their numbers were preliminary and would be refined before the RTO makes its compliance filing, due March 18.

Energy & Ancillary Services Offset

PJM’s Pat Bruno began the session with a presentation on the differences between the use of forward-looking and historical E&AS revenues. The E&AS will be subtracted from generators’ going-forward costs to determine unit-specific net ACRs.

The RTO and its Independent Market Monitor currently calculate unit-specific offer caps with a simple average of net E&AS revenues from the three most recent calendar years.

PJM’s preliminary net cost of new entry (CONE) values, including energy and ancillary service (E&AS) revenue offset | PJM

Bruno said PJM intends to allow use of both historical and forward-looking E&AS revenues in determining MOPR offer floors for both new and existing units, consistent with its previous policy on new units.

He acknowledged this could result in an existing unit’s net ACR floor price being above its net ACR offer cap. In such cases, he said, the seller will be required to offer at the floor price.

Becky Robinson of Vistra Energy said the possibility of the floor price exceeding the price cap “is creating a dartboard for people to criticize the justness and reasonableness” of MOPR floor prices. But she said it was unlikely to happen. “Why would anyone use forward-looking [prices] if it would make their MOPR floor price higher?”

‘Irrational’ FERC Ruling on Maintenance

Monitor Joe Bowring gave a short presentation on the IMM’s ACR template and discussed the development of E&AS offsets, including the treatment of major maintenance.

Bowring cited what he called the “unintended consequences” resulting from an April 2019 FERC order requiring that major maintenance costs be allowed in energy offers and no longer included in net ACR calculations (ER19–210). Bowring said the “irrational definition of major maintenance” was made at PJM’s request and over the IMM’s objection. (See FERC to PJM: Clarify Allowable Costs for Energy Offers.)

“The FERC decision removed major maintenance from gross ACR, which would reduce net ACR if nothing else changed. Historical net revenues should not be reduced after the fact by subtracting major maintenance as PJM and Brattle propose. That would effectively mean that ACR was not reduced. Price-based offers were used in the calculation of historical net revenues. If participants wanted to include major maintenance in their energy offers, they would have done so,” Bowring explained after the meeting. “Similarly, for going-forward net revenues, there is no reason to assume that participants will include major maintenance in their energy offers. We have seen no evidence that they do.”

Reducing net revenue to reflect major maintenance would improperly assume that all generators include 100% of their maintenance costs in their offers, Bowring said. “We didn’t see any bump [in prices] after the FERC order. Forwards didn’t really change.”

“Arbitrarily adding major maintenance costs to energy offers will inappropriately reduce net revenues and increase net ACRs,” he added.

Bob O’Connell of Panda Power Funds said FERC’s policy might cause units to run even when LMPs are below their operating costs just to minimize maintenance expenses from start-ups, citing a “rule of thumb” that one start is equal to 20 base hours. That, he said, could suppress energy prices in off-peak hours.

Bowring said O’Connell’s scenario seemed logical but that there was no way for the Monitor to quantify such behavior in unit-specific ACR calculations.

“We put a list of items that shouldn’t be included in major maintenance in our filing, and FERC copy and pasted it in the definition of what should be” included, Bowring said.

‘Representative’ Resources

Brattle’s Michael Hagerty presented the consulting firm’s preliminary default ACR values.

Michael Hagerty, Brattle | The Brattle Group

The group listed costs it considered most representative of each technology along with “representative low” and “representative high” costs to provide a range PJM could consider in its filing. “Not the lowest of the low and the highest of the high,” Hagerty said.

The selection of the “representative” plant for each technology was based on several characteristics, including the distribution of plants by age, state, capacity and — for fuel-burning resources — post-combustion controls.

Hagerty said the firm identified the primary factors affecting cost across fleets and compared publicly available costs with those in a confidential generation project database from design firm Sargent & Lundy.

The “very significant range of plants within each technology … creates a bit of a challenge,” he said. “Our intent was to show what we see in the existing fleet and leave it to PJM to determine where they want to be on this scale.”

PJM Vice President of Market Services Adam Keech said it was too soon to say “what [costs] we think is reasonable.”

“We’re still digesting the data ourselves,” he added.

Brattle noted that its gross ACR values for nuclear units are about 12% lower than the Monitor’s largely because of lower capital cost assumptions and because it estimated that about $1/MWh of operations and maintenance costs should be accounted for in the estimate of net E&AS revenues. Bowring said the $1 reduction was inconsistent with the FERC order on maintenance.

Exelon’s Jason Barker said the Monitor’s characterization of what constitutes variable operations and maintenance (VOM) costs are “illogical and wrong.” Barker indicated that the nuclear capital costs referenced in the Nuclear Energy Institute data, upon which Brattle and the Monitor have relied, are not the classes of costs described in the FERC order.

“It’s not our characterization. It was FERC’s,” Bowring responded.

Energy Efficiency

Brattle calculated a net CONE of $230/MW-day (ICAP) for energy efficiency based on analysis of EE programs of four utilities in PJM: American Electric Power, Baltimore Gas and Electric, Commonwealth Edison and PPL.

It noted its net CONE for PJM EE was higher than estimates for ISO-NE, saying it was because of lower assumed wholesale energy prices in PJM ($29/MWh vs. $60/MWh in ISO-NE).

Brattle calculated net CONE by subtracting wholesale energy savings and transmission and distribution savings from gross CONE but did not consider any capacity savings.

Bruce Campbell, CPower Energy Management | © RTO Insider

PJM’s Jeff Bastian said capacity market benefits were not included for EE just as they were excluded from the calculations for generating resources.

“This is a load-side resource,” responded Bruce Campbell of CPower Energy Management. “It’s different than a generator.”

Tom Rutigliano of the Natural Resources Defense Council said Brattle appeared to be “vastly undervaluing” EE, saying it should be assessed from the point of view of the asset owner. In addition to including capacity benefits, that means energy savings should be valued at the retail — not wholesale — rate, he said.

“This stuns me that you simply ignore the capacity benefit at the customer level,” Campbell added. “You recognize the energy savings, but you don’t recognize the capacity savings. That just seems inconsistent to me.”

Errors on Solar PV?

The three-hour meeting ended with a presentation by Michael Borgatti of Gabel Associates on how resources seeking unit-specific price floors would document their actual costs. “The fundamental rule in the Tariff is you have to be able to provide the same level of detail and support as in [PJM’s] CONE study. That is a reasonable standard,” he said.

Borgatti used an example of a 100-MW single-axis tracking solar PV array to identify what he said are errors in PJM’s assumptions. Correcting PJM’s assumptions on useful life (30 years, not 20), construction duration (nine months), weighted average cost of capital (7.7%, not 8.2%) and capacity value (60%, not 42%) reduced the gross CONE from $290/MW-day to $168/MW-day, he said.

Separately, he offered a Lazard proxy that set gross CONE at $143/MW-day, which he said represented “what you should expect market participants to” submit. “There’s a delta there [between $168 and $143], but it’s not significant,” he said.

With a $213/MW-day E&AS offset, he added, net CONE is zero.

Gabel Associates says correcting errors in PJM’s assumptions on useful life, construction duration, weighted average cost of capital (WACC) and capacity factor reduced the gross CONE for a 100-MW single-axis tracking solar PV array from $290/MW-day to $168/MW-day. | Gabel Associates

MIC Chair Lisa Morelli said Borgatti’s presentation would inform PJM’s compliance filing and future discussions on MOPR procedures. She joined Keech in apologizing that some materials for Friday’s meeting were not posted until just hours beforehand.

“You are … getting real-time updates of the latest and greatest PJM thinking,” she said. “It’s a pretty heavy lift within the 90-day compliance [deadline]. You’re seeing a race to the finish.”

Next Meeting

The next scheduled discussion on MOPR will be the MIC’s regular meeting March 11. Morelli said the afternoon would be reserved for MOPR, “if not more.”

“We can’t sweep aside all MIC business.”