By Rich Heidorn Jr.

A financial transmission rights trader has filed a new challenge to the way PJM and its Independent Market Monitor prevent gaming, saying it is “so broad that it captures competitive market conduct and leads to less efficient market outcomes.”

XO Energy, of Landenberg, Pa., asked FERC to order PJM to change its FTR forfeiture rule or abandon it and adopt “a structured market monitoring approach” like the one used by MISO (EL20-41). The company said it exited PJM’s virtual market in December after getting hit with $4.3 million in forfeitures.

FTRs allow load-serving entities to hedge the risk of transmission congestion costs; they also allow financial traders to arbitrage day-ahead and real-time congestion.

Ten largest positive and negative FTR target allocations summed by sink: 2019/2020 | Monitoring Analytics

PJM implemented the forfeiture rule to prevent market participants from using virtual transactions to create congestion that benefits their FTR positions. The FTR holder forfeits the profit from its FTR when it submits an increment offer (INCs) or decrement bid (DECs) at or near an FTR location that results in a higher LMP spread in the day-ahead market than in real time.

In January 2017, FERC ordered PJM to change how it implements the forfeiture rule, saying the RTO’s focus on individual transactions failed to capture the impact of a market participant’s overall portfolio of virtual transactions on a constraint (EL14-37). (See FERC Orders Portfolio Approach for PJM FTR Forfeiture Rule.)

PJM filed Tariff revisions in April and June 2017 describing its new approach (ER17-1433). In September 2017, PJM began billing forfeitures based on its new approach, XO said, despite the fact that the commission has never acted on it.

Financial Leverage Test

To encourage legitimate hedging while preventing manipulation, XO said PJM’s forfeiture rule should be changed to identify when participants that hold physical assets and engage in virtual transactions have a leveraged portfolio — when the net benefits to the participant’s FTRs exceed the net losses of its virtual transactions on a given constraint.

“A critical defect of the FTR forfeiture rule is that … it fails to consider whether a market participant has financial leverage, rendering the rule unjust and unreasonable,” XO said. “If financial leverage does not exist, further scrutiny of a market participant’s activity is unnecessary.”

XO said the rule also must require the Monitor to determine the participant’s intent.

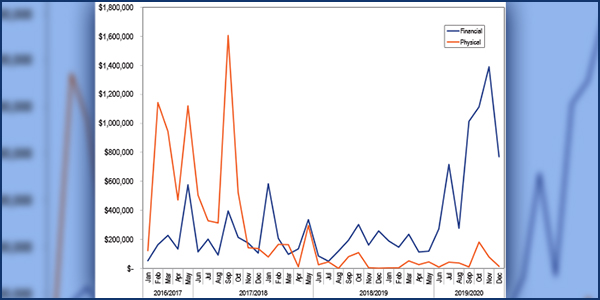

Monthly FTR forfeitures for physical and financial participants | Monitoring Analytics

“There is no such thing as a properly designed automatic forfeiture rule; any forfeiture rule should only relinquish profits from conduct that, if combined with sufficient credible evidence of intent, would constitute a potential violation,” XO said. “In Order 670, the commission found that a fundamental component of any alleged manipulation claim is whether the market participant acted with sufficient scienter or intent.

“Although the presence of financial leverage can be easily determined, a comprehensive, fact-specific examination is necessary to identify sufficient evidence of intent.”

Although PJM and CAISO use forfeiture rules, XO said MISO, NYISO, SPP and ISO-NE “use their market monitoring function to provide surveillance in lieu of a rule that oftentimes captures rational economic behavior.”

XO complained that market participants lack access to the data on which forfeiture determinations are made and that the assessments are made more than two months after the activity in question. “The current FTR forfeiture rule has resulted in market inefficiencies by penalizing financial market participants whose virtual activity is profitable. In addition, market participants with physical positions are unable to hedge their physical load or generation positions.”

PJM did not respond to questions about the complaint.

Monitor Joe Bowring said in an email that “the complaint rehashes old and discredited arguments in an effort to overturn a rule which efficiently and effectively protects the markets from manipulation. … It would be a waste of the commission’s, PJM’s and stakeholders’ time to proceed.”

Leaving the Markets

In 2019, XO said, it forfeited $4.3 million, while its gross FTR revenue was only $1.4 million, resulting in a net loss of $2.9 million.

As a result, XO said it withdrew from the virtual market in December 2019. It said Exelon and NextEra Energy Marketing stopped virtual trading also. NextEra did not reply to a request for comment on the complaint Thursday. Exelon declined to comment.

Exelon raised concerns similar to XO’s complaint in a problem statement in February 2018, and it backed a proposal to change the FTR impact threshold from PJM’s “penny test” to one of FTR flows of 10% or more across a constraint.

The Markets and Reliability Committee declined to adopt the proposal in April 2019. (See “Load Interests Block FTR Rule Changes,” PJM MRC/MC Briefs: April 25, 2019.)