By Rich Heidorn Jr.

PJM officials told stakeholders last week that revised calculations show lower floor prices for gas, nuclear and solar generating units under the expanded minimum offer price rule (MOPR).

Last month, PJM and The Brattle Group received feedback from stakeholders on their initial calculations of net cost of new entry (CONE) and avoidable-cost rate (ACR) values, the default minimum price for existing units. (See PJM Stakeholders Get First Look at MOPR Floor Costs.)

At Wednesday’s Market Implementation Committee meeting, PJM and Brattle shared revised numbers. PJM’s calculations showed a 39% reduction in onshore wind’s net CONE, to $1,023/MW-day, because of an increase in the capacity value (to 17.6% of nameplate) and an increase in its energy and ancillary services (E&AS) revenue offset.

Net CONE for combined cycle plants was reduced to $152/MW-day, a 35% reduction from the price PJM shared last month, because of a near-doubling of its E&AS offset to $152/MW-day.

Solar PV (fixed) came in at $367/MW-day, an 18% reduction from the earlier calculation, because of a reduction in gross CONE and an increase in E&AS revenue.

FERC’s Dec. 19 order requiring an expansion of the MOPR required that net E&AS offset revenues be determined for each transmission zone. PJM plans to propose using zonal LMPs from the last three years.

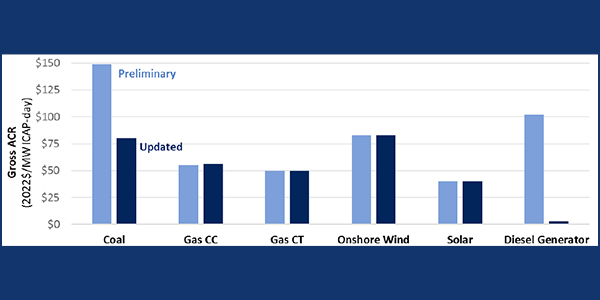

Brattle’s ACR results also showed reductions for nuclear and coal plants largely attributed to PJM’s guidance that shifted costs from the gross ACRs to variable costs.

Under the new analysis, the combination of gross ACR and variable costs include all avoidable costs to operate the resource for another year but not infrequent costs to extend the asset’s life or enhance its long-term performance. Maintenance costs for systems used for electric production are included in the operating costs maintenance adder for cost-based energy offers and excluded from the ACRs.

The ACR for “representative” multiple unit nuclear plants was reduced 27% to $444/MW-day, and 22% to $692/MW-day for single-unit nuclear plants, primarily because of shifts of fuel costs, sustaining capital costs, and materials and services operating costs to variable costs.

Coal’s ACR was cut to $80/MW-day for the representative plant, a 46% reduction, after Brattle shifted necessary and routine expenditures to maintain performance from gross ACR to variable costs.

The diesel generator ACR was slashed to $3/MW-day from $102/MW-day based on a changed cost basis from a 12-MW wholesale resource to a 1-MW behind-the-meter resource at a commercial facility. The gross ACR was revised to include only an annual maintenance contract.

The energy efficiency net CONE value was cut 19% to $1,761/kW from $2,179/kW to correct an overcount of incentive costs. Brattle is now using the total resource cost of each program.

PJM must file a compliance filing in response to the order by Wednesday.

On Monday, the Sierra Club and the Natural Resources Defense Council released a report by economist James F. Wilson criticizing the RTO’s capacity market, particularly its net CONE estimates. (See related story, Report Slams PJM Forecasting, CONE Estimates.)