By Rich Heidorn Jr.

PJM’s Planning Committee delayed a vote Tuesday on a new regional targeted market efficiency project (RTMEP) process to consider whether it can be approved without first considering related cost allocation rules.

The RTO said cost allocation is the responsibility of transmission owners under the Consolidated Transmission Owners Agreement (CTOA) and should not be considered until FERC approves the planning change. It cited the timeline for the recent change to the market efficiency benefit/cost ratio, which was approved by FERC in February 2019 (ER19-80) and followed by a cost allocation filing in January 2020 (ER20-776).

LS Power’s Sharon Segner acknowledged that cost allocation is the TOs’ responsibility. But she said FERC Order 1000 requires any regional planning process to be accompanied by a “cost allocation methodology.”

“We believe this is a different situation than in the past … What’s being proposed here is an entirely new type of regional planning project with … new parameters; new conditions; new modeling,” she said. “We don’t think it’s possible to separate the cost allocation from the planning protocol under Order 1000, and stakeholders deserve to understand both at the same time.”

PJM attorney Pauline Foley disagreed with Segner’s conclusion, saying FERC has historically reviewed planning processes separately from cost allocation. “We believe, based on historical practices, that should not forestall us moving forward,” she said.

The committee ultimately approved a motion by Alex Stern of Public Service Electric and Gas to defer the vote for two months and allow LS Power to share a legal memo with the PC outlining its arguments. The issue of cost allocation had been ruled out of scope in the proceedings of the Market Efficiency Process Enhancement Task Force, which developed the three sets of packages on which the PC had been scheduled to vote.

Stern made his motion after Segner said she would raise a point of order via a legal memo on the issue at the Markets and Reliability Committee meeting if the package advanced beyond the PC before considering the cost allocation. “I’d rather discuss it in a collaborative fashion rather than a contentious one,” he said. “We worked hard to get consensus. While I don’t necessarily agree with LS Power’s legal conclusions, I would like to see them before I’m having to see them at the MRC.”

The packages address changes to the benefit calculation, the window for capacity drivers and the RTMEP process, and included proposals from PJM, the Independent Market Monitor, American Electric Power and FirstEnergy. (See “Market Efficiency Process Enhancement Packages,” PJM PC/TEAC Briefs: Feb. 4, 2020.)

Storage as Transmission

LS Power also challenged PJM during a discussion on the RTO’s efforts to develop rules for treating energy storage as a transmission asset.

PJM hopes to develop rules by the end of the year for treating storage that would be dispatched by the RTO to address thermal, voltage or stability violations or to relieve transmission constraints. Other potential drivers are operational performance (mitigating real-time violations not identified in planning studies) or public policy (grid enhancements requested by a state to further its policies). The PC is scheduled to review a draft issue charge at its April meeting.

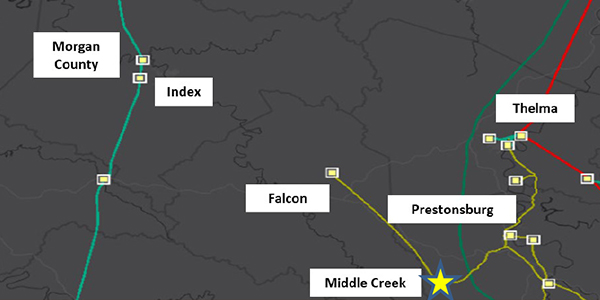

Segner has raised questions about a proposal by AEP to use storage to correct repeated outages on its Falcon-Prestonsburg 46-kV circuit (AEP-2018-AP010). AEP said the 23-mile line, which dates to the 1940s and 1950s, is plagued by rotted wood poles and damaged guy wires and cross arms.

The company proposed a supplemental project to install a 2-MW battery at its Middle Creek substation at a cost of $9.7 million; rebuild 8.5 miles of 46-kV line between Prestonsburg and Middle Creek station ($25.5 million); and retire 14.5 miles of 46-kV line between Falcon and Middle Creek ($6.1 million).

AEP said the total cost of $41.3 million would save almost $30 million over the $70 million cost of rebuilding the entire 23-mile line.

Segner said PJM cannot include non-transmission alternatives such as storage in the Regional Transmission Expansion Plan until it has been designated as transmission by FERC. Allowing AEP to win approval of the project under the M-3 process — which is limited to TOs — discriminates against non-TOs, she said.

PJM’s Aaron Berner said the RTO disagrees with LS Power’s position. “We don’t believe there are any issues about how the M-3 process is being followed,” he said. “The asset is being proposed in accord with that process.”

Segner said her company might seek to use the dispute resolution process under M-3.

“We would like to avert dispute resolution,” Berner said. “But if you wish to continue that … we can start discussions on how to move that forward.”

A similar dispute has arisen in MISO SATOA Proposal Faces Opposition.)

“Hopefully FERC will rule on the MISO issue sooner rather than later,” Segner said. A few hours later, FERC did rule, ordering its staff to schedule a technical conference on the issue. The commission said MISO’s Tariff changes “may be unjust, unreasonable, unduly discriminatory or otherwise unlawful” (ER20-588). (See related story, MISO SATOA Proposal Set for Technical Conference.)