By Rich Heidorn Jr.

PJM staff normally count on their near-term load forecasting algorithm “learning” as it goes to improve its accuracy. But the COVID-19 pandemic was such an unexpected and unprecedented shock to the system, PJM’s Chris Pilong said Thursday, that they’re trying to make the algorithm “not quite as smart.”

“That’s part of our challenge here,” Pilong, director of operations planning, told the Markets and Reliability Committee in a briefing on the RTO’s plans for updating its load forecasts to reflect the new normal. “We’re trying to use our near-term load forecasting algorithm for something it’s not designed to do.”

Earlier in the day, the U.S. Labor Department announced 3.3 million unemployment claims for the week — almost five times the previous record set in 1982. Only three weeks ago, the economy was humming along at “full” employment, with claims totaling only 200,000.

Limited Visibility

PJM’s residential load normally equals its commercial load (37% each), with industrials representing the remaining 26%. Pilong said PJM expects the reduced commercial load from business closures will cause an increase in residential load as employees work from home, adding lighting, computer, and heating and air conditioning demand. Any reductions in industrial loads are not expected to shift to residential.

Pilong said PJM can only observe changes in net load, however. “We’re not receiving updated information … that distinguishes between residential and commercial and industrial load usage,” he said. “What’s happening beyond a transformer [in] distribution is not something we have the ability to see.”

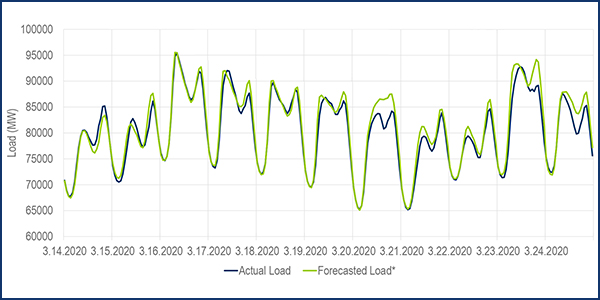

Between March 14 and 23, peak loads were 3 to 12% lower than the five-year average for March, while total electricity usage has been down 2% to almost 12%.

Those figures do not account for weather: March 14 and 17-20 were warmer than usual. Tom Falin, director of resource adequacy planning, estimated that about half of the 12% peak drop on March 20 was because of mild weather. (The Electric Power Research Institute reported last week that Italy has seen an 18 to 21% reduction in peak and energy use year-over-year following its nationwide lockdown.)

Pilong said PJM has seen the morning peak a bit later on some days, suggesting people are getting up later because they have no commute. “The peaks are moving some days. Some days they’re going down. Some days there’s no difference. We don’t have a ton of history.”

He noted that not all schools were closed during the time period. “We may see more patterns once the situation stabilizes,” he added.

Teams Collaborating

PJM has its operations load forecasters and resource adequacy forecasters working together to adjust their load projections during the crisis.

The RTO will post updates on the load analysis methodology each Monday on the Operating Committee’s webpage and discuss them at the OC and System Operations Subcommittee meetings. The postings will include actual and forecasted hourly data so market participants can conduct their own analyses.

PJM expects to continue updating load models to reflect load behavior for the duration of the economic shutdown and prepare for a transition to normal conditions. Results of the modeling will be shared with the Planning Committee.

Falin said PJM will be adjusting its long-term forecasts (2021-2035) once it receives updated economic forecasts from Moody’s Analytics for the “metro level.” Falin said staff hope to have a forecast reflecting the impact of the crisis by the PC’s April 14 meeting.

Moody’s doesn’t expect much change in the long-term gross domestic product from what it predicted before the outbreak last fall, Falin said. Moody’s expects a 2.2% drop in first-quarter GDP to be followed by an 18% drop in Q2 before rebounding with an 11% gain in Q3 and a 2.4% increase in Q4. (See related story Moody’s: Coronavirus Recession to Cut GDP 2.3%.)

“Once we have this behind us, the rebound will be quite sharp” according to Moody’s, Falin said.

Economist James Wilson said PJM should consider other economic forecasts in additions to Moody’s, recalling that the company predicted the impact of the 2008 financial crisis “wouldn’t be much of a recession or would be very V-shaped.

“Moody’s was quite wrong, and we suffered about a decade of forecasts that were way too high” as a result, Wilson said.