ISO-NE’s wholesale market costs last fall declined 38% year over year to $1.5 billion, with both energy and capacity market costs decreasing significantly, the New England Power Pool Markets Committee heard Tuesday.

Energy costs dropped by 47% ($655 million) to $746 million because of falling natural gas prices, lower loads and higher nuclear availability because of fewer outages, the Internal Market Monitor said in its Fall 2019 Quarterly Markets Performance Report. Capacity market costs were down 24% from 2018, at $749 million.

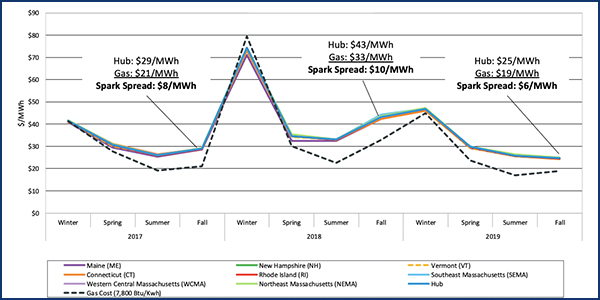

Average day-ahead and real-time hub LMPs were $24.69/MWh and $24.98/MWh, 43% and 45% lower, respectively. Natural gas averaged $2.44/MMBtu, down 42% from the fall 2018 average price of $4.21/MMBtu.

Lower gas prices and loads drove lower energy prices. The spark spread is the difference between the wholesale market price of electricity and its cost of production using natural gas. | ISO-NE

“Really this is driven by an auction that occurred several years ago,” said Dave Naughton, IMM manager of surveillance and analysis. “Fall 2019 was the second quarter of the Forward Capacity Auction 10 commitment period, with clearing prices of $7.03/kW-month for rest-of-system, compared to $9.55/kW-month the previous year.”

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to clarify their presentations.]

Average hourly load was down 6% to 12,551 MW because of lower temperatures in September and higher temperatures in late November. New England pipeline demand fell by about 20% for the season.

Net commitment period compensation costs (NCPC) totaled $8.5 million, down 26% from the prior fall, and represented about 1% of total energy costs, consistent with the historical range, Naughton said. Economic payments made up 57% ($4.9 million) of the total NCPC, down 46% from the previous year, and the decrease was consistent with lower gas and energy prices.

Grid Study Procedures

The MC held a joint meeting with the Reliability Committee on Tuesday afternoon and heard recommendations from the New England States Committee on Electricity (NESCOE) on how to proceed with a planned study on the future of the New England grid, the kickoff for which has been delayed until May because of the COVID-19 pandemic.

Heather Hunt and Ben D’Antonio of NESCOE presented preliminary staff suggestions on how best to assess the future state of the regional power system in light of state law requirements, as well as an overview of recent carbon-related studies. Day Pitney provided a compilation of recent ISO-NE economic studies and a list of relevant studies on the grid transition and carbon pricing.

Very different gas and energy prices season-over-season | ISO-NE

NESCOE highlighted five studies and summarized their findings, starting with a September 2019 report by The Brattle Group funded by the Coalition for Community Solar Access, which found that “annual clean energy resource additions need to increase by a factor of four to eight times the current level to achieve 2050 carbon emissions reduction goals.”

The second report covered deep decarbonization through increased coordination with Hydro-Québec and was funded by the utility and Sustainable Development Solutions Network. It found that “more interconnections between the Northeast and HQ may be a less expensive approach to decarbonization than an alternative with an even greater reliance on offshore wind and solar.”

NESCOE also highlighted a study of deep decarbonization in California by E3, which it said found the least-cost electricity portfolio to meet California’s 2050 economy-wide greenhouse gas goals includes 17 to 35 GW of natural gas generation capacity for reliability — compared with the state’s current 29-GW natural gas fleet.

The fourth study cited was funded by NRG Energy, wherein Brattle examined the forward clean energy market design concept, finding that “broad competition will minimize the costs of achieving carbon goals.”

Finally, D’Antonio brought up a 2018 study by the Northeast States for Coordinated Air Use Management on greenhouse gas mitigation in New England. The white paper found that immediate action is required and recommended electrifying end-use energy consumption.

D’Antonio emphasized that he was sharing information and not endorsing any proposal or study.

New England will need to deeply decarbonize the electric grid in order to ensure that GHG emissions significantly decline from the electric generation sector as the grid experiences a significant increase in load, the study said.

“We really think it’s important to know who your audience is when you do your reporting,” D’Antonio said, adding that the planned grid study should reach a broader audience if NEPOOL and ISO-NE want to achieve economy-wide effects.

Opening the DA Offer Window

ISO-NE proposed to modify the submission deadline for offers and bids in the day-ahead energy market from 10 a.m. to 10:30 a.m. to address feedback from stakeholders.

RTO staffer Dennis Robinson said this modification may afford some suppliers additional time to consider information before finalizing their day-ahead offers and bids.

In addition, ISO-NE will be addressing clean-up revisions in the Tariff, with a proposed effective date of Oct. 1.

“We may have to go back to the 10 a.m. time in 2024 as a result of [Energy Security Improvements] and the new day-ahead ancillary service products in the market, which could also impact the day-ahead market deadlines and time frames,” Robinson said. “We might have optimization of energy storage resources or other changes by 2024 as well.”

The MC will discuss the changes and vote on them at the May meeting ahead of a June vote by the Participants Committee.

Enhancing Info Policy

ISO-NE Corporate Counsel Tyler Barnett presented two proposed enhancements to Section 2.3 of the Information Policy in order to enable the RTO to take quicker action to protect the markets from default and improve communication with stakeholders on the status of defaulting participants emerging from bankruptcy.

The effective date of these revisions is proposed for October.

One proposed change would remove confidentiality restrictions applicable to defaulting participants to enable the RTO to act more quickly and efficiently when emergency judicial or regulatory relief is reasonably necessary, he said.

Another would permit the removal of a market participant from the weekly notification of defaulting parties sent to all market members when the participant’s plan to emerge from bankruptcy has been approved by bankruptcy court and the participant is not otherwise in default.

Court approval of a bankruptcy plan is a practical milestone to mark the end of bankruptcy, as business operations may resume prior to the case file being dismissed, Barnett said.

Accordingly, the weekly information policy notification will more accurately reflect a formerly bankrupt market participant’s status in the markets.

“We’re looking to avoid market confusion,” Barnett said.

The RTO proposes additional discussion before a vote at the June MC meeting ahead of a vote by the PC at its summer meeting in late June.

— Michael Kuser