PJM will present a problem statement and issue charge to the Markets and Reliability Committee later this month on its proposal to apply its effective load carrying capability (ELCC) calculation to include storage resources.

PJM’s Andrew Levitt told the Planning Committee that RTO officials identified ELCC, which was already under consideration for solar resources, as “an effective alternative” to the 10-hour minimum run time requirement that was rejected by FERC in October.

ELCC evaluates reliability in each hour of a simulated year and compares a resource mix with limited resources against one with unlimited resources. A resource that contributes a significant level of capacity during high-risk hours will have a higher capacity value than a resource that delivers the same capacity only during low-risk hours.

On Oct. 17, FERC partially approved PJM’s Order 841 compliance filing but set a paper hearing to determine whether its 10-hour minimum run-time requirement for storage seeking capacity obligations is unjust and unreasonable. FERC Partially OKs PJM, SPP Order 841 Filings.)

In November, PJM requested a 90-day extension on the initial brief deadline for the hearing and asked that the proceeding (EL19-100, ER20-584) be held in abeyance until Jan. 29, 2021, when it hopes to file Tariff changes applying ELCC to storage for all intermittent and limited-duration resources. It has proposed a new senior task force to discuss the issue.

FERC set a new deadline for initial briefs for April 27. Responses to PJM’s motion for abeyance are due March 11.

Order 845 Update

PJM’s Susan McGill reviewed the changes proposed by PJM in its Feb. 21 compliance filing on FERC Order 845.

In December, FERC approved six of PJM’s 10 Order 845 proposals but required changes on four issues regarding contingent facilities (unbuilt interconnection facilities and network upgrades upon which the interconnection request’s costs and timing are dependent); provisional interconnection service that allows limited operation of a generating facility prior to completion of the full interconnection process; surplus interconnection service (any unused portion of interconnection service established in a large generator interconnection agreement); and the rules governing technology changes that can be considered without affecting the interconnection customer’s queue position (ER19-1958).

PJM’s Feb. 21 filing seeks to address FERC’s concern over a lack of transparency regarding contingent facilities by clarifying the scope of the study and the criteria used. It also clarified that studies for provisional interconnection service will be conducted annually.

FERC required PJM to conduct the surplus interconnection service process outside of the interconnection queue. PJM’s revisions also require that surplus service be only from in-service generators and that use of the service cannot impact the existing system or other queue projects as determined by load flow, short circuit and stability analyses. Applicants will be required to make a study deposit of $10,000 plus $100/MW.

PJM revised its process to allow technology changes as long as they do not increase the size of the project or change a generator’s fuel type. Technology changes must be submitted before the return of a facilities study agreement without a material modification review.

The RTO asked that the changes take place 60 days following the commission’s acceptance except for surplus interconnection service, for which it requested 180 days.

Critical Infrastructure Ruling Expected

PJM’s Christina Stotesbury told the PC that the RTO expects a ruling within days on the Transmission Owners sector’s proposed confidential process to mitigate critical infrastructure on NERC’s critical infrastructure protection (CIP-014-2) list.

In January, stakeholders endorsed a resolution objecting to the TOs’ proposed revisions to Manual 4, saying it lacked transparency. (See PJM Members Resist TO Critical Infrastructure Filing.)

The PC has held three special Critical Infrastructure Stakeholder Oversight sessions, at which stakeholders separated issues into two categories: mitigation of existing CIP critical facilities, and avoiding creating new critical facilities, Stotesbury said.

A fourth meeting is set for 1-4 p.m. on April 3. Regardless of how FERC rules on the TOs’ proposal, “we are still planning to move forward working the avoidance issue and defining a more transparent process to prevent those facilities from becoming CIP-critical,” she said.

PJM to Expand PMU Deployment

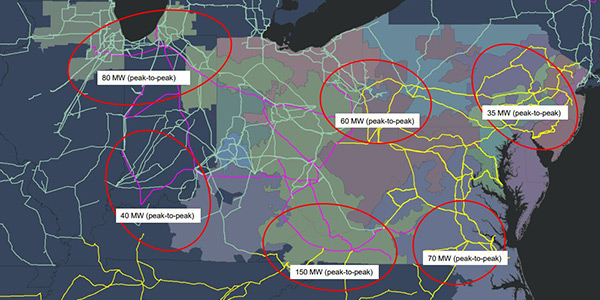

PJM’s Shaun Murphy said the RTO plans to expand the use of synchrophasors and formalize their placements — currently voluntary — into the Regional Transmission Expansion Plan.

Murphy said the RTO will begin discussions in the PC to require synchrophasors — also known as phasor measurement units (PMUs) — in all new substations and major construction projects to monitor bus voltage and line flows. He said the communication equipment needed at each substation costs $50,000 to $100,000. Each substation would have two or three PMUs — provided by already installed equipment such as relays or digital fault recorders.

PJM also plans to install 14 additional PMUs and retrofit four PMUs to support interconnection reliability operating limit (IROL) monitoring.

PJM last month completed a PMU data exchange with the Tennessee Valley Authority and expects to exchange data with Southern Co. and Oscillation Event Points to Need for Better Diagnostics.)

In addition to current roles in post-event analysis and oscillation detection, PJM plans to expand PMUs’ use to include detection of system islanding and other events and as backup monitors for area control error (ACE).

2020 RTEP Proposal Window Eyed

PJM posted the summer peak case for the 2020 RTEP on Feb. 28 and is asking transmission providers to begin their Form 715 analyses. The RTO plans to post preliminary violations between April 15 and May 1. It will open a competitive proposal window on potential solutions June 1.

Landfill Retirements Cleared

PJM’s reliability analyses found no reliability violations from the retirement of three landfill gas generators: Sussex County landfill (2 MW) in the JCPL zone and the Salem County landfill (1.7 MW) in the AEC zone, both retiring April 26, 2020; and the BC landfill (6 MW) in the PSEG zone, retiring May 31, 2023.

Analyses are underway on the retirement of the coal-fired Chesterfield Units 5 and 6 (1,015 MW) in the Dominion zone, retiring May 31, 2023, and Keystone NUG (4.9 MW) in the PPL zone, retiring May 31, 2020.

Questions on PPL Supplemental Project

TOs presented summaries of $173 million in supplemental projects, led by American Electric Power ($105.9 million) and PPL ($63 million).

Baltimore Gas and Electric presented two projects totaling $3.2 million, and Dominion Energy presented two projects totaling $1.25 million.

AEP’s biggest project is in response to the termination of the Department of Energy’s plan to retire its X 530 substation, which is connected to the Ohio Valley Electric Corp. (OVEC), and its request for a new delivery point at AEP’s Don Marquis substation. The total cost to AEP is estimated at $30.4 million, with OVEC spending an additional $4.4 million.

OVEC was created in 1952 to service a DOE uranium enrichment plant near Piketon, Ohio, that ceased operations in 2001. DOE ended the 2,000-MW contract in 2003 but maintains a load estimated to peak at 38 MW. (See FERC OKs OVEC Move to PJM.)

PPL said scope changes have reduced the cost of a supplemental project in northern Pennsylvania from $95 million to $63 million (S1106).

The project was originally presented before the M-3 process in January 2016 and called for building a new 230/500-kV substation and tapping the Sunbury-Susquehanna 500-kV and 230-kV lines and the Columbia-Frackville 230-kV line to address a stability issue in the Montour area. PPL said a three-phase fault with normal clearing on the double circuit Montour-Susquehanna 230-kV line will cause generator instability and tripping of several power plants totaling 2,400 MW.

PPL’s Shadab Ali said the new design involves 22 miles of second circuits on existing 230-kV lines between the Montour, Milton and Sunbury substations and rebuilding 12 miles of the Montour-Milton 230-kV line to double circuit. The project would also change the operating voltage of about 10 miles of 69-kV line between the Milton and Sunbury 230-kV substations and line terminal work at the Montour, Milton and Sunbury substations. The project is expected to be online by the summer of 2023.

David Mabry of the PJM Industrial Customer Coalition said he recognized the region as a “generation pocket” for PPL but questioned why stability issue concerns weren’t identified in the RTEP process or through the generation interconnection studies rather than being a supplemental project.

“It seems like we might be transferring cost allocation onto PPL’s end-use customers [for what is] a network-type upgrade,” Mabry said.

Ali said the project was originally proposed based on an actual event that identified it as a weak area in the system. With as much as 45% of PPL’s generation coming from that region, Ali said the utility wanted to address the issue even though it did not violate PJM or PPL criteria.

“It’s a little bit more than what is required in terms of criteria,” Ali said. “That’s why it’s not part of the RTEP process.”

Mabry asked if paying for the risk was being misallocated and said new generating facilities that affect stability should have some responsibility for the upgrade costs.

“Obviously new generation is going to make the situation worse, but there’s no way that new generation coming online making the situation worse has any cost responsibility in fixing the problem,” Mabry said.

Ali said Mabry’s feedback would be considered in potential changes to PPL planning criteria.

– Rich Heidorn Jr. and Michael Yoder