New England stakeholders on Tuesday pushed back on ISO-NE’s draft assumptions showing that several variable changes between Forward Capacity Auctions 14 and 15 will improve system fuel security.

ISO-NE Manager of Outage Coordination Norm Sproehnle presented the New England Power Pool Reliability Committee with assumptions based on the RTO’s capacity, energy, loads and transmission (CELT) forecast and consistent with Planning Procedure 10 (PP-10) Appendix I.

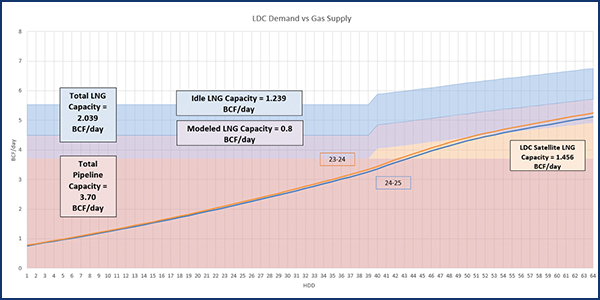

The assumptions show FCA 15 will see increases in gas pipeline capacity, total PV, onshore and offshore wind nameplate and demand response, coupled with lower peak load, lower winter LDC natural gas demand forecast and lower equivalent forced outage rate demand (EFORd).

The RTO also is wrapping up its Energy Security Improvements (ESI) initiative ahead of an April 15 filing deadline with NEPOOL Markets Committee Briefs: March 10-11, 2020.)

Chris Hamlen, the RTO’s assistant general counsel for markets, clarified “that the fuel security retention rules are in place only through FCA 15, and so beyond FCA 15 there is no mechanism in place for performing this type of review.”

Further, the RTO indicated that, in response to stakeholder concerns raised during the meeting, it would consider whether it is possible to adjust some of the assumptions in the retention analysis performed for FCA 15 to better reflect the way in which the impact analysis was performed for ESI.

[Note: Although NEPOOL rules prohibit quoting speakers at meetings; those quoted in this article approved their remarks afterward to clarify their presentations.]

The committee will review FCA 15 fuel security inputs and results in April and May and vote on the proposed PP10-I revisions in May, if applicable. If necessary, NEPOOL’s Participants Committee will vote on the revisions in June.

The RTO also is preparing for fuel security reliability reviews of FCM retirement de-list bids, substitution auction demand bids, bilateral transactions and reconfiguration auction demand bids submitted in connection with FCA 15.

FCA-14 Auction Results

Ryan Hoskin, ISO-NE senior analyst for transmission services and resource qualification, presented results of FCA-14, which was held in the first week of February.

The RTO’s 2020 capacity auction cleared at a record low of $2/kW-month, a nearly 50% drop from $3.80/kW-month in 2019. (See ISO-NE Capacity Prices Hit Record Low.)

ISO-NE filed the auction results with FERC on Feb. 18 (ER20-1025) and posted its capacity supply obligations (CSO) spreadsheet on its website. No capacity supply obligations were traded this year under the substitution auction.

FCA 15 Capacity Zones OK’d

The RC also voted to recommend that ISO-NE identify the zonal boundaries to be used in modeling criteria for FCA 15 — unchanged from FCA 14 — in accordance with Tariff rules.

Al McBride, the RTO’s director of transmission strategy and services, reviewed the proposed capacity zone construct for FCA 15, as well as the interface transfer capabilities and external interfaces.

For FCA 15, the RTO will evaluate potential export-constrained zones, including Northern New England (NNE), which includes Vermont, New Hampshire and Maine, and a portion of Maine nested within NNE.

Potential import-constrained zones to be evaluated include Southern New England (SENE), which includes Northeast Massachusetts/Boston (NEMA), and Southeast Massachusetts/Rhode Island (SEMA/RI), and Connecticut.

The RTO will test the potential capacity zone boundaries and present the results at the May 2020 Power Supply Planning Committee, McBride said.

Zones that trigger the objective criteria indicating constraints will be modeled in FCA 15 and associated reconfiguration auctions, which will determine whether any of the modeled zones bind in the auction and experience price separation, he said.

Regarding internal interface transfer capability, the study noted increases associated with various transmission system upgrades, including ones in Greater Boston, Greater Hartford/Central Connecticut, Southwest Connecticut, as well as with SEMA/RI reliability project upgrades.

The study found a decrease in internal interface transfer capability associated with the updated load assumptions, updated NNE-Scobie transfer capability and the retirement of Mystic units 7, 8 and 9.

One stakeholder assumed that a drop in load would increase import capability and that the Mystic retirements will increase import capability.

“No, all these factors have the effect of lowering the transfer capability,” McBride said. “The load change really becomes as much about relative load changing, [and] in particular, changes in where load is on the key transmission lines.

“If you’re lowering load at a point on the transmission system that causes less local drawdown and more flow to remain on the system, but it seeks to try to get into, in this case, southeast New England, lowering load at particular points can actually cause more flow to be on those lines as it tries to serve the load beyond that point, lowering the transfer capability,” McBride said.

“We did some sensitivity analysis in an attempt to identify what the factors were,” he said. “The predominant thing we were looking at was the change from Mystic 8 and 9 at retirement, and we wanted to make sure we understood what the other factors were.”

For external interface import capability, limits are usually for the summer period, may not include possible simultaneous impacts and should not be considered as firm, McBride said.

For example, the electrical limit of the New Brunswick (NB)-New England (NE) Tie is 1,000 MW, but downstream constraints, particularly in Orrington South, led planners to adjust that tie’s transfer capability to 700 MW for ability to deliver capacity to the greater New England Control Area.

Similar to what it did with NB-NE, the RTO has assumed transfer capability for capacity and reliability calculation purposes to be 1,400 MW for the 2,000 MW Hydro-Quebec Phase II interconnection, lowering the figure due to the need to protect for the loss of the line at full import level in the PJM and New York Control Areas’ systems, he said.

— Michael Kuser