By Rich Heidorn Jr.

FERC on Thursday denied rehearing requests on two orders rejecting PJM’s efforts to prevent capacity market participants from attempting to arbitrage between the Base Residual Auction and Incremental Auctions.

PJM and several of its member utilities requested rehearing and clarification of the commission’s May 2018 and May 2014 orders that rejected the RTO’s proposed rule changes to prevent participants from obtaining capacity supply obligations in the BRA and buying out of them with lower-priced replacement capacity in subsequent IAs (ER18-988-001, EL14-48-001, ER14-1461-002).

The 2014 order rejected a proposal to prohibit the submission of capacity sell offers not tied to an underlying physical capacity resource. (See PJM Wins on DR, Loses on Arbitrage Fix in Late FERC Rulings.)

The 2018 order rejected PJM’s proposal to create a sell-back offer floor at the relevant BRA clearing price and eliminate two IAs while increasing charges and penalties. (See FERC Closes Book on PJM’s ‘Paper Capacity’ Concerns.)

“As explained in the May 2018 order, and as reaffirmed here, PJM failed to justify the Incremental Auction modifications that have been proposed,” FERC said.

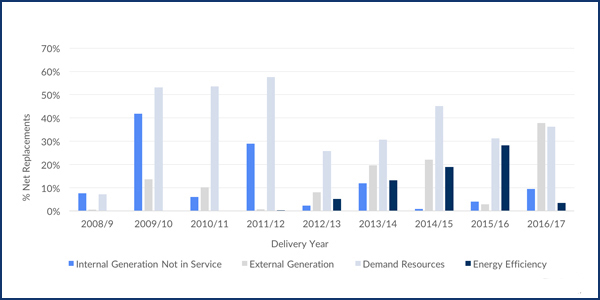

The commission said PJM’s evidence that resources, particularly demand resources, seek to buy out of their BRA commitments “may not necessarily demonstrate that resources are engaging in speculative behavior.” It noted that the commission approved changes in 2014 requiring DR providers to designate that their resources will be available in the delivery year.

It also noted that PJM’s Capacity Performance rules impose large penalties on resources that fail to perform during a performance assessment interval. “This creates a substantial downside risk for would-be speculators or any market participant … that fails to buy out its capacity obligation in the Incremental Auction.”

And it said PJM was attempting to address the cause of the price differentials between the BRA and IAs by revising its load forecasting methodology in 2015 to reduce over-procurements.

“We do not find it advisable to design a market on the assumption that over-procurement in capacity auctions will result in lower energy market prices,” the commission said. “Each market ought to be designed properly.”

The commission added that it encouraged PJM and its stakeholders “to continue to monitor the issues raised in this proceeding and to develop, if appropriate, solutions to address them.”